Oil Rises as Traders Buy the Dip With Key Pipeline Still Shut

(Bloomberg) -- Traders swooped in to buy oil at the lowest price this year, as markets digested the fact that a key North American crude pipeline remains shut with no timeline for reopening.

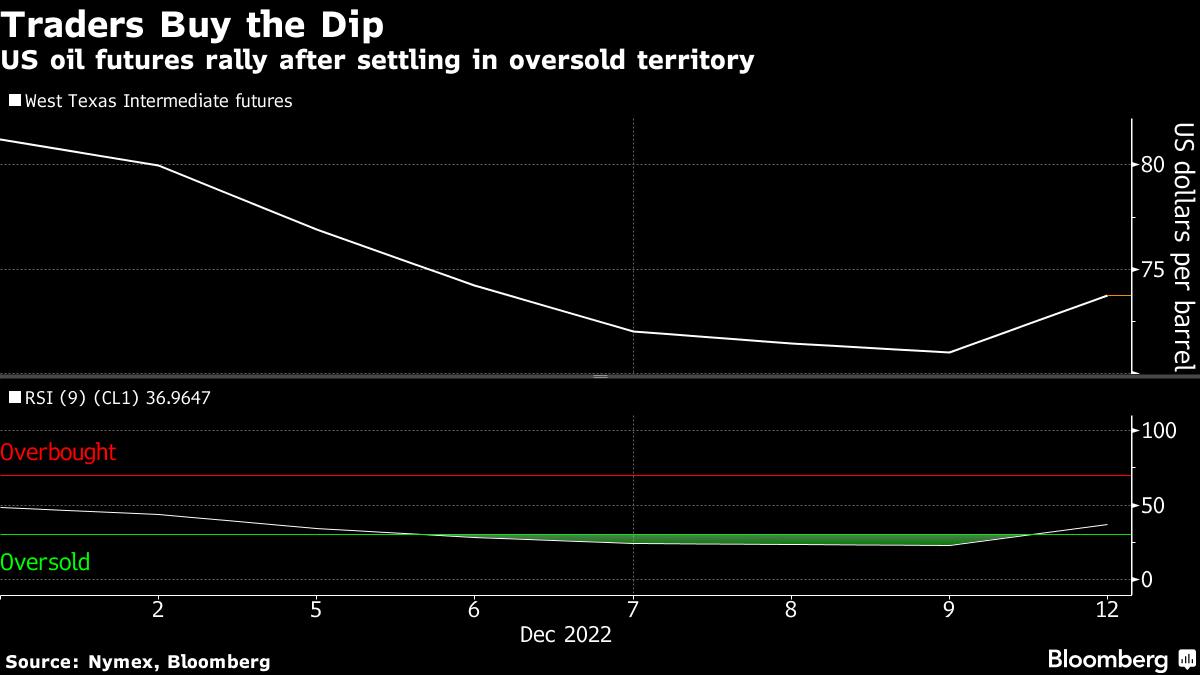

West Texas Intermediate rose as much as 4.2% to trade over $73 a barrel, rallying after prices plunged 11% last week to settle at the lowest price in 2022. Crude’s slump pushed the US benchmark to settle Friday below its nine-day relative strength index for a third day, a technical indicator that oil is oversold and presents a good buying opportunity for some traders.

Meanwhile, TC Energy Corp. is continuing recovery efforts at its shuttered Keystone pipeline —which links fields in Canada to refiners on the US Gulf Coast — and a date for a restart hasn’t yet been set, according to a statement on Sunday. Refined products also recovered this morning, with gasoline futures rising 1.2% after touching a new low for the year overnight.

Crude is on track for its first back-to-back quarterly decline since mid-2019 as the demand outlook sours and thin liquidity exacerbates price swings into the year-end. December was expected to be a rocky month with sanctions on Russian oil shipments taking effect, but the weakening demand outlook — led by risks to global growth — has weighed on prices.

As the oil market has softened in recent days, both Brent and WTI have at times traded in contango. The bearish market structure indicates plentiful crude supply over the short term. Russia being able to export crude oil without as many disruptions as traders anticipated has left markets softer, Francisco Blanch, head of commodity and derivatives research at Bank of America said in a Bloomberg Television interview.

“We have a bit of a soft patch right here; contango is happening but it is very front-loaded,” said Blanch. “You have a modest surplus you need to adjust for, and that’s exactly what the market has done.”

Following the imposition of the price cap on Russian crude and related curbs, a backlog of tankers waiting to haul oil through Turkey’s vital shipping straits built up amid a dispute over insurance cover. That now appears to be clearing, with a port agent tally on Sunday showing 19 tankers waiting to pass through the Bosphorus and Dardanelles straits, down from a total of 27 on Saturday.

Elements, Bloomberg’s daily energy and commodities newsletter, is now available. Sign up here.

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.