‘Come Out to Fight’: Surging Diesel Strains Asia’s Truckers

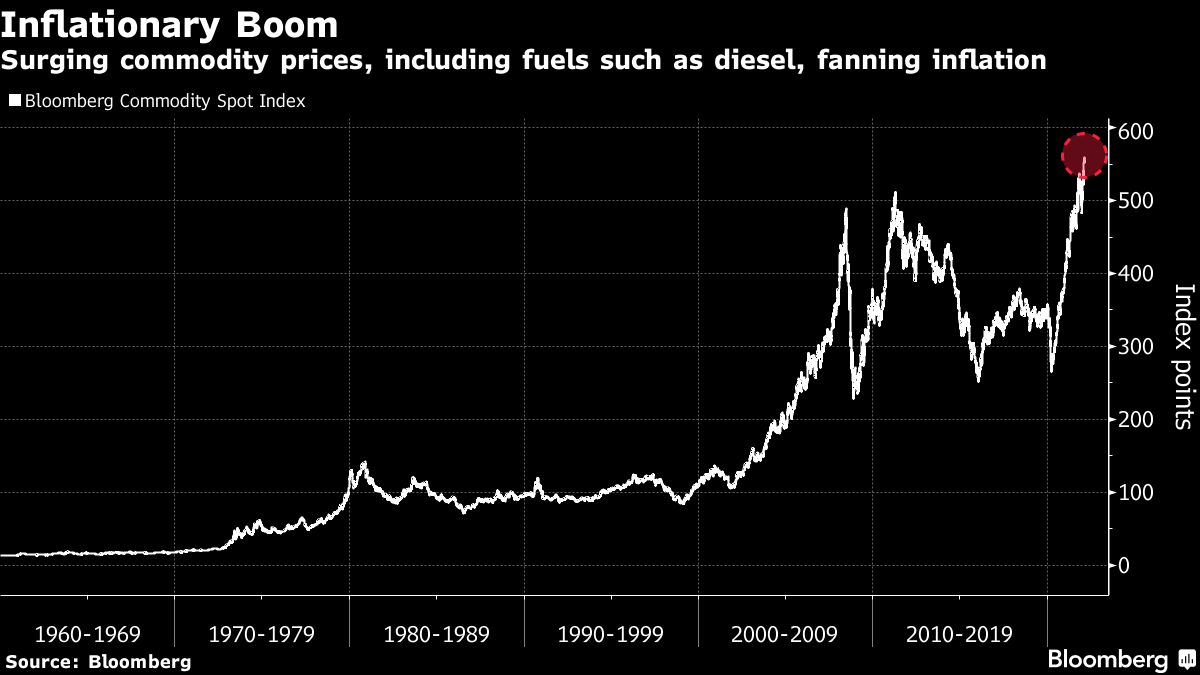

(Bloomberg) -- Soaring diesel prices are straining governments as they seek to stave off inflation from rising energy costs and quell discontent from aggrieved truck operators that are seeing profits shrink.

The diesel market in Asia has tightened significantly as reduced supplies from China coincided with production disruptions and surging demand in economies rebounding from the pandemic. That’s led to rising prices, putting a strain on truckers and governments including Thailand, which this week rejected a plea for an extra fuel subsidy, saying it would cost as much as $7.3 billion a year.

The increasing cost of fuels such as diesel and gasoline is posing a challenge for authorities and central banks globally as they try and tackle inflation while supporting economic growth. It’s also exposing Asia’s fragile supply chain to more volatility as angry truck operators resort to strike action. Convoys of trucks clogged streets in Bangkok on Tuesday after the subsidy snub, while similar protests have been seen in Bangladesh and Indonesia.

The sector has experienced numerous hurdles since the start of the pandemic, from the infection of drivers that led to widespread labor shortages to supply-chain bottlenecks caused by delayed seaborne shipments and congested ports.

Diesel’s surge is part of a global upswing in energy prices that’s seen crude rally to the highest level since 2014 as consumption picks up and stockpiles dwindle. Further gains are forecast for oil, a rise that will only stir more resistance from truckers who are already saying enough is enough.

“We have been patient and run at losses for a year,” said Apichart Prairungruang, the president of Land Transport Federation of Thailand. The main industry body, which represents about 10,000 members, plans to raise service charges from Feb. 15. “We need to come out to fight.”

Trucks are the backbone of supply chains across Asia and disruptions such as strikes can worsen shipping delays and congestion at ports. There’s likely to be little respite for diesel consumers in the near term, with industry consultant FGE predicting elevated prices until at least the middle of year as oil refiners seek to rebuild depleted stockpiles.

In India, the main industry body estimates the cost of operating trucks has climbed by 15%-20% over the past year, outpacing a gain in freight charges. There are also concerns that diesel prices will increase again once elections in some states end in March. The fuel, which accounts for almost 40% of total oil-product demand, has remained steady since November after a cut to taxes.

“There would be a big repercussion,” said Naveen Gupta, secretary-general of the All India Motor Transport Congress, the industry group that represents about 10 million truck and bus operators. “There will be clamor for agitation asking the government to cut down prices.”

While India’s diesel and gasoline prices haven’t increased since November, Bloomberg Intelligence predicts inflation in January likely climbed above the central bank’s 6% target ceiling. Japan is subsidizing transport fuels as inflation expectations hit the highest since 2008, and the South Korean central bank has expressed concerns over rising prices.

Overall transport costs have climbed about 13% over the past year in Australia, primarily due to more expensive fuel, which has prompted the National Road Transport Association to seek assistance from the government. In Singapore, fuel costs make up about 30% of monthly expenses and the industry has no choice but to boost freight charges, which is likely to “snowball into other industries,” said Cherie Goh, chairwoman at Singapore Transport Association.

“The trucking industry is facing a double whammy from higher diesel costs and supply constraints, which translates into a longer lead time for delivery in most countries,” said Howie Lee, economist at Oversea-Chinese Banking Corp. “Almost about every business in the world right now is raising their selling prices to stay afloat in this inflationary environment.”

(Updates with Bloomberg Commodity Spot Index chart.)

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.