Stocks Set for Best Month Since 2020; Dollar Falls: Markets Wrap

(Bloomberg) -- Stocks in the US and Europe are set for their biggest monthly advance since November 2020 on positive earnings and expectations of shallower Federal Reserve monetary tightening.

Nasdaq 100 futures added more than 1% after the US stock market hit a seven-week high Thursday. Amazon.com Inc. and Apple Inc. rose in premarket trading after both companies beat revenues estimates.

The banking sector outperformed in Europe after a slate of better-than-expected results from Banco Bilbao Vizcaya Argentaria SA, Standard Chartered Plc and BNP Paribas SA. Hermes International rose more than 6% after joining LVMH and Kering SA in posting strong results, showing the luxury consumer is resilient so far to high inflation and worries over a potential economic downturn.

The tone was more somber in Asia, hampered by a tumble in Chinese tech shares that dragged Hong Kong toward a correction of more than 10% from a June high. US-listed Chinese stocks fell in premarket trading, following a downbeat economic growth assessment from China’s top leaders and a lack of new stimulus policies.

The yen strengthened as the dollar retreated. Treasuries yields rose with oil and gold. Data showing a second straight quarterly US economic contraction supported arguments that inflation will cool and that the Fed will become less aggressive.

Meanwhile, the euro-zone economy expanded by more than three times the amount economists expected, putting it on a firmer footing as surging inflation and a possible Russian energy cutoff threaten to tip it into a recession. Inflation in the region climbed to another all-time high, supporting calls for the European Central Bank to follow up its first interest-rate hike since 2011 with another big move.

Global shares are set for a second weekly advance, paring this year’s rout. The risk is that the recent bout of optimism eventually gets a reality check if inflation stays stubbornly elevated, leaving interest rates higher than investors would like amid an economic downturn.

“At some point, the Fed will pivot policy and that should be better for risk markets, but in the meantime, they’re so bent on quelling inflation that we prefer not to buy the dip here,” Thomas Taw, head of APAC iShares Investment Strategy at BlackRock Inc., said on Bloomberg Radio.

Elsewhere, a call between US President Joe Biden and China’s Xi Jinping underlined bilateral tension even as the leaders sought an in-person meeting.

Here are some key events to watch this week:

- US PCE deflator, personal income, University of Michigan consumer sentiment, Friday

Musk, Tesla and Twitter are this week’s theme of the MLIV Pulse survey. Also share your views on the S&P 500’s biggest stocks. Click here to get involved anonymously.

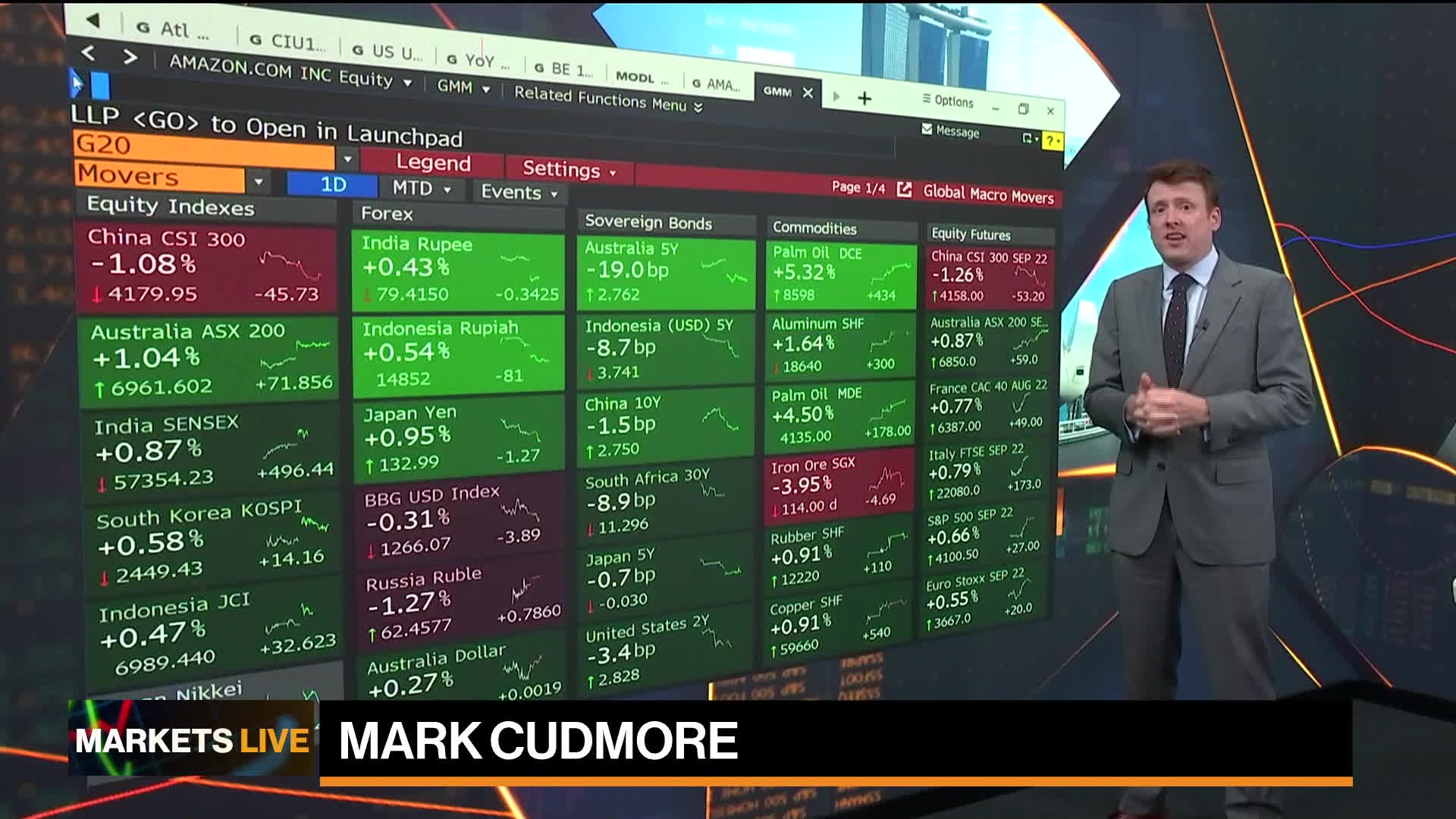

Some of the main moves in markets:

Stocks

- Futures on the S&P 500 rose 0.7% as of 6:05 a.m. New York time

- Futures on the Nasdaq 100 rose 1.2%

- Futures on the Dow Jones Industrial Average rose 0.3%

- The Stoxx Europe 600 rose 0.9%

- The MSCI World index rose 1.2%

Currencies

- The Bloomberg Dollar Spot Index fell 0.1%

- The euro was little changed at $1.0203

- The British pound fell 0.3% to $1.2149

- The Japanese yen rose 0.7% to 133.35 per dollar

Bonds

- The yield on 10-year Treasuries advanced four basis points to 2.72%

- Germany’s 10-year yield advanced nine basis points to 0.91%

- Britain’s 10-year yield advanced eight basis points to 1.95%

Commodities

- West Texas Intermediate crude rose 2.2% to $98.58 a barrel

- Gold futures rose 0.3% to $1,774.20 an ounce

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.