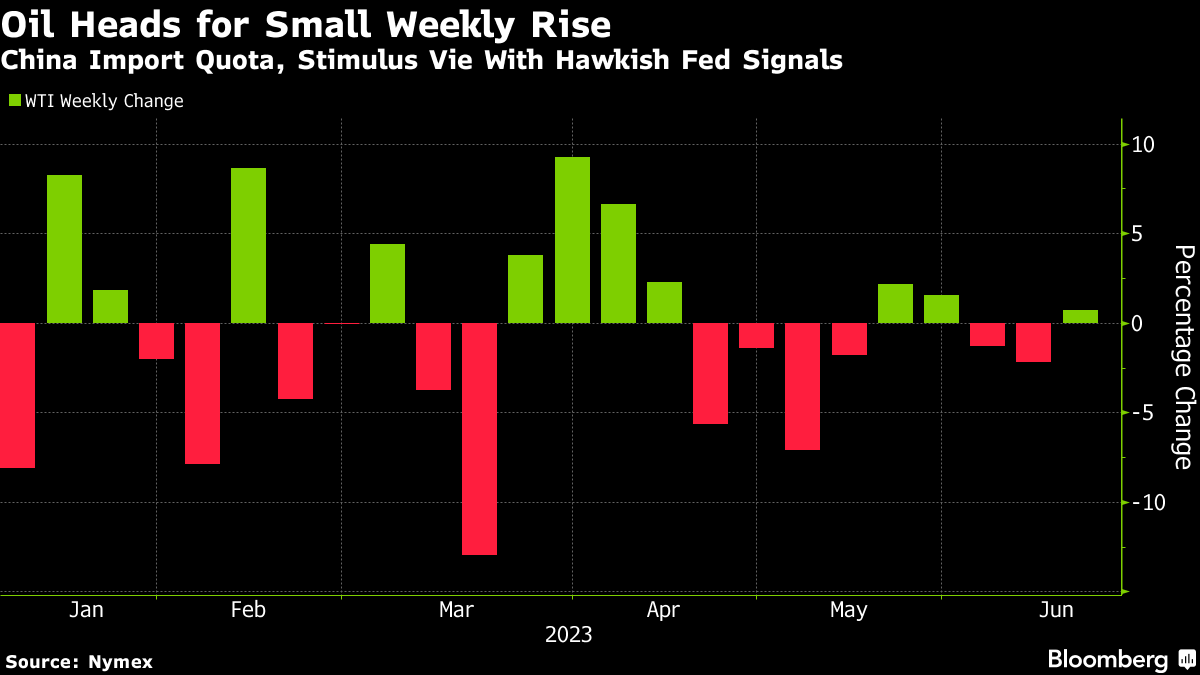

Oil Holds Biggest Jump in Six Weeks on China Stimulus Signs

(Bloomberg) -- Oil was steady in Asia after jumping the most in six weeks on Thursday as a weaker dollar and expectations for more stimulus in China outweighed concerns over higher interest rates in the US and Europe.

West Texas Intermediate held above $70 a barrel after jumping 3.4% in the previous session, putting it on course for a modest weekly gain.

China loosened monetary policy this week to revive its stalled recovery and there are expectations it will announce more targeted stimulus. Beijing also issued a large crude import quota earlier in the week. The dollar is on track for its biggest weekly drop since January, making oil cheaper for most buyers.

“While overall Chinese activity data was disappointing, Chinese crude throughput in May jumped,” said Charu Chanana, market strategist for Saxo Capital Markets Pte in Singapore. “Stimulus hopes also continue to support sentiment,” she said.

The Federal Reserve left borrowing costs unchanged on Wednesday, but signaled rates will still go higher than previously expected owing to persistent inflation and labor market strength. The European Central Bank hiked its main rate on Thursday and suggested another increase was likely next month.

The higher borrowing costs are adding to demand headwinds, with worries that the US will go into a Fed-driven recession increasing. On the supply side, exports from Russia have stayed strong, helping push crude down by around 12% this year. The bearishness is being reflected in the oil futures curve, with WTI’s prompt spread in the widest contango, where near-term prices are lower than those further out, since February.

©2023 Bloomberg L.P.