Stocks Plunge Anew as Fed, Russia Stoke Volatility: Markets Wrap

(Bloomberg) -- The historic rebound in American stocks proved short-lived, with major averages plunging Tuesday as investors remained on edge over the Federal Reserve’s inflation-fighting stance and Russia’s saber-rattling against Ukraine.

Mounting geopolitical concern continued to weigh on investor sentiment even as Western allies push ahead with diplomatic efforts to avert a war between Russia and Ukraine. Traders also waded through a raft of corporate earnings. The S&P 500 sank over 2%, while the technology-heavy Nasdaq 100 underperformed major benchmarks. The dollar rose alongside Treasuries.

Read: Powell’s Legacy Is at Stake in Fed Pivot to Beat Back Inflation

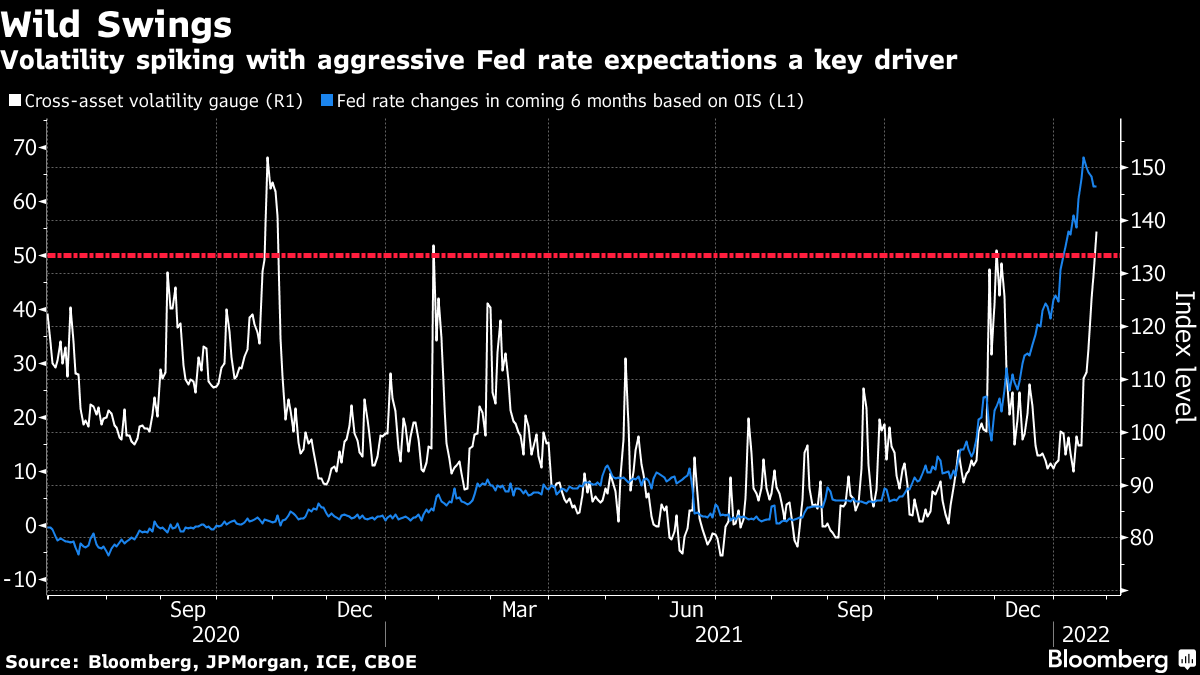

Cross-asset volatility is surging again, with investors facing a nervous wait for the Fed decision after Chair Jerome Powell and several officials spent much of the month signaling little could deter them from plotting out a rapid removal of pandemic-era stimulus. The International Monetary Fund cut its world economic growth forecast for 2022, citing weaker prospects for the U.S. and China along with persistent inflation.

“Volatility is back,” Lori Calvasina, head of U.S. equity strategy at RBC Capital Markets, told Bloomberg Television. “We’re having a sea-change in terms of Fed policy. Equity investors frankly have been behind the curve in anticipating what’s coming, so there’s a lot of catch-up to do.”

Read: ‘Fed Put’ Looks Elusive to Money Market Fixated on March Liftoff

“We remain cautious near term on U.S./global stocks. We’d like to be wrong on that since we remain bullish over the medium and long term,” wrote Nicholas Colas, co-founder of DataTrek Research.

Evidence emerged that European governments are split on what Russian actions short of a military attack on Ukraine should trigger sanctions. A Kremlin spokesman warned that a U.S. move to put as many as 8,500 troops on alert “exacerbates tensions,” as a top White House official said the reinforcements for North Atlantic Treaty Organization forces in Eastern Europe are “ready to go at a moment’s notice.”

Corporate highlights:

- International Business Machines Corp. reported revenue that beat estimates, buoyed by strong demand in the software unit.

- General Electric Co. missed sales expectations for the fourth quarter as it grappled with worsening supply-chain pressures.

- American Express Co. raised forecasts for revenue and profit after spending on its cards surged to a record.

- Johnson & Johnson projected 2022 earnings and sales above Wall Street’s average expectations. Fourth-quarter revenue narrowly missed analysts’ estimates.

- Verizon Communications Inc. exceeded estimates for subscriber growth and gave a full-year earnings forecast that topped expectations.

- Nvidia Corp. is quietly preparing to abandon its purchase of Arm Ltd. from SoftBank Group Corp. after making little to no progress in winning approval for the $40 billion chip deal, according to people familiar with the matter.

What to watch this week:

- Fed monetary policy decision Wednesday.

- EIA crude oil inventory report Wednesday.

- U.S. new home sales, wholesale inventories Wednesday.

- South African Reserve Bank rate decision Thursday.

- U.S. initial jobless claims, durable goods, GDP Thursday.

- Euro zone economic confidence, consumer confidence Friday.

- U.S. consumer income, University of Michigan consumer sentiment Friday.

For more market analysis, read our MLIV blog.

Some of the main moves in markets:

Stocks

- The S&P 500 fell 2.3% as of 9:57 a.m. New York time

- The Nasdaq 100 fell 2.6%

- The Dow Jones Industrial Average fell 1.9%

- The Stoxx Europe 600 rose 0.3%

- The MSCI World index fell 1.7%

Currencies

- The Bloomberg Dollar Spot Index rose 0.2%

- The euro fell 0.5% to $1.1275

- The British pound fell 0.1% to $1.3471

- The Japanese yen was little changed at 113.86 per dollar

Bonds

- The yield on 10-year Treasuries declined three basis points to 1.74%

- Germany’s 10-year yield was little changed at -0.10%

- Britain’s 10-year yield advanced two basis points to 1.15%

Commodities

- West Texas Intermediate crude rose 1% to $84.13 a barrel

- Gold futures rose 0.5% to $1,854 an ounce

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.