Oil Slides on Report Saudi Arabia Prepared to Boost Production

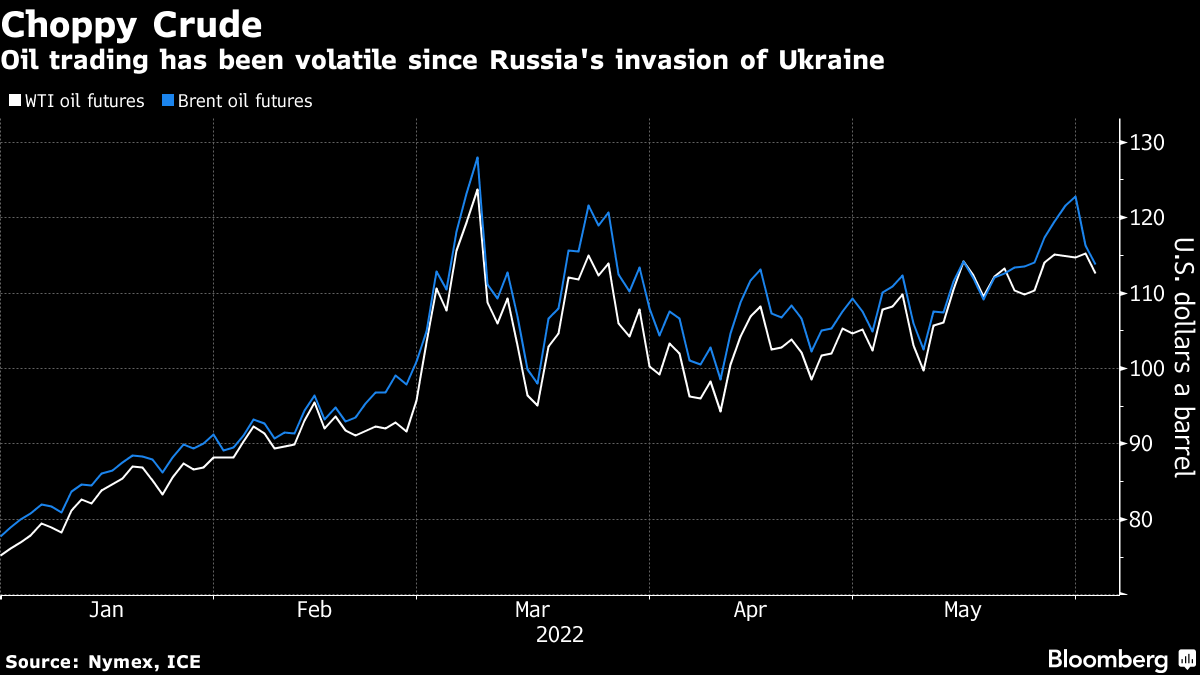

(Bloomberg) -- Oil fell to trade near $113 a barrel following a report that Saudi Arabia is ready to pump more should Russian output decline substantially due to increasing sanctions over its invasion of Ukraine.

West Texas Intermediate futures dropped more than 3% in Asian trading before paring some of those losses. The Financial Times reported that Saudi Arabia had indicated to Western allies that it is prepared to increase oil supply. The news comes ahead of a monthly OPEC+ meeting on Thursday at which the group is expected to ratify a modest increase in output for July.

The Biden administration has called repeatedly for the cartel to increase production faster to deal with surging gasoline prices and the hottest inflation in decades, which has been fanned by the war in Ukraine. The rising cost of everything from food to fuel is spurring aggressive monetary tightening by many central banks, which is threatening the global growth outlook.

There have been talks about an immediate supply boost from Saudi Arabia and the United Arab Emirates, which could be announced at the OPEC+ gathering on Thursday, though nothing has been finalized, the FT reported. Output increases scheduled for September might be brought forward to July and August, it said. The Wall Street Journal also reported this week that some OPEC members were discussing exempting Russia from the oil-production agreement.

If the Saudis do pump more that would be an abrupt turnaround from their current stance. The kingdom’s foreign minister said last week that there was nothing more it could do to tame oil markets, and even suggested there was no shortfall of crude. OPEC+ is expected to rubber-stamp a production increase of 430,000 barrels a day for next month, although the alliance has struggled to meet its modest supply increase targets in recent months.

“The downward trajectory for oil boils down to just how deep OPEC is willing to dip into its spare capacity without entirely turning their back on Russia,” said Stephen Innes, managing partner at SPI Asset Management. “A shift in strategy, even a slow drip response, brings a new downside risk for oil.”

US president Joe Biden is likely to visit Saudi Arabia later this month as part of an international trip that will include NATO and Group of Seven meetings, said people familiar with the matter. The Biden administration is coming under increasing pressure to rein in record high gasoline prices.

Oil capped a sixth monthly advance in May, the best winning streak since early 2011, as tightening markets because of the war in Ukraine coincided with a recovery in demand as countries threw off virus restrictions. European Union efforts to approve a partial ban on Russian oil imports hit an obstacle after Hungary raised new or already rejected demands.

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.