Oil Jumps as OPEC+ Mulls Biggest Production Cut Since Pandemic

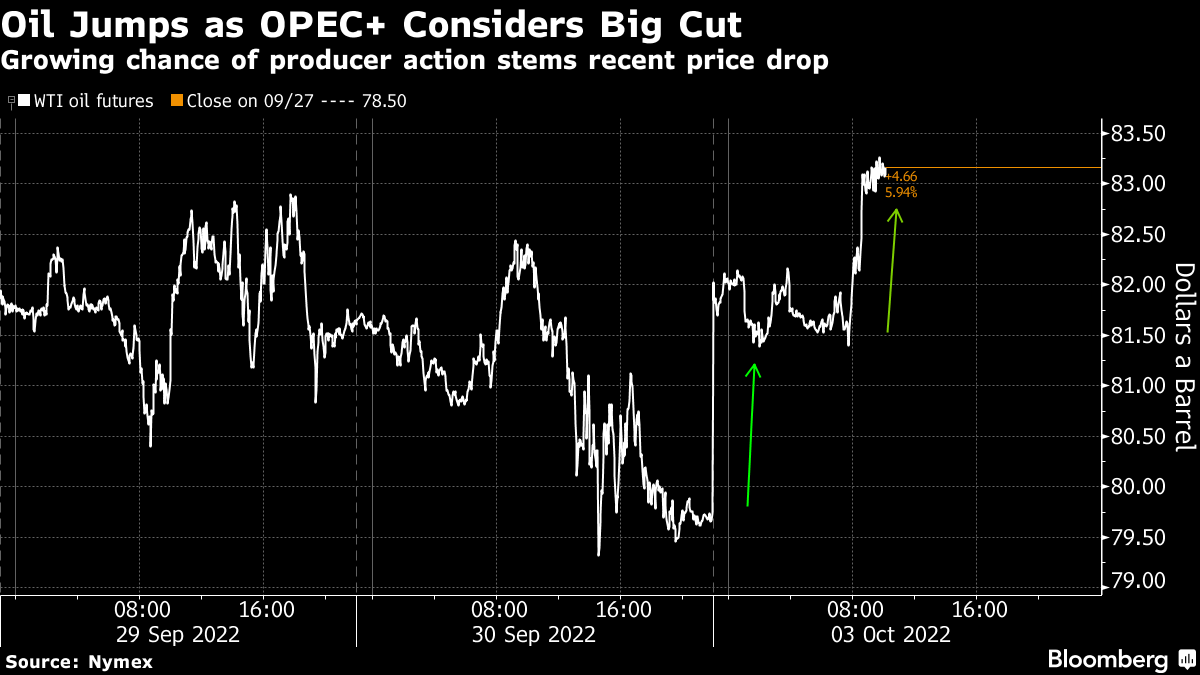

(Bloomberg) -- Oil surged above $83 a barrel on indications the OPEC+ alliance is considering slashing production by more than 1 million barrels a day to revive plunging prices when it meets this week.

A reduction of that magnitude would be the biggest since the pandemic, although OPEC+ delegates said a final decision on the size of the cuts won’t be made until ministers gather in Vienna on Wednesday. West Texas Intermediate rose as much as 5.5%, the biggest intraday gain since July.

“It is interesting that OPEC+ is considering a production cut already when Brent has hardly touched below $85 a barrel,” said Helge Andre Martinsen, senior oil analyst at DNB Bank ASA. “Most of the OPEC+ players, including Russia, are producing below its production quota due to capacity constraints. Hence, the majority of the group will feel no pain.”

Oil fell by a quarter in the three months through September as a slowing global economy sapped demand. Banks, including UBS Group AG and JPMorgan Chase & Co., said the Organization of Petroleum Exporting Countries and its allies may need to trim output by at least 500,000 barrels a day to stabilize prices.

This week’s OPEC+ meeting will be the first in-person gathering since March 2020. The group is deciding on supply for November.

A large output cut may draw criticism from the US and other major consumers, where energy-driven inflation has forced central banks to aggressively jack up interest rates. There also is the specter of European sanctions on Russian oil that are due to take effect in December.

“Risk-reward in the oil market is improving if OPEC is ready to act with oil prices just below $90 a barrel,” Martinsen added.

The European Union is aiming for a preliminary deal as soon as Monday for a package designed to punish Russia for its war in Ukraine. The agreement likely would include political backing for imposing a price cap on Russian oil.

In Asia, China issued new quotas for fuel exports and crude imports last week as it seeks to revive its economy, adding to the bullish outlook for oil. The world’s biggest crude importer has seen energy demand tumble due to virus lockdowns and a property slump.

Elements, Bloomberg’s daily energy and commodities newsletter, is now available. Sign up here.

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.