Futures Mixed Before Inflation, Treasuries Steady: Markets Wrap

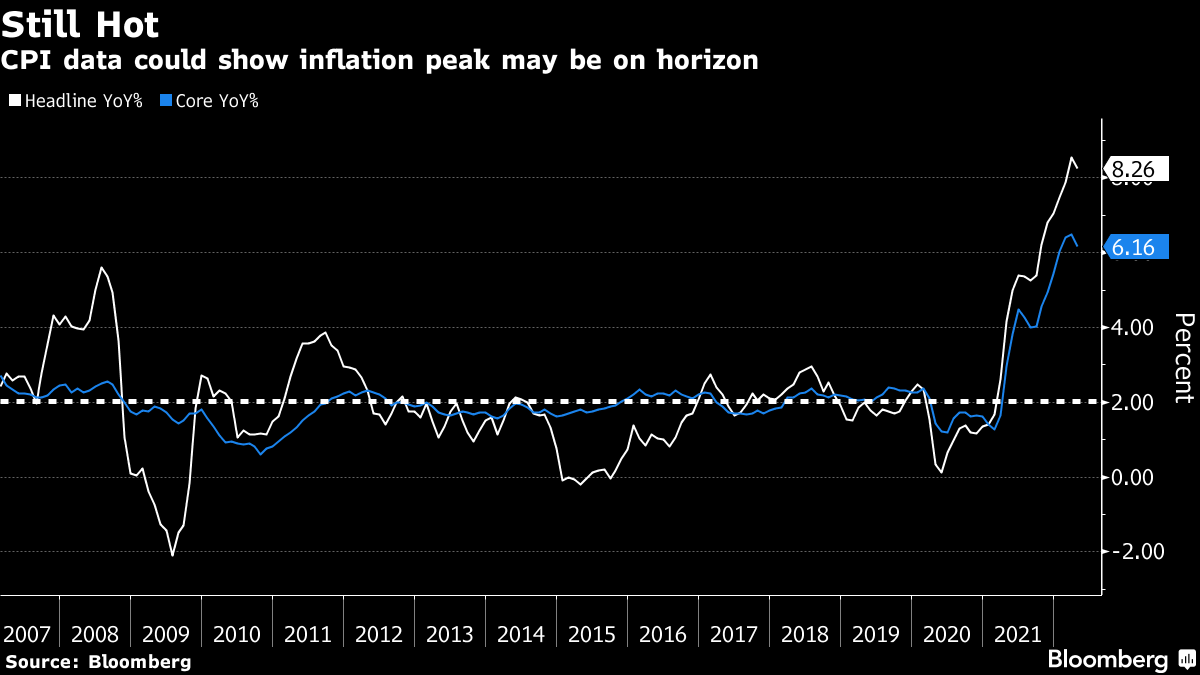

(Bloomberg) -- US equity futures were mixed before inflation data that may help decide the course of the Federal Reserve’s tightening path. Bonds stabilized.

S&P 500 futures dipped after the S&P 500 shed 2.4% Thursday, while contracts on the tech-heavy Nasdaq 100 were steady. The Stoxx Europe 600 Index fell 1.5%, with all sectors in the red.

Treasury yields steadied near the 3% level while German government bonds recovered after a selloff following the European Central Bank tilt toward aggressive policy and the possibility of a half-point interest-rate hike later in the year.

Investors will be closely watching the US inflation reading. An upside surprise would be a setback for both the Fed and markets, raising doubts about how well rates are working to subdue prices rising at a clip of more than 8%.

Policymakers “are looking for ‘clear and convincing evidence’ that inflation in the US is going to start falling back from its eye-watering level,” Nick Chatters, investment manager at Aegon Asset Management, wrote in a note. “Wishful thinking?”

Oil rose after erasing an earlier loss triggered in part by new restrictions in Shanghai. Chinese President Xi Jinping called on his government to adhere “unwaveringly” to its Covid Zero policy, while at the same time striking a balance with the needs of the economy.

Asia’s stock market was on the back foot Friday but off session lows as investors assessed China’s outlook and girded for US inflation data. Chinese tech shares including Alibaba Group Holding Ltd. reversed an early-session swoon, helping the region’s equity index to keep losses below 1%.

The dollar edged higher and the yen snapped a slide.

Which commodities will outperform into year-end? Raw materials is the theme of this week’s MLIV Pulse survey. Click here to participate anonymously.

Key events to watch this week:

- US CPI, University of Michigan consumer sentiment Friday

Some of the main moves in markets:

Stocks

- Futures on the S&P 500 fell 0.2% as of 6:41 a.m. New York time

- Futures on the Nasdaq 100 were little changed

- Futures on the Dow Jones Industrial Average fell 0.3%

- The Stoxx Europe 600 fell 1.5%

- The MSCI World index fell 0.5%

Currencies

- The Bloomberg Dollar Spot Index was little changed

- The euro fell 0.1% to $1.0602

- The British pound fell 0.3% to $1.2458

- The Japanese yen rose 0.4% to 133.79 per dollar

Bonds

- The yield on 10-year Treasuries declined two basis points to 3.03%

- Germany’s 10-year yield declined two basis points to 1.41%

- Britain’s 10-year yield declined two basis points to 2.30%

Commodities

- West Texas Intermediate crude rose 0.8% to $122.45 a barrel

- Gold futures fell 0.5% to $1,844.40 an ounce

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.