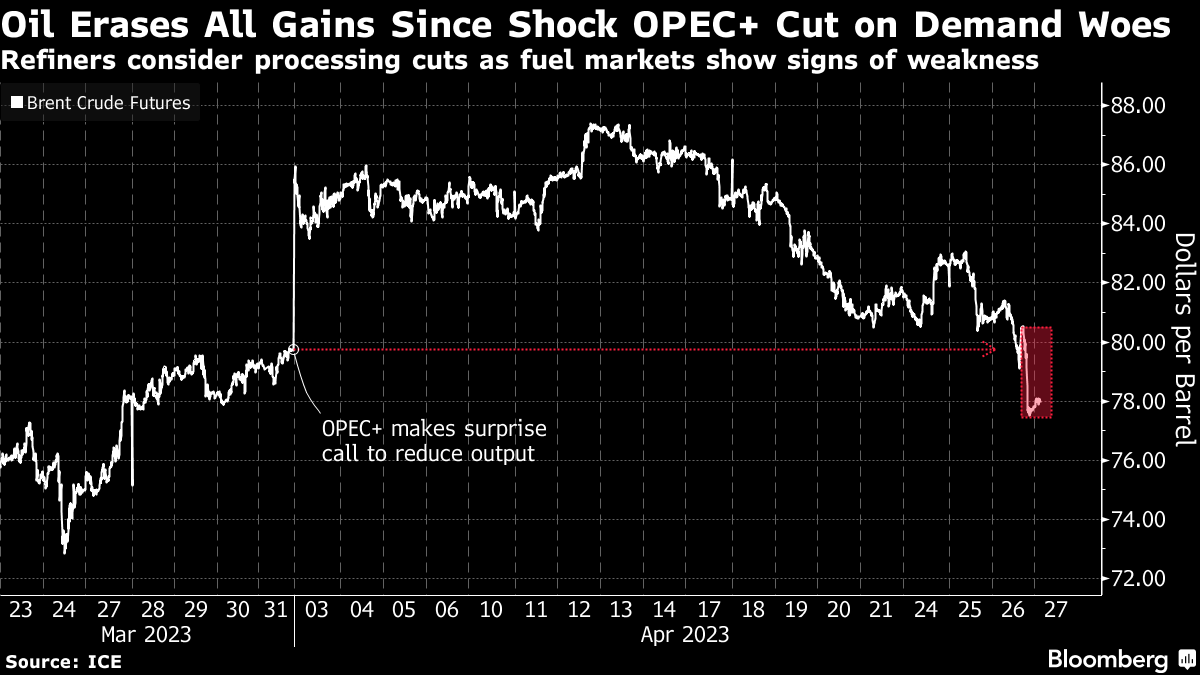

Oil Erases All Gains Since Surprise OPEC+ Cut on Demand Woes

(Bloomberg) -- Oil steadied after a two-day decline of almost 6% as concerns about slowing demand continued to hang over the market.

West Texas Intermediate traded above $74 a barrel and has now given up all of the gains put on after OPEC+ blindsided markets with news of a surprise cut to output at the start of this month. Fuel markets are showing weakness and some refiners in Asia are considering reducing processing as margins shrink.

Oil has been swinging in tandem with wider equity markets in recent sessions, as investors respond to the conflicting drivers of tighter US monetary policy and a resurgent China. Traders are also watching energy flows from Russia and the fallout from sanctions for its war in Ukraine, with researchers saying there has likely been widespread breaches of a price cap by Asian buyers.

“Falling refining margins and worries over the recovery in China’s commodity‑intensive economy have continued to weigh on oil,” said Vivek Dhar, director of mining and energy commodities research at Commonwealth Bank of Australia. Slowdown fears and concerns over the health of the US banking system added to the bearish sentiment, he added.

Concerns over slowing demand overshadowed a largely bullish US stockpile report. The nation’s crude inventories shrunk by 5.05 million barrels last week — a second weekly draw — while gasoline and distillate supplies declined.

©2023 Bloomberg L.P.