Adnoc Gas Draws $124 Billion of Orders for $2.5 Billion IPO

(Bloomberg) -- Abu Dhabi’s main energy company raised $2.5 billion from the initial public offering of its gas business, pulling off the year’s biggest listing and continuing a trend that saw the Middle East emerge as a bright spot for share sales in 2022.

Investors placed $124 billion of orders for a 5% stake in Adnoc Gas, an oversubscription level of more than 50 times.

Parent firm Abu Dhabi National Oil Co. priced the shares at 2.37 dirhams ($0.65) each after offering a range from 2.25 to 2.43 dirhams. The IPO values Adnoc Gas at about $50 billion, roughly in line with Occidental Petroleum Corp.

The company benefited from natural gas prices soaring last year as Russia’s invasion of Ukraine roiled energy markets. It made record adjusted underlying earnings of $8.7 billion in the 12 months through October.

While prices have dipped in recent months, they are still well above historical averages in Europe and Asia. Demand for liquefied natural gas — which the United Arab Emirates is investing billions of dollars in — is expected to remain strong for years.

Shares of Adnoc Gas are due to start trading in Abu Dhabi on March 13.

Adnoc increased the size of the offering by 25% this week on the back of strong demand. Most IPOs in the Gulf in 2022 saw double-digit oversubscription levels, as the increase in energy prices buoyed stock markets in Saudi Arabia, Abu Dhabi and Dubai. Elsewhere, high inflation and rising interest rates led to a slump in deals.

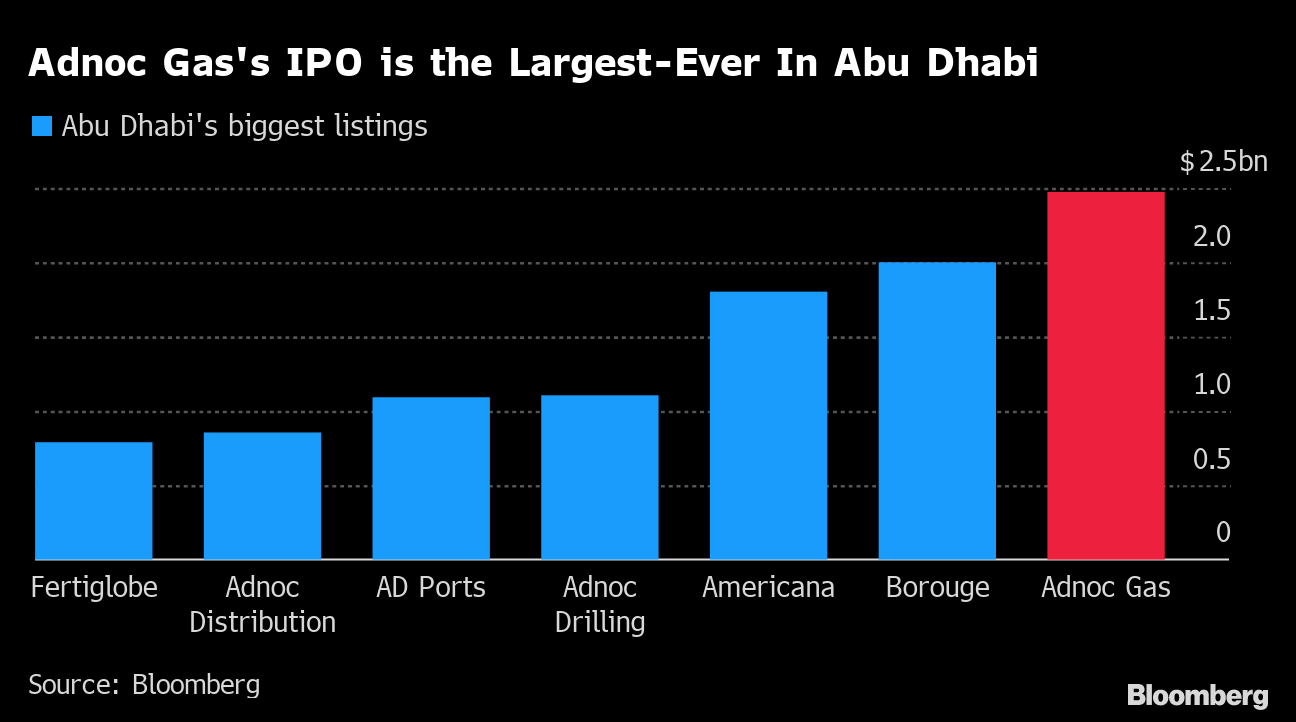

The Adnoc Gas IPO is the biggest-ever in Abu Dhabi, surpassing chemicals firm Borouge’s $2 billion deal in mid-2022. It’s the latest in a series of stock sales by state entities as governments try to fund a transition away from fossil fuels and bring more international investors into their markets.

Retail investors put in orders for $23 billion, over 58 times the shares reserved for them, which was also the highest-ever level of demand by mom-and-pop buyers in the MENA region, Adnoc said.

Fast Deal

Cornerstone investors, several including Abu Dhabi state-linked firms, committed to buy $850 million of stock in the IPO. Among them were Alpha Dhabi and International Holding Co.

The IPO ran on an accelerated timeline, with Adnoc only announcing the listing in late November and formally creating the gas unit at the beginning of this year. The tight schedule led to Goldman Sachs Group Inc. and Bank of America Corp. dropping off the deal because there wouldn’t have been time to get Adnoc Gas audited by a Big Four accounting firm, Bloomberg News reported.

Prior to the IPO, Adnoc transferred 5% of Adnoc Gas to Taqa, a state-controlled power producer in Abu Dhabi.

Home to world’s seventh largest gas reserves, the UAE is seeking to triple its LNG export capacity to about 15 million tons annually in the next few years. Adnoc Gas will be at the forefront of that push.

The firm has a gas-processing capacity of 10 billion cubic feet a day across eight onshore and offshore sites and a pipeline network of more than 3,250 kilometers (2,020 miles).

First Abu Dhabi Bank PJSC and HSBC Holdings Plc are the lead banks on the IPO. Abu Dhabi Commercial Bank PJSC, Arqaam Capital Limited, BNP Paribas, Deutsche Bank AG, EFG-Hermes and International Securities are joint bookrunners.

Moelis & Co. is an independent financial adviser.

(Updates throughout.)

More stories like this are available on bloomberg.com

©2023 Bloomberg L.P.