Stocks, US Equity Futures Climb as Dollar Slides: Markets Wrap

(Bloomberg) -- Stocks and US equity futures advanced Friday as investors assessed whether monetary tightening to tackle inflation in the US and Europe is getting closer to being priced in. A gauge of dollar strength dropped the most in a month.

Europe’s Stoxx 600 Index jumped as miners rallied on optimism over Chinese demand, while banks surged following the European Central Bank’s record rate hike. Gains in S&P 500 and Nasdaq 100 contracts exceeded 0.8%. In New York premarket trading, DocuSign Inc. rallied after estimate-beating sales and a raised billings forecast. Digital Media Solutions Inc. soared on a non-binding “go private” proposal from Prism Data.

The euro touched the highest level in three weeks after the ECB raised rates 75 basis points Thursday. Bets the Federal Reserve will hike by the same margin when it meets later this month increased after chair Jerome Powell reiterated the Fed is determined to curb price pressures.

European natural gas prices eased as the region’s energy ministers gathered for a summit to draw up plans to fix an unprecedented crisis that threatens to undermine the broader economy.

Treasuries trimmed their retreat, with the policy-sensitive two-year yield still near the highest since 2007. The Bloomberg Dollar Spot Index slipped as much as 1%, while the pound rallied against the greenback. Oil advanced and gold climbed, while Bitcoin rose the most in more than a month.

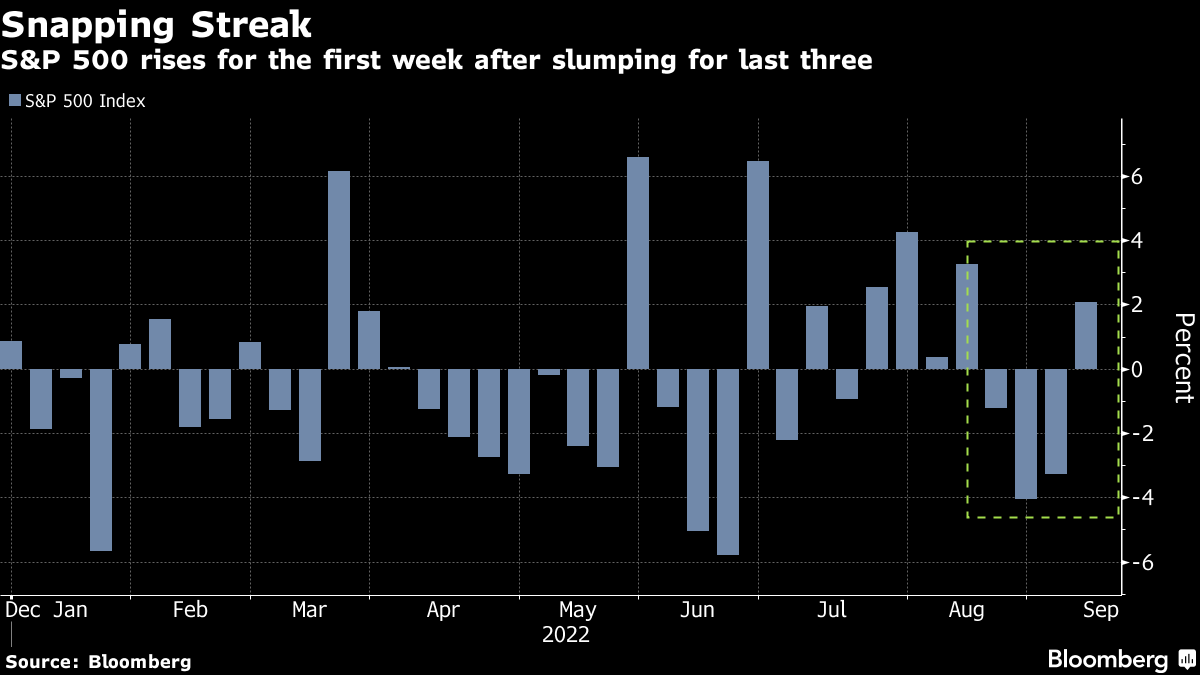

Global stocks are on course for their first weekly advance in four, a small measure of respite from the bear-market omens circling markets due to monetary tightening, energy woes and China’s growth slowdown.

“The market has been extraordinarily focused on the actions of the ECB and Fed as they try to bring inflation under control,” said Sebastien Galy, senior macro strategist at Nordea Asset Management. “Eventually this will change and the investment horizon will lengthen considerably. For now though, the market has good reasons not to. Inflation saps consumer confidence and overtightening could send the European and US economies into a recession.”

Speaking at a conference, Powell said “we need to act now, forthrightly, strongly as we have been doing” and added that “my colleagues and I are strongly committed to this project and will keep at it.”

In contrast with the buoyant mood in equity markets Friday, Bank of America Corp. strategists flagged that investors are rushing out of US stocks as the likelihood of an economic downturn increases amid a myriad of risks. US stock funds posted outflows of $10.9 billion in the week to Sept. 7, according to EPFR Global data cited by the bank, with the biggest exodus in 11 weeks led by technology stocks.

In Asia, a gauge of regional equities rose the most in two weeks. The yen headed for its best day in a month as Japanese officials gave the strongest hint yet at possible direct market intervention as a response to weakness in the currency.

The gyrations in markets are being overshadowed Friday by the death of Queen Elizabeth II, whose passing prompted an outpouring of condolences from around the world.

Some of the main moves in markets:

Stocks

- Futures on the S&P 500 rose 0.8% as of 6:32 a.m. New York time

- Futures on the Nasdaq 100 rose 1.1%

- Futures on the Dow Jones Industrial Average rose 0.8%

- The Stoxx Europe 600 rose 1.5%

- The MSCI World index rose 0.8%

Currencies

- The Bloomberg Dollar Spot Index fell 0.9%

- The euro rose 0.9% to $1.0091

- The British pound rose 0.9% to $1.1607

- The Japanese yen rose 1.7% to 141.68 per dollar

Bonds

- The yield on 10-year Treasuries declined six basis points to 3.26%

- Germany’s 10-year yield declined one basis point to 1.70%

- Britain’s 10-year yield declined eight basis points to 3.06%

Commodities

- West Texas Intermediate crude rose 1.6% to $84.84 a barrel

- Gold futures rose 1% to $1,737.70 an ounce

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.