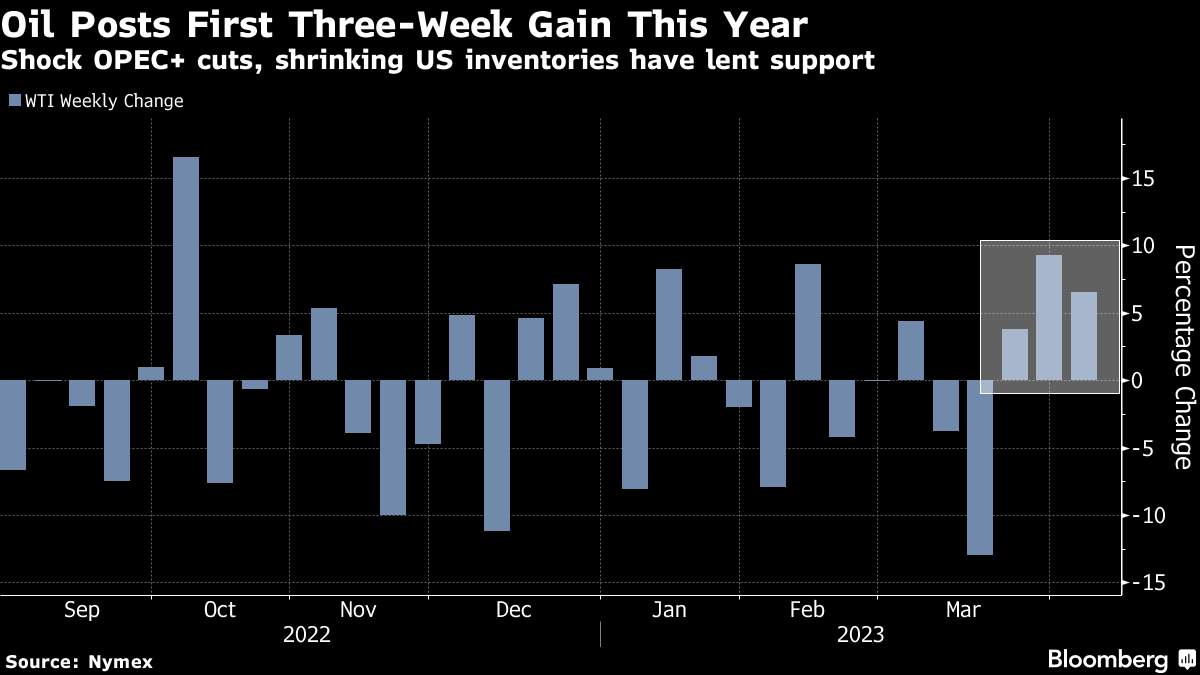

Oil Posts Third Weekly Gain on OPEC+ Cut, Inventory Declines

(Bloomberg) -- Oil posted a third straight weekly gain after a surprise supply cut by OPEC+ and a drop in US inventories tightened the market outlook.

Prices rallied the most this year on Monday, surging 6.3%, following the decision of the Organization of Petroleum Exporting Countries and its allies to slash more than 1 million barrels of daily output starting in May. Saudi Arabia has since hiked prices of all its oil sales to customers in Asia.

Crude has risen 26% from its intraday low reached mid-March, when banking turmoil prompted a flight from risk assets. Prices were already recovering amid growing Chinese fuel demand and a weakening US dollar when OPEC+ intervened, confounding short sellers and amplifying the rebound.

Meanwhile, geopolitical tensions in the Middle East are abating as top diplomats from Saudi Arabia and Iran meet to continue mending relations, de-escalating a decades-long rivalry that’s fueled proxy wars and rattled oil markets.

Adding to tightening supply, US crude stockpiles sank 3.7 million barrels last week, with inventories of gasoline and distillates dropping as well. Despite the fundamental picture, traders will continue to look to US economic data for further clues on recession risks and the Federal Reserve’s interest rate hikes.

“Physical OPEC+ crude oil cuts will clash with monetary central bank hikes designed to rein in demand, posing macro risks,” Francisco Blanch, an analyst at Bank of America Corp., said in a note to clients. “Net, we stay constructive.”

Energy Daily, Bloomberg’s energy and commodities newsletter, is now available. Sign up here.

©2023 Bloomberg L.P.