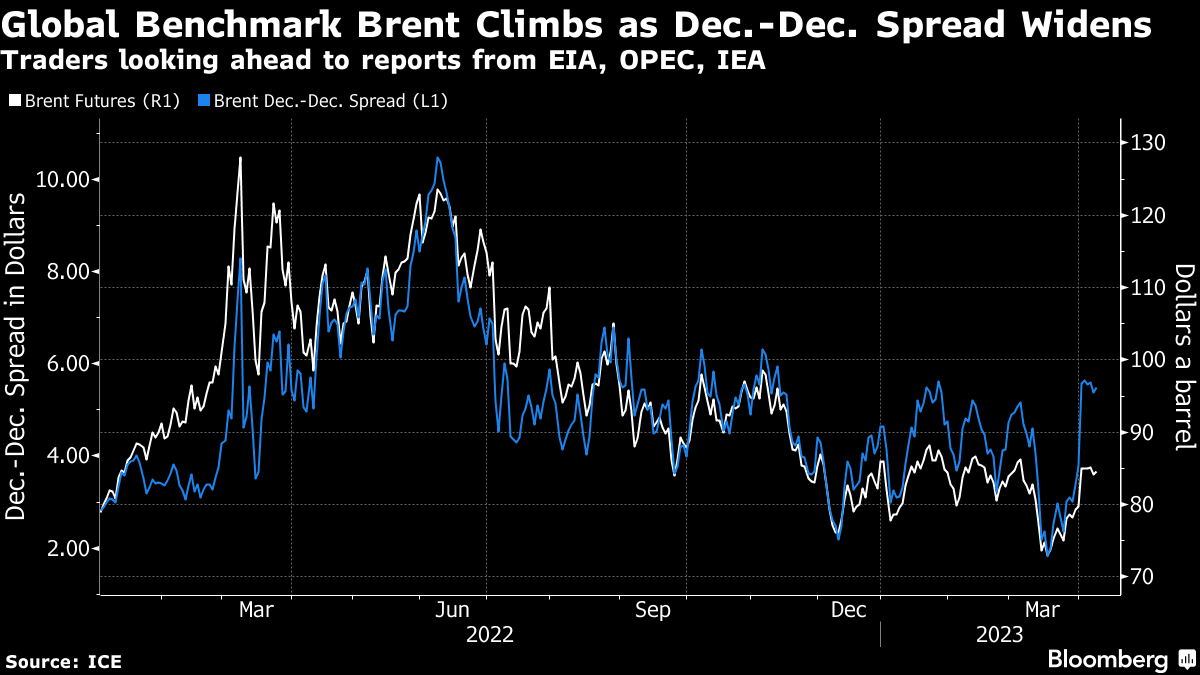

Oil Advances With Equities as Traders Wait for Clues From EIA

(Bloomberg) -- Oil rose as traders looked ahead to a slew of market data that’ll shed light on supply-demand trends after OPEC+ cut production.

West Texas Intermediate advanced above $80 a barrel, gaining along with equities while the dollar fell. In the US, the Energy Information Administration unveils its short-term outlook later Tuesday, while OPEC and the International Energy Agency are also scheduled to issue monthly reports this week.

Crude has rebounded from a 15-month low hit in March as a concerns over a banking crisis faded, US stockpiles fell, and the Organization of Petroleum Exporting Countries and its allies cut output. In addition, there have been disruptions to supply, including a halt to pipeline flows from Iraq to Turkey.

Key metrics suggest tighter conditions. Brent’s December-December spread — the difference between futures for the final month this year and in 2024 — widened to $5.50 a barrel. That compares with $2.53 a barrel three weeks ago.

©2023 Bloomberg L.P.