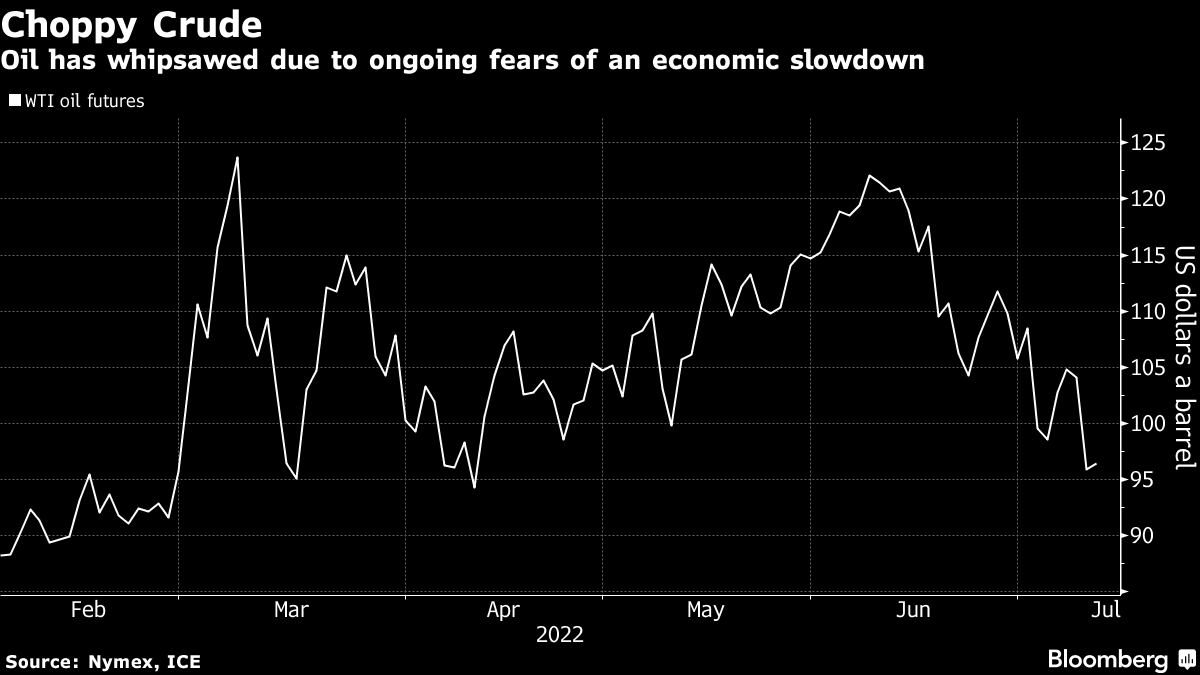

Oil Swings as US Report Shows Demand Falling Amid Surging Prices

(Bloomberg) -- Oil fluctuated after a US government showed crude and gasoline inventories rising as high energy prices continue to propel inflation.

West Texas Intermediate teetered between gains and losses to trade near $96. US gasoline stockpiles rose 5.8 million barrels last week, the most since January. Fuel stocks are building as high prices appear to be shifting consumer habits.

US consumer prices jumped in June by 9.1% year-on-year, the largest gain in over four decades. Market participants fear the report will keep the Federal Reserve geared for another big interest-rate hike and lead to possible economic slowdown.

“The oil market might be tight, but high energy costs are clearly leading to crude demand destruction,” said Ed Moya, senior market analyst at Oanda Corp.

Crude prices pose a high risk to global economic recovery, with signs that fuel costs are starting to “take their toll” on demand growth, the International Energy Agency said in a report. Increases in the energy sector accounted for nearly half of all consumer price spikes in the US June inflation report, according to Labor Department data released Wednesday.

OPEC’s first outlook for 2023 suggests that there will be no relief for squeezed consumers, with more oil needed from the group even though most members are already pumping flat out.

Meanwhile, US President Joe Biden has repeatedly called on OPEC to pump more and is scheduled to visit Saudi Arabia this week during a tour of the Middle East. The kingdom along with the United Arab Emirates are the only cartel members with significant volumes of unused production capacity.

China’s exports expanded at a faster pace than expected in June as Covid disruptions continued to ease, though concerns about virus outbreaks remain. Some residents in Shanghai have been urged to stockpile food and medicines as the fear of returning to lockdown hangs over the city.

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.