Oil Pushes Higher on Bets Chinese Demand Will Surge This Year

(Bloomberg) -- Oil headed for the highest close since early December on optimism that demand in China will improve after officials ditched Covid Zero, with traders waiting for the International Energy Agency’s latest outlook.

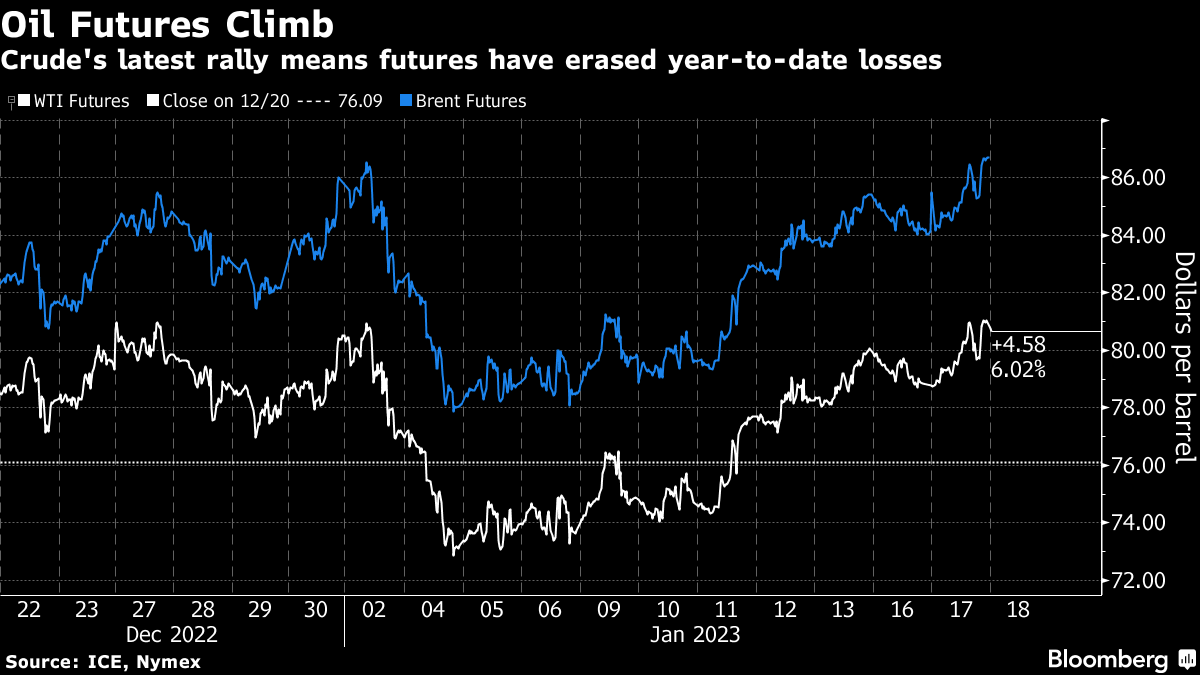

West Texas Intermediate climbed toward $81 a barrel, building on a modest gain on Tuesday and last week’s more-than 8% jump. OPEC Secretary General Haitham Al-Ghais said he’s “cautiously optimistic” about the global economy after the cartel forecast a balanced crude market this quarter.

Later Wednesday, the IEA, which advises major economies, issues its monthly market analysis, which may reflect China’s swift shift as well as the expected impact of sanctions on Russian flows in response to the war in Ukraine.

Crude has navigated a rocky start to the year, sinking in the opening week on concerns of a global slowdown, before rebounding. Aside from China, oil has found support from a weaker dollar and expectations the Federal Reserve is nearing an end to its rate hikes. The US benchmark is now little changed for 2023.

China’s economic recovery is “boosting confidence that we could see a strong recovery in Chinese oil demand this year,” said Warren Patterson, head of commodities strategy at ING Groep NV. “The market will likely be keeping an eye on any potential demand revisions in today’s IEA monthly report.”

Reflecting the upbeat tone from China, the world’s largest crude importer, the nation’s top economic official said that the economy will likely rebound to its pre-pandemic growth trend this year. Last week, a Bloomberg survey showed analysts expect Chinese crude consumption to hit a record in 2023.

Goldman Sachs Group Inc., one of the most vocal commodity bulls, upgraded its forecast for China’s gross domestic product growth this year after stronger-than-expected economic data earlier this week. The bank now project the economy will expand 5.5% in 2023, up from 5.2% previously.

The rising sense of optimism in the oil market, as well as raw materials more broadly, has helped to boost liquidity, with total oil futures open interest rising to the highest since June. Last year, liquidity fell, exacerbating price swings.

Elements, Bloomberg’s daily energy and commodities newsletter, is now available. Sign up here.

More stories like this are available on bloomberg.com

©2023 Bloomberg L.P.