Oil Rises After Saudis Pledge Million-Barrel Cut at OPEC+ Meet

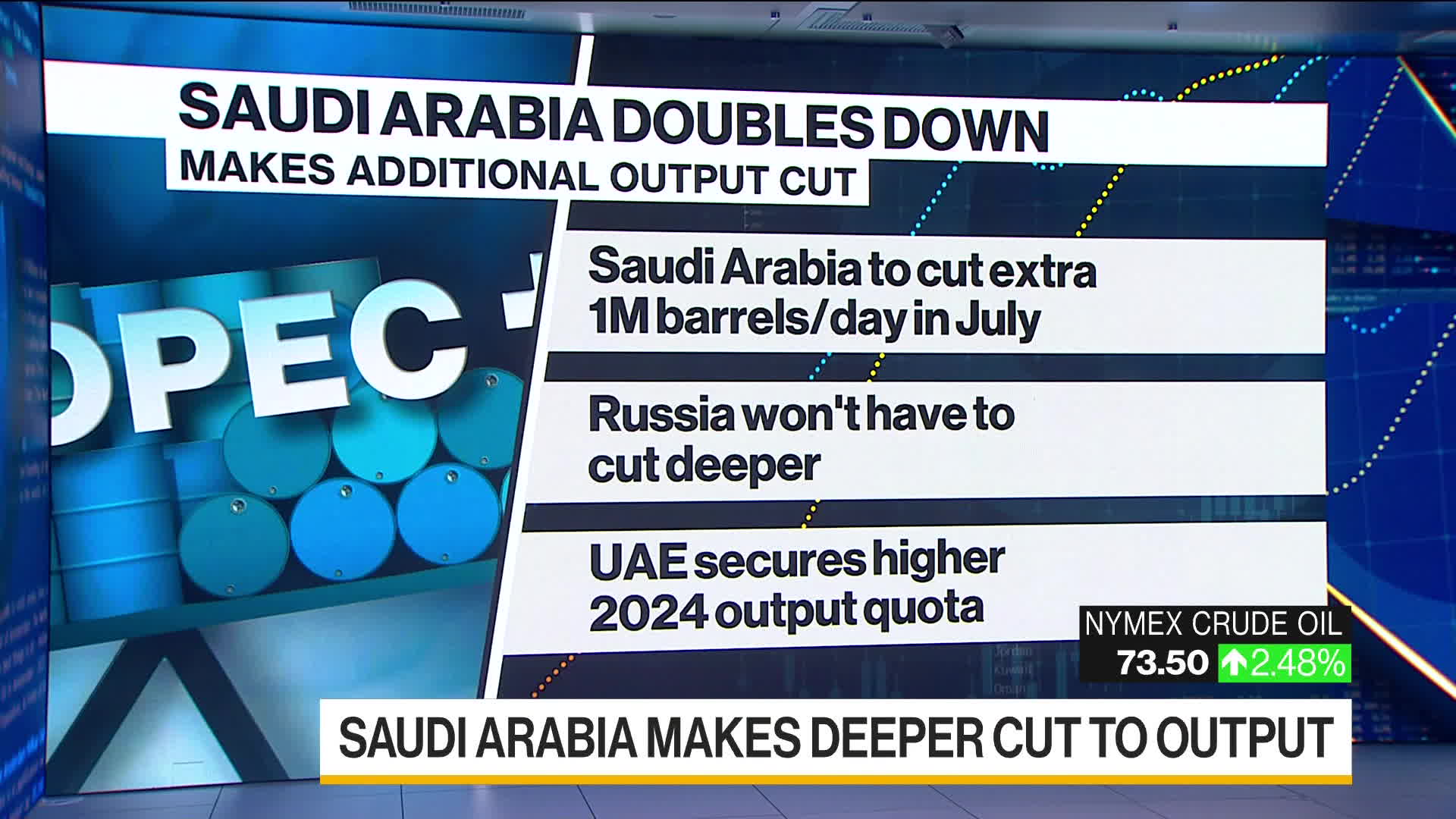

(Bloomberg) -- Oil advanced at the week’s open after Saudi Arabia said it will make an extra 1 million barrel-a-day supply cut in July, taking its production to the lowest level for several years following a slide in prices.

West Texas Intermediate jumped almost 5% early in the session before paring gains to trade below $73 a barrel, while global benchmark Brent changed hands at about $77. Saudi Energy Minister Prince Abdulaziz bin Salman said he “will do whatever is necessary to bring stability to this market” following a tense OPEC+ meeting over the weekend.

“The voluntary cut, in my view, is notable more for downside protection” rather than to spur a sustained rally, said Vivek Dhar, director of mining and energy commodities research at Commonwealth Bank of Australia. Markets may return to focus on the broader outlook of macroeconomic weakness, he said.

Oil in New York tumbled 11% last month as demand concerns weighed on the outlook, especially in China. Most market watchers including Goldman Sachs Group Inc. had expected OPEC+ to keep output unchanged, and the rest of the 23-nation coalition offered no additional action.

That’s left Saudi Arabia potentially sacrificing further market share to stabilize the market. While others in the group pledged to maintain their existing cuts until the end of 2024, Russia made no commitment to curb output further and the United Arab Emirates secured a higher production quota for next year.

The OPEC+ deal came after a long dispute with African members over how their cuts are measured, which delayed the start of the meeting by several hours. Next month’s additional cut could be extended, but the Saudis will keep the market “in suspense” about whether this will happen, Prince Abdulaziz said.

The minister has repeatedly sought to hurt bearish oil speculators, warning them to “watch out” in the buildup to Sunday’s meeting.

“Saudi Arabia would ideally want prices to be above $80 a barrel,” Vandana Hari, the founder of Vanda Insights in Singapore, said on Bloomberg television, referring to Brent. If the health of the global economy falters, the short sellers “will be back in no time,” she said.

©2023 Bloomberg L.P.