Oil Edges Higher as Libyan Output Falls Ahead of OPEC+ Meeting

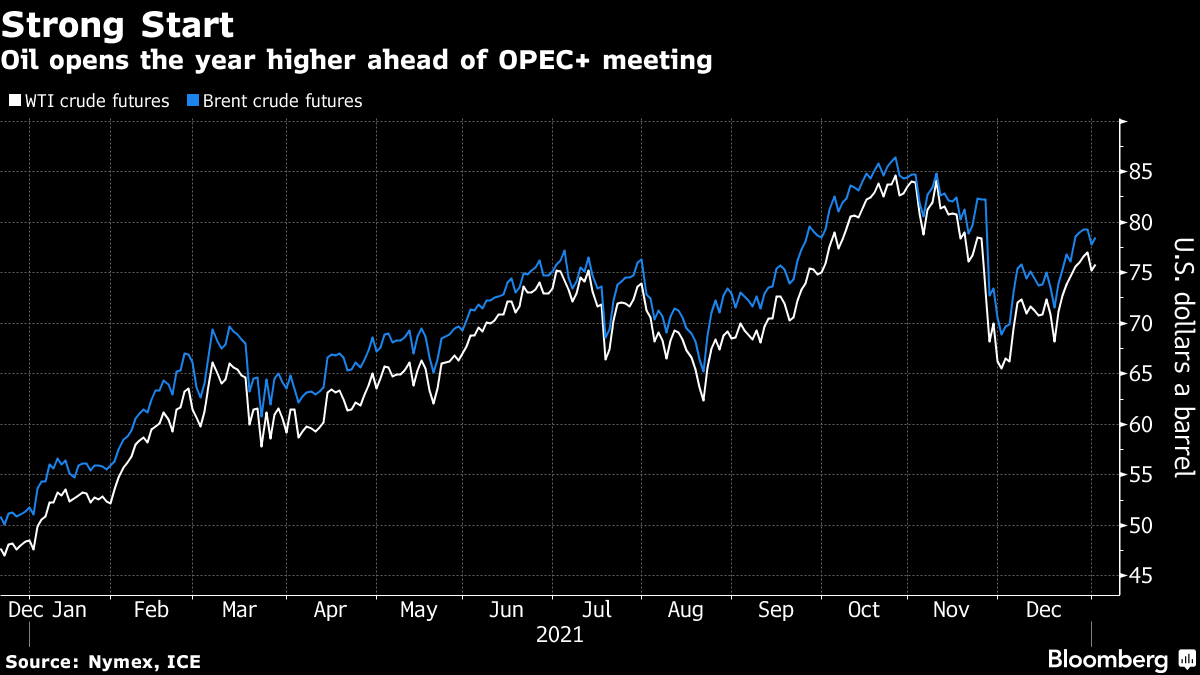

(Bloomberg) -- Oil edged higher as Libyan supply tightened ahead of an OPEC+ meeting on Tuesday to discuss production policy for February.

Futures in New York advanced toward $76 a barrel in Asian trading after sliding 2.3% on Friday. Libyan output is expected to decline to the lowest level in more than a year as workers try and fix a damaged pipeline less than two weeks after militia shut down its biggest field. The OPEC+ alliance is set to agree to an increase in production next month, a Bloomberg survey shows.

Oil posted its biggest annual gain since 2009 last year as the rollout of vaccines helped economies to reopen, boosting energy demand. While OPEC+ is poised to add another 400,000 barrels a day to global supply, there are still concerns about crude demand as China tackles a Covid-19 flare-up and the omicron virus variant leads to flight cancellations worldwide.

“I think OPEC+’s decision is a foregone conclusion and omicron news and data will remain the major influence on oil sentiment,” said Vandana Hari, founder of Vanda Insights in Singapore. “We’re likely seeing some bargain hunting today after a rush to sell at the end of last week.”

Libya expects its oil production to drop by another 200,000 barrels a day over the next week. Together with the supply lost from the shutter of its Sharara field, that will trim overall output to about 700,000 barrels a day.

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.