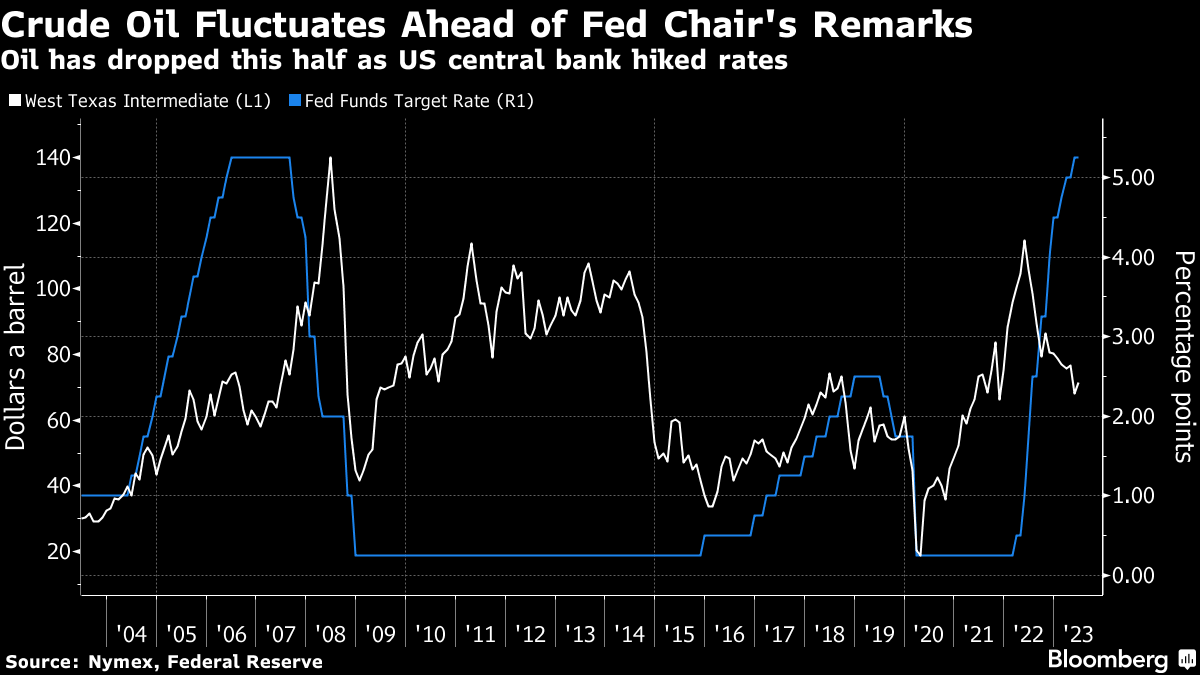

Oil Swings With China’s Demand Outlook and Fed Remarks in Focus

(Bloomberg) -- Oil fluctuated as traders took stock of China’s calibrated efforts to stimulate the economy and prepared for commentary from the head of the US Federal Reserve that may flag further monetary tightening.

West Texas Intermediate for August delivery edged higher to trade above $71 a barrel after dropping as much as 0.6% early in the session. While China has taken a series of incremental steps in recent days to aid growth, there is persistent concern that its moves may lack punch.

Fed Chair Jerome Powell is scheduled to give his semi-annual report to Congress on Wednesday. While policymakers kept interest rates unchanged at their meeting last week, they forecast further rises in the second half to help bring still-elevated inflation back toward their target.

Oil has dropped this half as China’s reemergence from its strict Covid Zero policies failed to gain traction and global crude supplies, including from Russia, proved abundant. In response, the Organization of Petroleum Exporting Countries and its allies have announced supply cuts, including a voluntary reduction by cartel leader Saudi Arabia that will take effect in July.

“Markets have shrugged off China’s monetary stimulus measures so far,” said Vandana Hari, founder of analysis firm Vanda Insights. The mood in oil remains somber, with a potential Fed hike lying ahead at the next meeting, she added.

Reflecting the concerns about the weaker outlook for energy demand growth in Asia’s largest economy, China National Petroleum Corp. trimmed its forecast for the increase in oil consumption this year to 3.5% from 5.1%.

Still, China’s economy is expected to stabilize in the second half following the stimulus, the China Securities Journal reported Wednesday, citing analysts. Separately, Wang Huning, the Communist Party’s No. 4 official, highlighted the importance of boosting consumption, according to the Xinhua News Agency.

©2023 Bloomberg L.P.