Oil Set for Third Weekly Drop as Global Demand Concerns Escalate

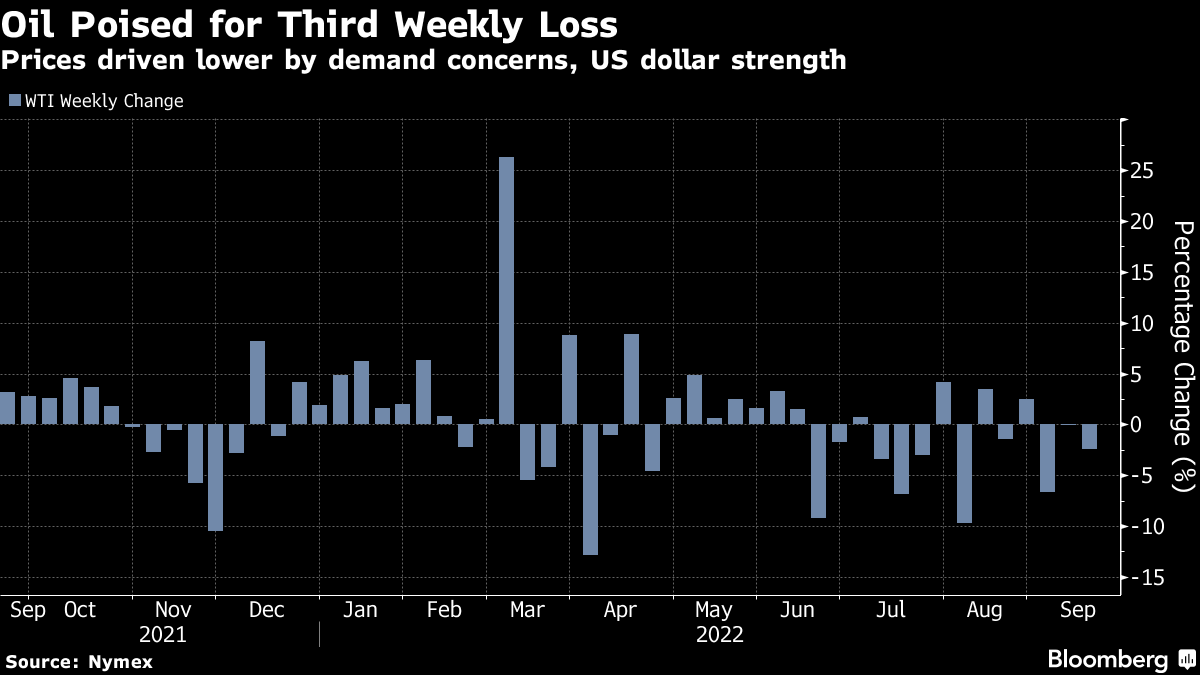

(Bloomberg) -- Oil headed for a third weekly loss as a deteriorating global economic backdrop stoked demand concerns and a buoyant US dollar made crude more expensive for most buyers.

West Texas Intermediate edged higher above $85 a barrel, but remains on track to finish the week more than 1% lower. Consumption is being threatened by a hawkish Federal Reserve, the risk of a recession in Europe due to a severe energy crisis, and China sticks with its Zero Covid policy.

Data from China on Friday painted a mixed picture in the world’s largest oil importer. While some indicators showed signs of recovery in August as industrial production, retail sales and fixed-asset investment grew faster than expected, the refining industry remained under pressure.

Among bearish signals on Thursday, the US Department of Energy dialed back expectations that a restocking of the nation’s strategic reserves was imminent. Meanwhile, China could allow more fuel exports, potentially reflecting weak domestic consumption in the top importer.

Crude is on course for the first quarterly loss in more than two years, having reversed all the gains seen in the wake of Russia’s invasion of Ukraine. It has retreated alongside global equities and other commodities including copper as investors recalibrated their expectations for the economic outlook. In the US, a swathe of leading companies have flagged rising risks this week.

“Sentiment in the oil market remains largely negative, with Chinese demand concerns lingering,” said Warren Patterson, head of commodities strategy at ING Groep NV in Singapore. “The broader strength that we have seen in the US dollar, coupled with expectations of a more hawkish Fed, will not be very helpful for the bulk of the commodities complex.”

Oil has also come under pressure from a strong US dollar, with a Bloomberg gauge of the currency trading near a record this week on the outlook for tighter monetary policy. A rising greenback -- which has helped push the yuan to its lowest since 2020 -- makes commodities more expensive for buyers outside of the US.

With prices in retreat, several banks have cautioned on the outlook. Standard Chartered Plc said the global oil market has swung into a “large surplus” this quarter, while Morgan Stanley and UBS Group AG both cut their near-term forecasts amid mounting fears of recessions in major economies.

Widely-watched time spreads have been volatile. Brent’s prompt spread -- the difference between its two nearest contracts -- was $1.24 a barrel in backwardation, compared with $1.13 a week ago and more than $2 last month.

Elements, Bloomberg’s daily energy and commodities newsletter, is now available. Sign up here.

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.