Oil Steadies as U.S. Stockpiles Drop With Focus on Iran Progress

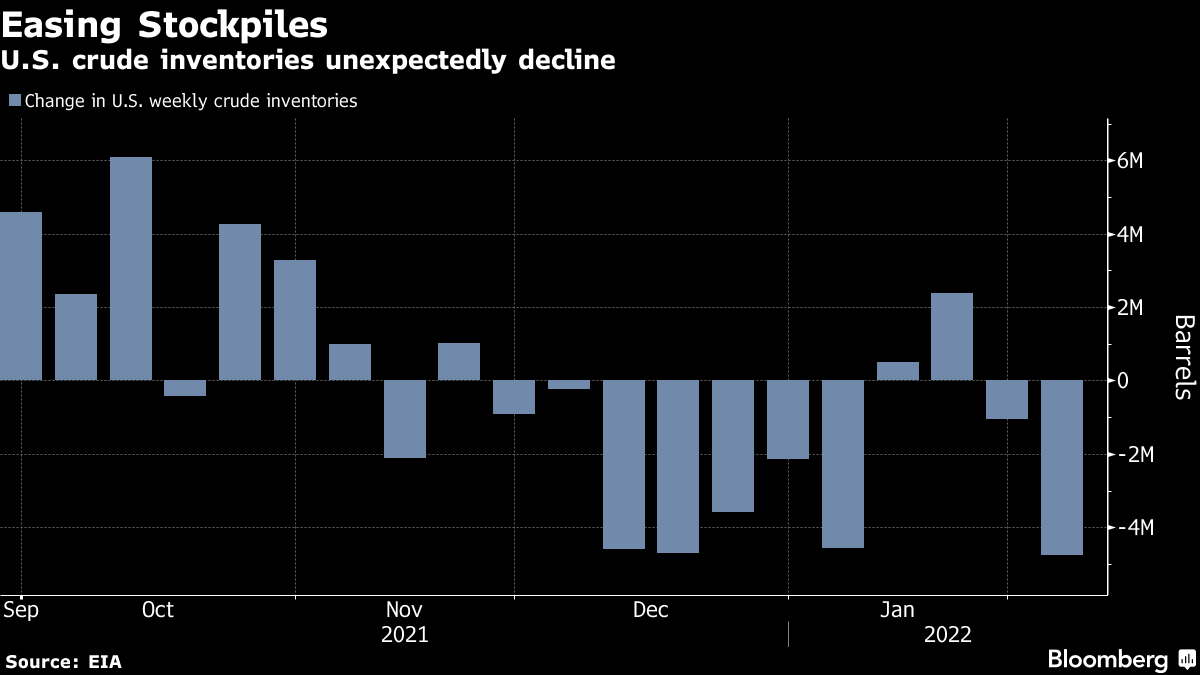

(Bloomberg) -- Oil was steady in Asian trading after a surprise decline in U.S. crude inventories tightened the market further amid signs of strong demand in the world’s biggest economy.

Futures in New York traded near $90 a barrel on Thursday after rising 0.3% in the previous session. U.S. crude stockpiles fell by about 4.8 million barrels last week, according to government data, compared with an expected increase in a Bloomberg survey. Investors are also keeping an eye on progress of reviving a nuclear agreement with Iran. A deal that addresses the concerns of all sides is in sight, White House Press Secretary Jen Psaki said Wednesday.

Oil’s sizzling rally has cooled this week after a run of weekly gains propelled prices to the highest since 2014. Stronger-than-expected demand and a series of supply outages helped to tighten the market, which has been exacerbated by the inability of OPEC+ to meet its targeted output pledges.

The prospect of world powers resuming the nuclear agreement with Iran has become more likely after talks resumed this week in Vienna, which saw a flurry of diplomacy. A deal would pave the way for in an increase in official crude exports from the OPEC producer, alleviating some market tightness.

“The market has very low stockpiles, very little spare capacity at the moment and that’s going to be key to watch,” said Vivek Dhar, director of mining and energy commodities research at Commonwealth Bank of Australia. Iran could add as much as 1.5 million barrels a day in six months if an agreement is reached that allows sanctions to be lifted, he added.

See also: Senators Call Iran Nuclear Progress Sobering as Talks Resume

Crude inventories at the key Cushing storage hub fell for the fifth week to the lowest level since November, according to data from the Energy Information Administration. The four-week average for supplied oil products -- a gauge of demand -- climbed to a record last week.

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.