Oil Wavers, Caught Between China Lockdowns and Saudi Inaction

(Bloomberg) -- Oil fluctuated as comments from the Saudi Foreign Minister suggested the Kingdom wouldn’t supply more oil underscored market tightness, while China’s continuing lockdowns dampened the global demand outlook.

West Texas Intermediate futures rose as much as 1% before paring gains to nearly even with the previous session’s close. Saudi Foreign Minister Faisal Bin Farhan said there’s nothing more it can do to tame markets implying it wouldn’t boost production further at the World Economic Forum in Davos, Switzerland.

Earlier in the session, markets shrugged off China’s latest attempts to support businesses and aid demand in one of the world’s biggest users of oil and metals. Banks have pruned China’s economic forecasts, but global crude markets are still signaling strength, with the premium for prompt Brent supplies near the highest in more than seven weeks.

“Movements in oil have become more subdued,” said Alex Kuptsikevich, senior market analyst at FxPro. “It will take a meaningful, bullish driver for quotes to manage to consolidate above this area this time.”

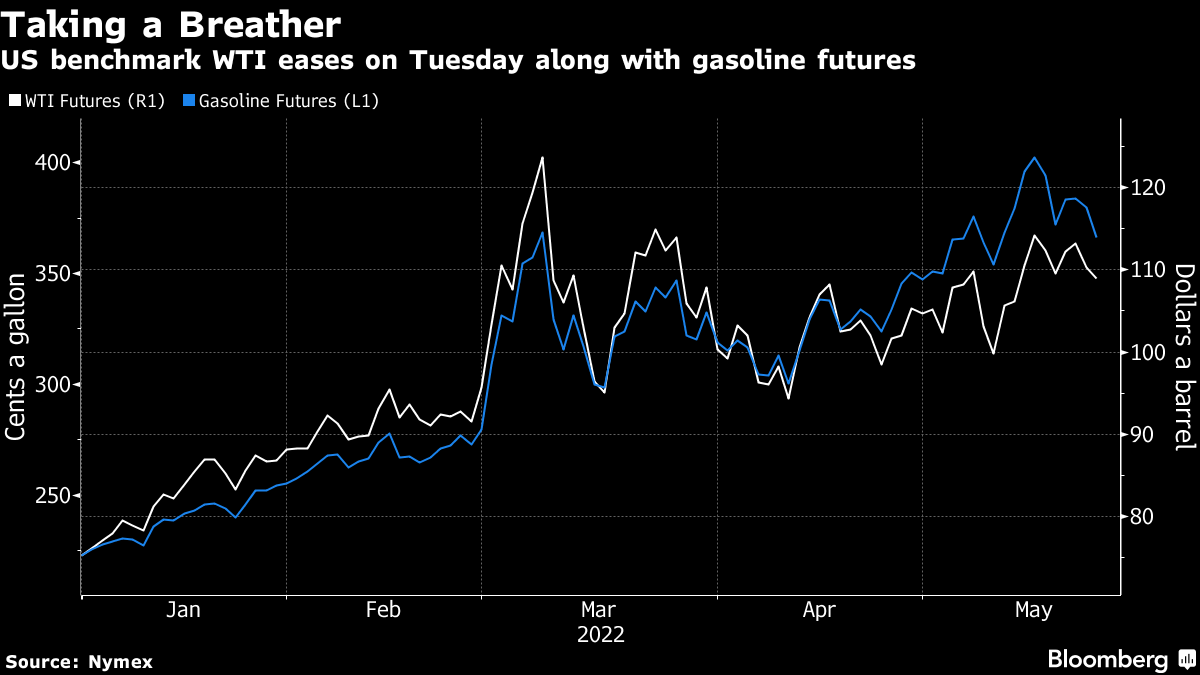

US benchmark oil has traded in a narrow range around $110 a barrel over the past two weeks as investors weigh the fallout from the war in Ukraine, including Hungary’s opposition to a European Union ban on Russian crude, and the outlook for global economic growth. While American oil consumption is expected to pick up further over a busy summer-driving season, energy usage in China has been crimped by the harsh lockdowns imposed in key cities to combat coronavirus outbreaks.

Oil-product markets are losing some of their momentum, with US gasoline futures down about 4% this week after hitting a record high last week. America’s imports of the motor fuel from Europe soared to a six-month high in the seven days to May 19, according to bills of lading and ship-tracking data.

Still, there’s a continuing premium for low-sulfur, low-density crude supplies amid robust global demand and constrained output. Prices in Europe have already soared as shipments from the North Sea and Libya are disrupted, further complicating efforts to replace Russian barrels. The strength is now spilling over into Asia, where a cargo of Malaysian light-sweet Labuan crude fetched a hefty premium of $12 a barrel.

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.