Oil Climbs From Three-Month Low as China’s Recovery Strengthens

(Bloomberg) -- Oil rose from its lowest close in three months as traders took stock of the outlook for demand amid turmoil in the US banking sector.

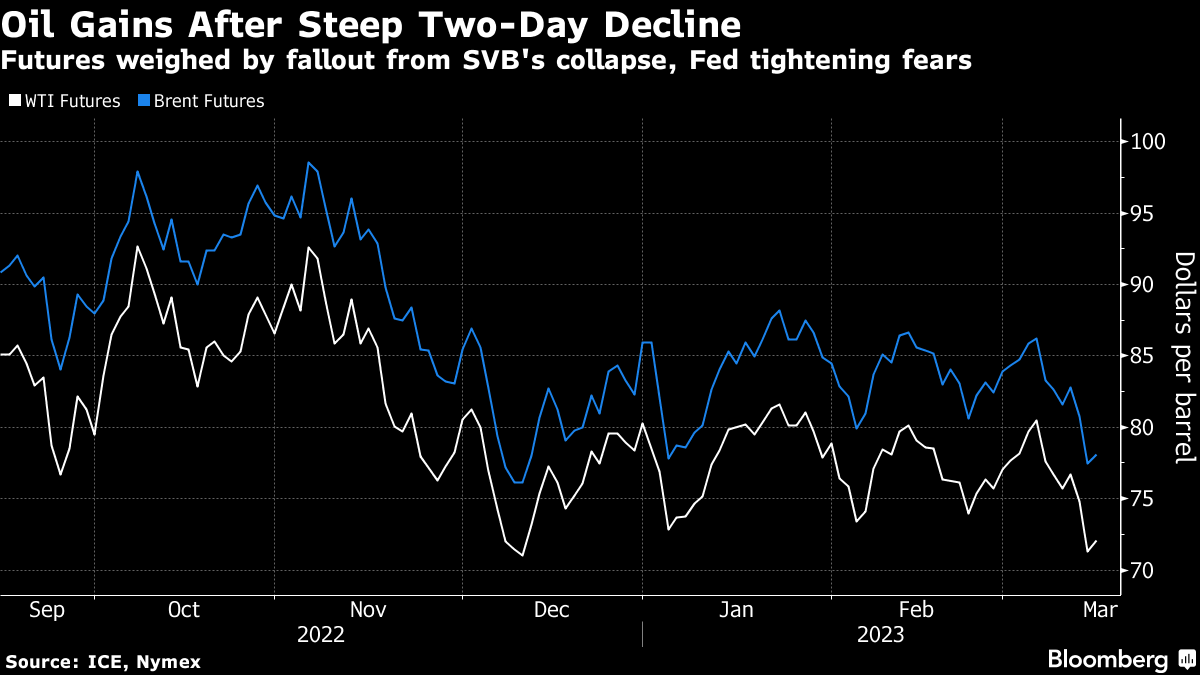

West Texas Intermediate futures climbed toward $72 a barrel after losing 7% over the past two sessions. China’s economic activity showed further signs of strengthening during the first two months of the year, including a boost in oil refining, though the rebound remains unbalanced.

The market is still facing another interest-rate hike from the Federal Reserve next week after US inflation gained, despite the collapse of Silicon Valley Bank leading to turmoil across the banking sector.

“Oil investors should price in volatility for now until further clarity on the Fed policy decision,” said Priyanka Sachdeva, an analyst at brokerage Phillip Nova Pte Ltd. The steep drop seems like an overreaction to the SVB crisis, she said.

Oil has endured a bumpy year, whipsawed by aggressive monetary tightening from the Fed and optimism around China’s demand recovery. Further gains may be constrained in the near term, with OPEC forecasting a modest surplus in the second quarter, a typical period of soft demand prior to the summer.

The price cap imposed on Russian crude is working, even with three-fourths of such sales occurring outside the mechanism, a senior US official said. In India — which is ensuring it won’t breach the limit — opaque purchases of grades like Urals and ESPO mean it’s hard to be sure if imports are bought below it.

The International Energy Agency is scheduled to release its monthly market report later Wednesday, providing the market with a snapshot on the demand and supply outlook. US inventory data is also expected.

More stories like this are available on bloomberg.com

©2023 Bloomberg L.P.