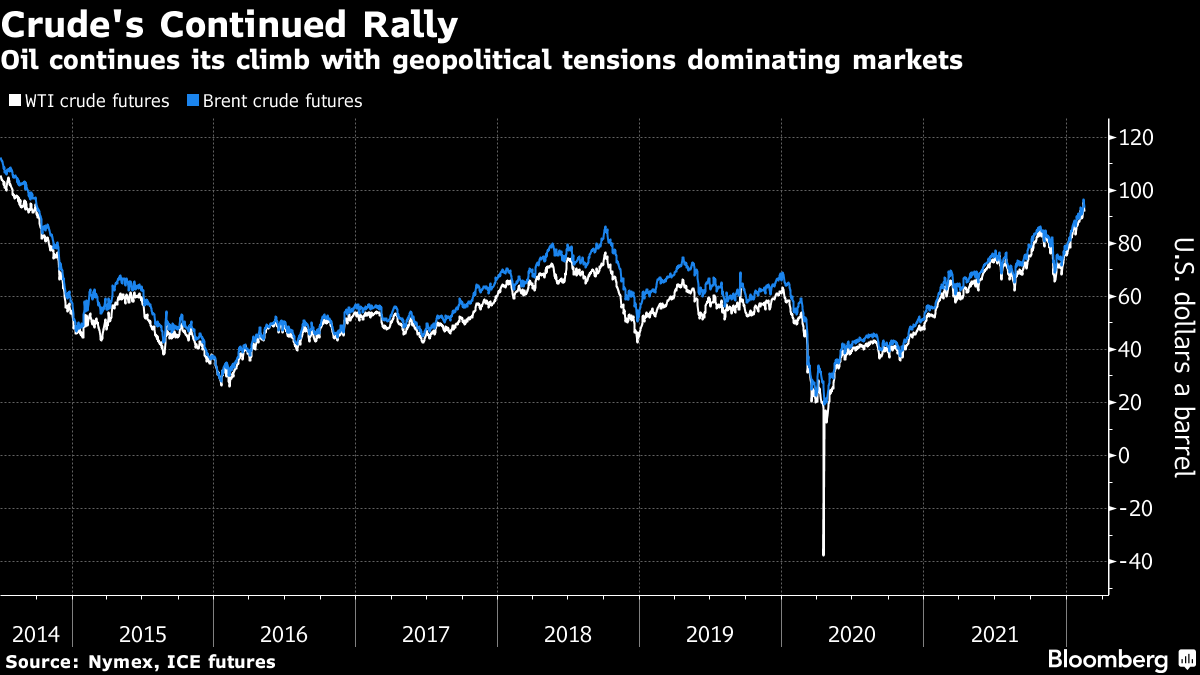

Oil Rises as Investors Weigh Ukraine Crisis, Rising Fuel Demand

(Bloomberg) -- Oil rallied as U.S. and NATO officials reiterated they have yet to see evidence of a Russian pullback and a government report showed U.S. fuel demand rising.

West Texas Intermediate traded near $94 a barrel on Wednesday, clawing back from the biggest one-day loss since November. U.S. officials said they haven't verified the claim that Russia is pulling back some troops. Moscow has repeatedly denied it plans to invade its neighbor.

Without solid evidence of a Russian troop pullback, the narrative that cooled off prices yesterday has shifted back to the potential for escalation, said Rebecca Babin, senior energy trader at CIBC Private Wealth Management.

Adding to bullish sentiment, inventories at the biggest U.S. crude storage hub fell to the lowest since September 2018, according to an Energy Information Administration report. Meanwhile, the four-week average for deliveries of oil products from primary storage, a proxy for demand, rose to the highest in weekly data going back to 1990.

Crude is trading near the highest level since 2014 as investors bet global demand is running ahead of supply, draining inventories and forcing traders to pay steep premiums to get their hands on prompt barrels. The rally has lifted product prices, including for gasoline. That is fanning inflation and posing a thorny challenge for leaders including U.S. President Joe Biden, as well as central bankers.

The steady erosion of supplies has pushed gauges of market strength to their strongest levels in years, indicating near-term bullishness. The premium of Brent oil's front-month contract to the second month -- known as prompt timespread -- expanded further after reaching the widest bullish backwardation structure since 2019 earlier this week. Spreads are typically a good indicator of underlying supply-demand dynamics, while individual futures contracts can gyrate on jitters including geopolitical risks.

(An earlier version of this story corrected a reference to day of the week.)

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.