Oil Extends Gains as China Optimism Outweighs Slowdown Concerns

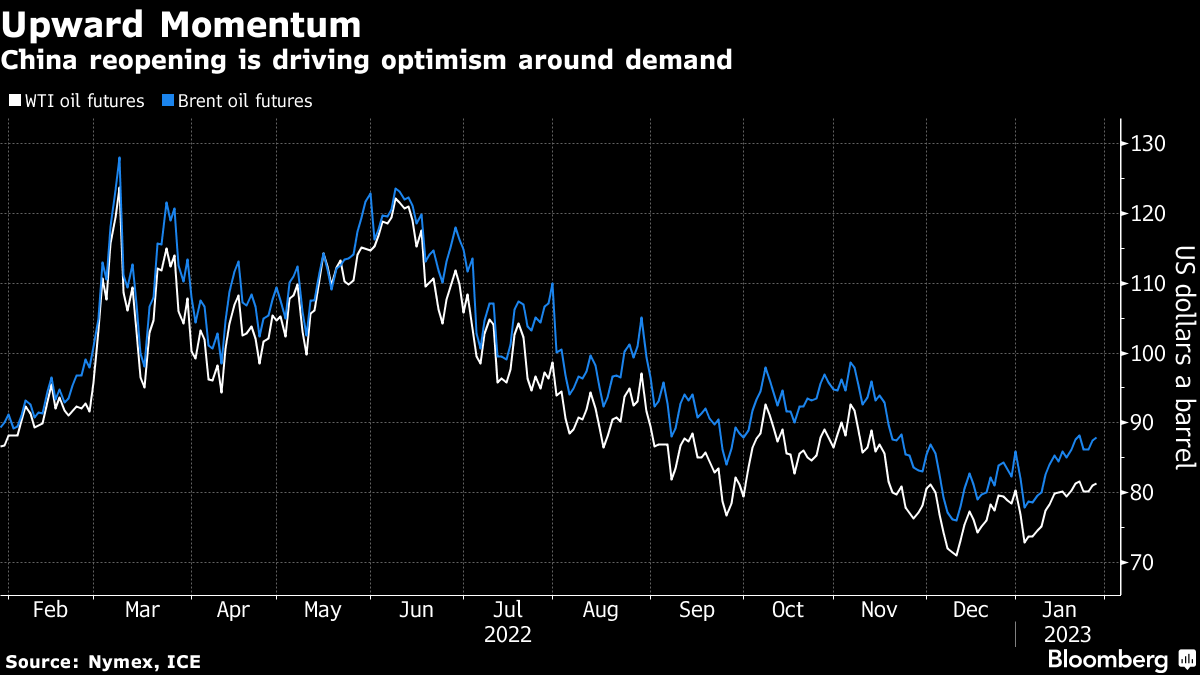

(Bloomberg) -- Oil rose in line with a broader market rally in Asia as optimism over Chinese demand outweighed concerns over an economic slowdown.

West Texas Intermediate futures gained for a third session to trade above $81 a barrel on Friday. Trafigura Group sees “a lot of upside” for oil markets as pent-up demand is unleashed, especially as Chinese consumption rebounds after the nation dismantled its strict Covid Zero policy.

US economic growth beat expectations in the last quarter of 2022, but there’s still a considerable risk of a recession this year. The Federal Reserve is set to raise interest rates next week, although there’s speculation that the central bank could be less aggressive in its monetary policy tightening.

“The theme for oil this year is China plus supply tightness from Russia, against a recessionary backdrop,” said Sean Lim, an analyst at RHB Investment Bank Bhd in Kuala Lumpur. “We expect Brent to average $85 in the first quarter.”

Chinese markets are closed this week for the Lunar New Year holiday and will reopen Monday. Crude futures are little changed for the week.

Oil has recovered from a steep slump at the start of the year and liquidity is returning to the futures market. Attention is shifting to the potential fallout from European Union sanctions on Russia’s seaborne shipments of petroleum products early next month. The EU is considering a plan to cap the price of premium refined fuel exports like diesel at $100 a barrel.

The forward curve is starting to indicate signs of tightness in the oil market after a period of weakness. The prompt spread for global benchmark Brent — the gap between the two nearest contracts — firmed in a bullish backwardation pattern after spending most of the past two months in contango.

Elements, Bloomberg’s daily energy and commodities newsletter, is now available. Sign up here.

More stories like this are available on bloomberg.com

©2023 Bloomberg L.P.