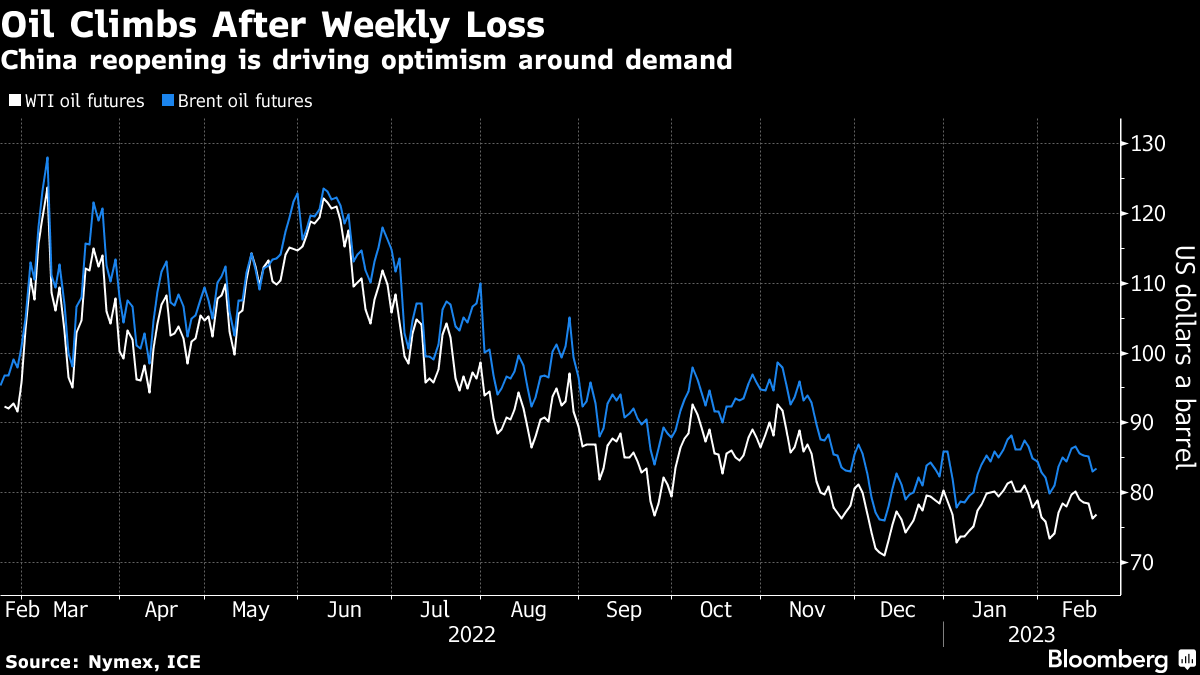

Oil Gains After Weekly Loss as China Recovery Competes With Fed

(Bloomberg) -- Oil rose after a weekly loss on hopes that a Chinese demand rebound is picking up pace following the end of Covid Zero, outweighing hawkish signals from the Federal Reserve.

West Texas Intermediate climbed toward $77 a barrel, snapping the longest run of declines this year. Signs are emerging of a recovery in Chinese oil demand, although the prospect of further monetary tightening from the Federal Reserve to combat inflation is keeping a lid on crude prices.

“Economic sentiment and the mood in the financial markets is likely to remain in the driver’s seat,” said Vandana Hari, found of Vanda Insights. “The Chinese reopening could spark a bout of bullishness at some point in coming weeks.”

Oil has endured a bumpy start to 2023 as investors juggle persistent concerns over a global economic slowdown and optimism around China’s reopening. The fallout from sanctions on Russian energy and the rerouting of global flows has added another element of uncertainty to the global market.

The US plans to impose new export controls and fresh sanctions on Russia, targeting key industries a year after the invasion of Ukraine. The measures will target the nation’s defense and energy sectors, financial institutions and several individuals, according to people familiar with the matter.

More stories like this are available on bloomberg.com

©2023 Bloomberg L.P.