U.S. Futures Dip With Stocks as Oil Extends Rally: Markets Wrap

(Bloomberg) -- U.S. equity futures slipped Friday as traders weighed mixed signals from the peace talks between Russia and Ukraine and braced for volatility from expiring options.

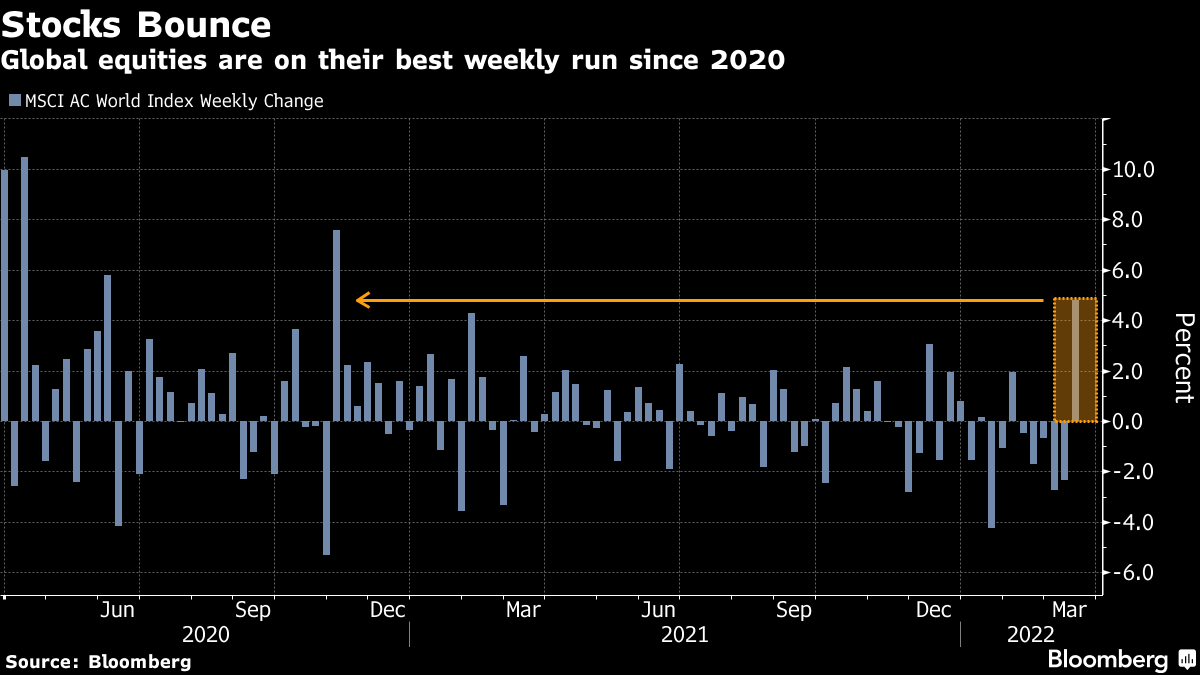

Contracts on the S&P 500 and Nasdaq 100 ticked lower following the best three-day rally in U.S. shares since 2020. In the premarket, shares in GameStop Corp. and FedEx Corp. slid after quarterly results.

Oil extended its biggest rally in 16 months, with West Texas Intermediate crude trading near near $104 a barrel as the war in Ukraine disrupts supplies. Treasuries and the dollar rose.

“In this environment of tightening monetary policy and higher inflation risks globally, we continue to believe in more downside for risk assets over the medium term,” Mizuho International Plc multi-asset strategist Peter Chatwell wrote in a note to clients.

The Federal Reserve’s multi-month campaign to tighten policy point to the likelihood of more cross-asset swings ahead, even with global stocks set for their biggest weekly gain since November 2020. Both the Fed and Bank of England increased rates this week to extinguish the hottest inflation in decades, while the Bank of Japan stuck with its dovish policy stance.

Volatility could also be higher today as about $3.5 trillion of single-stock and index-level options are set to expire in a quarterly event known as triple witching.

Read more: Stock Traders Brace for a $3.5 Trillion ‘Triple Witching’ Event

Continued fighting in Ukraine and the sanctions imposed on Russia are also headwinds on the global growth recovery, compounding worries about surging inflation and hawkish central bank policies.

Russian President Vladimir Putin accused negotiators in Ukraine of trying to “stall” progress on peace talks by putting out “more and more new unrealistic demands,” according to the readout of the phone talks from the Kremlin.

President Joe Biden and his Chinese counterpart Xi Jinping are due to discuss the war later Friday. The Pentagon warned that Russia may become more reliant on its nuclear deterrent as the conflict and sanctions weaken its conventional forces.

Meanwhile, Russia’s Finance Ministry said that coupon payments on two Eurobonds are with Citigroup Inc., confirming earlier reports that JPMorgan Chase & Co. processed the funds. S&P Global Ratings cut Russia’s credit score, saying its debt is “highly vulnerable to nonpayment.”

Some of the main moves in markets:

Stocks

- Futures on the S&P 500 fell 0.7% as of 7:02 a.m. New York time

- Futures on the Nasdaq 100 fell 0.7%

- Futures on the Dow Jones Industrial Average fell 0.6%

- The Stoxx Europe 600 fell 0.5%

- The MSCI World index fell 0.2%

Currencies

- The Bloomberg Dollar Spot Index rose 0.3%

- The euro fell 0.5% to $1.1040

- The British pound fell 0.2% to $1.3123

- The Japanese yen fell 0.4% to 119.08 per dollar

Bonds

- The yield on 10-year Treasuries declined three basis points to 2.14%

- Germany’s 10-year yield declined three basis points to 0.35%

- Britain’s 10-year yield declined seven basis points to 1.50%

Commodities

- West Texas Intermediate crude rose 1.4% to $104.41 a barrel

- Gold futures fell 0.5% to $1,937.50 an ounce

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.