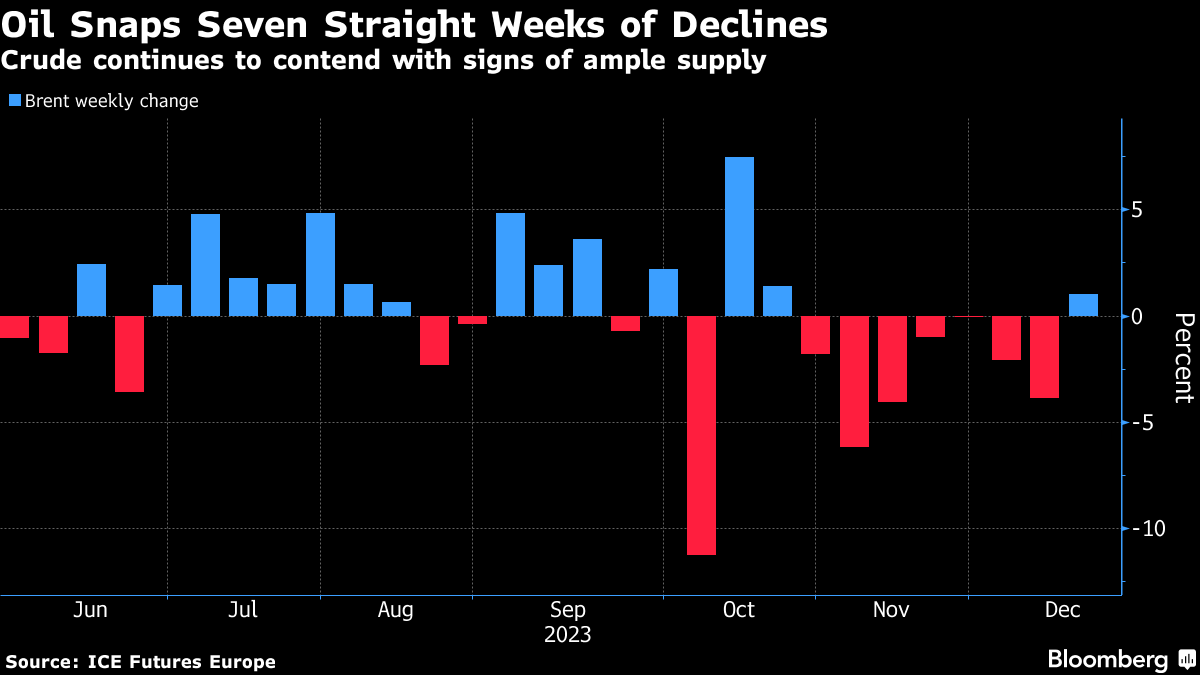

Oil Set for First Weekly Gain Since October on Fed Relief Rally

(Bloomberg) -- Oil was poised to eke out its first weekly gain in almost two months after dovish signals from the Federal Reserve on Wednesday unleashed a bullish pulse across markets.

Global benchmark Brent traded near $77 a barrel after rising more than 4% in the prior two sessions, with West Texas Intermediate below $72. Treasuries have risen and the dollar weakened since Fed Chair Jerome Powell said that policymakers are now turning their focus on when to cut borrowing costs. A softer greenback boosts the appeal of commodities priced in the currency.

The modest move higher comes after seven straight weeks of declines that brought futures to the lowest since June just before the Fed meeting. A surge in exports from non-OPEC countries including the US, and concerns over a weakening demand outlook, are pressuring prices while there’s also some skepticism over whether all OPEC members will adhere to the deeper voluntary cuts.

“Despite the recent recovery, crude prices remain relatively close to recent lows” as global demand and supply balances soften, said Ravindra Rao, head of commodity research at Kotak Securities Ltd. in Mumbai. “Even with recent production cuts by OPEC+, projections of higher non-OPEC supply led by the US may act as a limiting factor on further price gains.”

The International Energy Agency on Thursday added to the bearish outlook, slashing its estimates for global oil demand growth this quarter by almost 400,000 barrels a day as economic activity weakens. The Paris-based consumer organization continues to expect growth to almost halve next year, to about 1.1 million barrels a day.

Timespreads are also still flashing signs of weakness, with Brent and WTI both in bearish contango — when later contracts trade at premiums to prompt ones — until the middle of next year. Brent’s six-month spread was last 38 cents a barrel in contango, compared with $1.67 a barrel in the opposite, bullish backwardated structure a month ago.

©2023 Bloomberg L.P.