Oil Steadies After Three-Day Loss as Riyadh Defends OPEC+ Cuts

(Bloomberg) -- Oil steadied after a three-day loss as Saudi Arabia said recent cuts by OPEC+ would be honored in full and could be extended, pushing back against persistent skepticism over the curbs’ effectiveness.

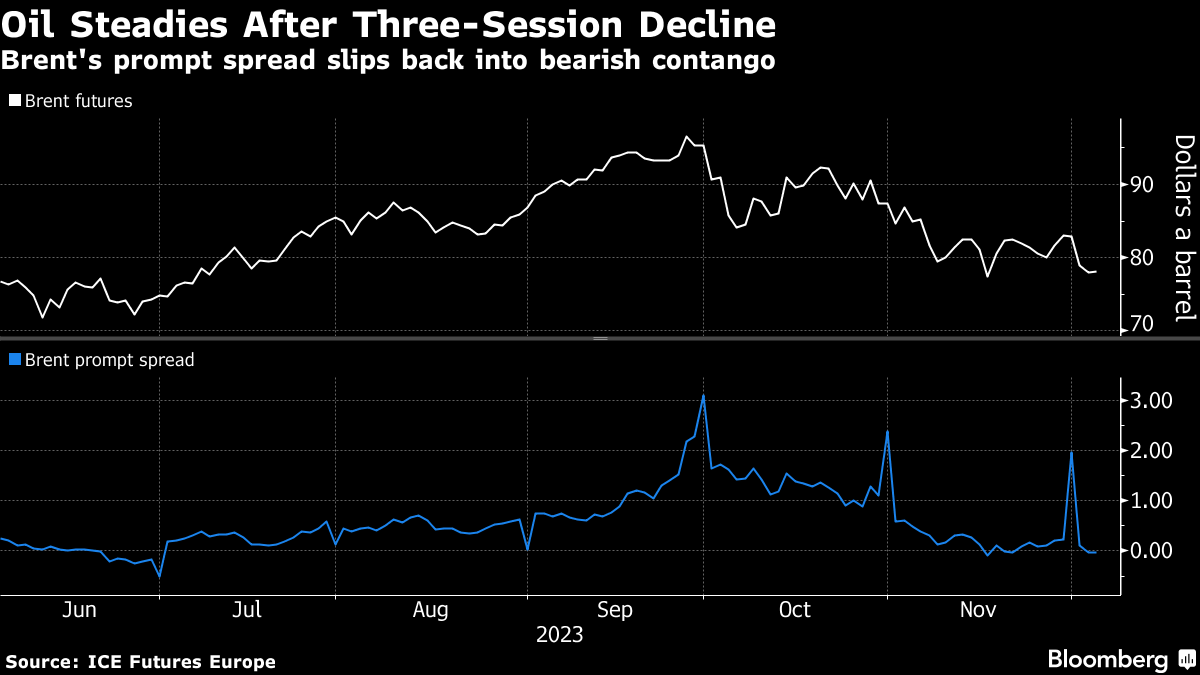

Global benchmark Brent held above $78 a barrel after dropping by more than 6% in the preceding three sessions, while West Texas Intermediate was over $73. Saudi Energy Minister Prince Abdulaziz bin Salman told Bloomberg News the recently decided cuts would “overcome” an expected inventory build in the first quarter, and could be continued further into 2024 if needed.

Crude has come under downward pressure since last week’s meeting of the Organization of Petroleum Exporting Countries and its allies, as traders remain unconvinced over how fully the package of voluntary cuts will be carried out. Analysts have highlighted the group’s ballooning spare capacity, saying traders needed to see evidence of the cuts’ actual impact. The meeting was delayed by several days and marked by internal disputes over quotas.

There are “compliance doubts in the context of more fractious internal OPEC dynamics,” said Vishnu Varathan, Asia head of economics and strategy at Mizuho Bank Ltd. After the meeting, rising non-OPEC supply, lower geopolitical tail risks and demand dynamics were moving to the fore, he said.

In testimony to the challenge facing OPEC+, timespreads have taken a tumble, highlighting a weakening of near-term conditions. The gap between the two nearest months for both Brent and WTI now trades in a bearish contango pattern, with the prompt contract at a discount to the later-dated one.

Meanwhile, Russian President Vladimir Putin will travel to the United Arab Emirates and Saudi Arabia this week, according to people familiar with the plans. Moscow is a key member of the broader OPEC+ grouping.

©2023 Bloomberg L.P.