China Oil Giant Plans Record Capex on Energy Security Push

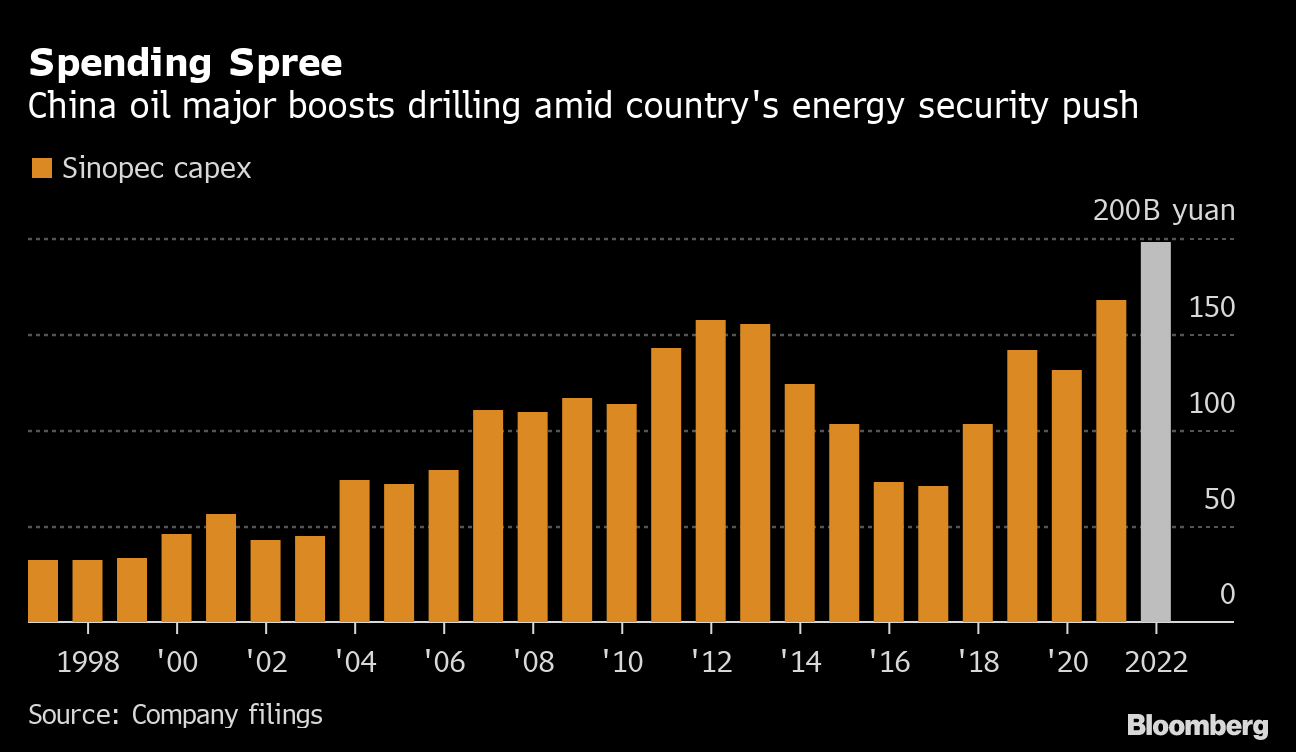

(Bloomberg) -- Sinopec will spend record amounts this year to increase oil and gas drilling as China aims to bolster its energy security and insulate itself from volatile global commodity markets.

China Petroleum & Chemical Corp., as it’s officially known, will increase capital expenditure 18% to 198 billion yuan ($31 billion), including a 22% boost in drilling, it said in its annual report Sunday.

Shares rose as much as 5.9% in Hong Kong on Monday, extending a rebound from a bottom earlier this month to 18%.

“The company will redouble its efforts in exploration, especially in shale oil and shale gas,” Sinopec said in the report. The company plans to develop reserves now that would have been unprofitable in recent years with lower oil prices, Chairman Ma Yongshen said on a conference call Monday.

The announced increase comes just weeks after China’s leaders made it clear the nation’s top energy priority this year is securing fuel supplies. The world’s biggest energy importer is trying to prevent soaring costs of oil, gas and coal from derailing efforts to keep its economy on a stable footing.

Sinopec is the first of China’s three state-owned oil majors to announce earnings, and the spending boost could augur similar actions from competitors. Cnooc Ltd. reports Wednesday, while PetroChina Co. files on Thursday.

Cnooc said in January it planned a modest increase in spending this year, but that was before Russia’s invasion of Ukraine sent energy prices to stratospheric heights.

Sinopec is best known for its oil refining business, but has had success in recent years drilling for natural gas in China’s hard-to-crack shale fields. The company aims to increase gas output by 4.8% this year after a 12% jump last year.

Annual net income for 2021 rose to 72 billion yuan from 33.4 billion yuan a year earlier, as Sinopec’s core refining business experienced a strong recovery on a rebound for travel and freight. That compares with an estimate of 70 billion yuan from analysts surveyed by Bloomberg.

China’s economy has been challenged so far this year, and oil processing has declined on concerns over lower demand as the country grapples with a resurgence in Covid-19 cases.

The refining sector faces “severe challenges” from soaring crude prices, Ma said Monday. The company expects oil prices to average $100 a barrel this year and $85 next year. The company plans to increas imports of more profitable caroes of crude and adjust refinery utilization rates to maximize profits, he said.

(Updates with comments from paragraph 4)

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.