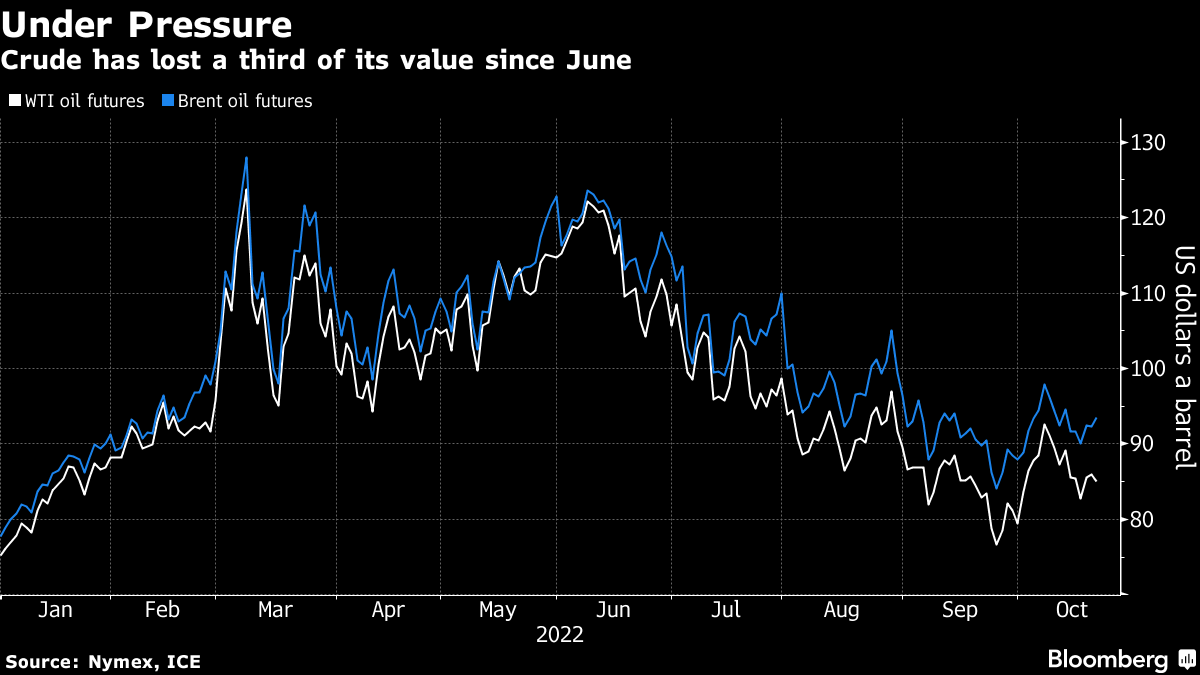

Oil Falls as Souring Chinese Sentiment Filters Through Markets

(Bloomberg) -- Oil declined as sentiment soured over China following the conclusion of the party congress, filtering through broader markets.

West Texas Intermediate slipped below $84 a barrel on Monday as investors also digested a raft of delayed Chinese economic data that showed a mixed recovery during the third quarter. A stronger dollar added to headwinds, making commodities priced in the currency less attractive.

See also: Xi’s Total Control in China Injects More Risk Into Chaotic World

Crude has lost a third of its value since June as fears over a global economic slowdown continue to hang over the market. However, significant OPEC+ output cuts and looming European Union sanctions on Russian oil flows have raised concerns about the supply outlook heading into winter.

“Oil will remain choppy as recession risks and supply tightening balance each other out,” said Gao Jian, a Shandong-based analyst with Zhaojin Futures Co. “The market will focus on compliance rates for OPEC+’s production cuts next month and whether the US will initiate counter-measures by adding supply.”

The decision by the Organization of Petroleum Exporting Countries and its allies to curb supply from November has drawn a sharp rebuke from the US, which previously called on producers for more oil to help curb inflation. President Joe Biden’s top energy adviser said Sunday the cut was largely a political move.

Brent remains steeply backwardated, a bullish structure where near-dated contracts are more expensive than later-dated ones. The prompt time spread was $2.15 in backwardation, compared with $1.44 a week earlier.

China ramped up its oil imports and processing last month as refineries returned from seasonal maintenance, while exports of fuel products jumped after the allocation of new quota. Inbound shipments rose to the highest since May, according to Bloomberg calculations based on government data.

Elements, Bloomberg’s daily energy and commodities newsletter, is now available. Sign up here.

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.