Oil Slips as China Lockdowns Overshadow Russian Output Risk

(Bloomberg) -- Oil slipped from brief gains as lockdowns across China countered looming European Union measures to limit purchases of Russian fuel.

West Texas Intermediate futures traded near $104 while struggling to find direction on Tuesday. Crude has swung within a $15 band in recent weeks as the market assesses the hit to demand from China’s Covid wave while supply concerns persists amid the war in Ukraine. Investors are also bracing for the biggest U.S. rate hike since 2000, which could slow demand.

“Crude prices are softer as Beijing tightens up their Covid controls and as energy traders become doubtful that the EU will be able to move forward with an embargo on Russian oil.” said Ed Moya, senior market analyst at Oanda.

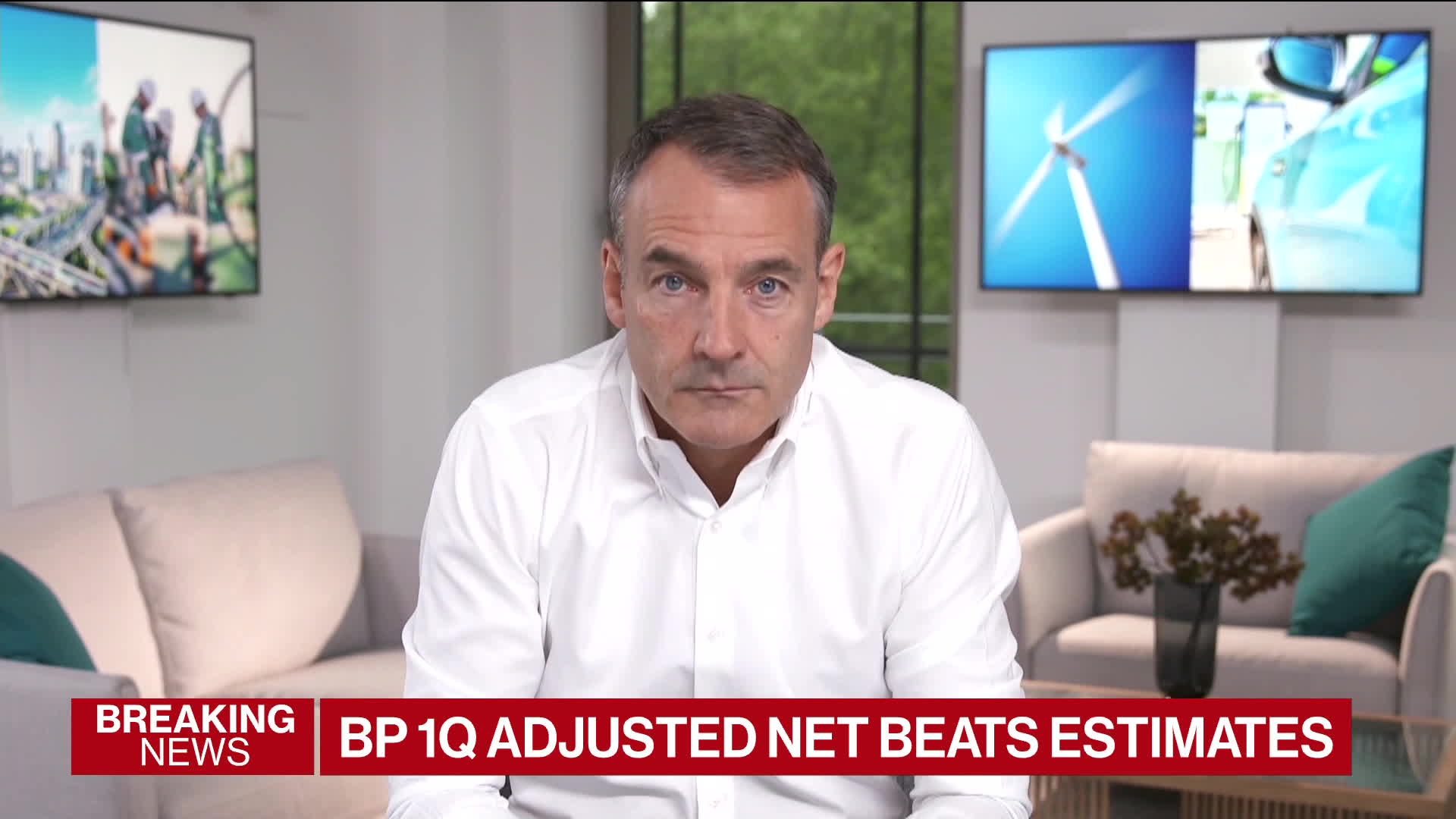

Since spiking after Russia’s invasion of Ukraine, oil has struggled to make further headway. A combination of lower demand in China and reduced supply from Russia has led to a period of volatility that’s boosted the cost of trading and forced some in the market to the sidelines. The wild swings could be set to continue, BP Plc said Tuesday.

“We’ve got low-ish stocks around the world, we’ve got low-ish spare capacity around the world and have a lot of uncertainty,” Chief Executive Officer Bernard Looney said in a Bloomberg Television interview. “All of these things lead to a lot of volatility and we can expect that volatility to continue.”

For now, the most extreme pocket of tightness in the oil market is in diesel. Record fuel exports from the U.S. Gulf Coast are draining local supplies, pushing diesel margins to a fresh high. Retail prices have peaked in recent days.

While prices have dipped in recent sessions due to concerns about lower demand, longer-term signals point to an undersupplied oil market. About 1 million barrels a day of Russian crude are offline, a number that could double this month, Looney said.

Additionally, the European Commission is set to propose a ban on Russian oil by the end of the year, with curbs on imports introduced gradually until then. And later this week, the OPEC+ alliance is likely to ratify its planned supply increase despite having managed to increase its production by only 10% in March.

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.