Global Oil Market Flashes Warning Signs on Rising Demand Angst

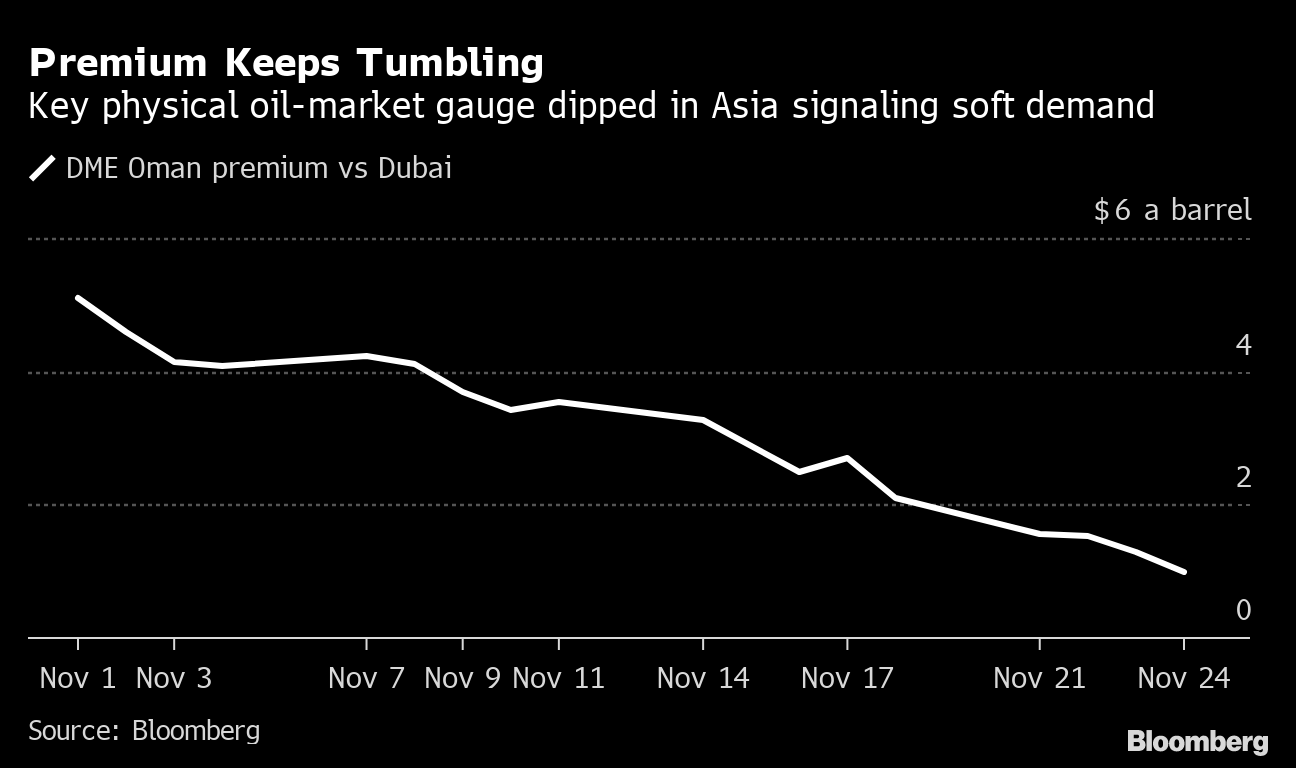

(Bloomberg) -- A closely-watched gauge of Asian oil demand has slumped to a seven-month low as surging virus cases in China trigger lockdown-like restrictions in the biggest crude importer.

The premium of Oman futures over Dubai swaps fell below $1 a barrel on the Dubai Mercantile Exchange on Thursday. It’s plunged about 80% this month.

Global oil markets have weakened in November, with a host of widely-watched metrics flashing warning signs and dragging futures prices lower. Among them, the prompt spreads for both Brent crude and leading US grade West Texas Intermediate have dipped into contango, a bearish pricing pattern that indicates ample near-term supply. As the red flags proliferate, Brent futures declined to their cheapest price since January earlier this week.

Expectations for a recovery in Chinese oil demand are fading as daily Covid-19 cases have hit record levels, spurring officials to step up containment measures and movement curbs. Amid the challenging backdrop, some Chinese refiners are refraining from buying cargoes of a favored Russian grade, cutting demand just as traders wait for more details on a Group of Seven plan to cap Russian oil alongside European Union sanctions that start on Dec. 5.

The Oman futures-Dubai swaps gauge, which slipped below $1 for one day in April, has mostly commanded multiple-dollar premiums since the invasion of Ukraine. It spiked as high as $15 in March as many buyers started shunning Russian oil, raising the appeal of Mideast crude and boosting the premium.

With physical trading this month mostly concluded for January-loading cargoes, spot premiums for key Persian Gulf grades have declined sharply. While China’s Rongsheng Petrochemical Co. did purchase about 7 million barrels mid-month, that wasn’t enough to lift the sentiment, traders of those grades said.

Meanwhile, another physical market indicator -- inter-month Dubai swaps -- flipped into contango on Friday, signaling bearishness for December through April, PVM Oil Associates data showed. Before this week, the last time it was in contango was in April 2021.

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.