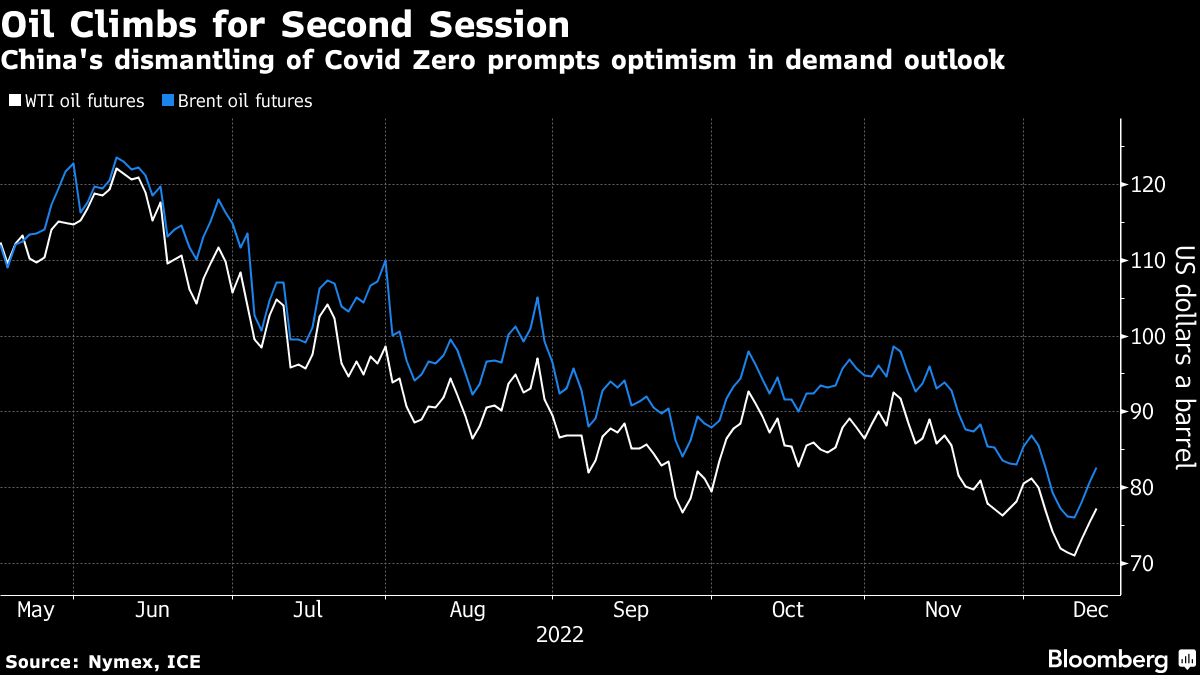

Oil Extends Gains as China Reopening Vies With Slowdown Concerns

(Bloomberg) -- Oil extended gains as investors weighed the outlook for energy demand after China abandoned its strict Covid Zero policy, while concerns over an economic slowdown continue to hang over the market.

West Texas Intermediate futures climbed toward $76 a barrel after closing 1.2% higher on Monday. China’s efforts to revive its economy by removing harsh virus curbs is spurring hopes of higher energy consumption in the long term, despite a surge in cases clouding the near-term outlook.

Gains are likely to be measured as the “current risk-off environment may serve as a limiting factor,” said Yeap Jun Rong, market strategist for IG Asia Pte in Singapore. There’s been an “unwinding of previous bullish build-up from the Covid-19 economic recovery and the Russia-Ukraine war.”

Crude still remains on track for a second monthly loss with a persistent lack of liquidity leaving prices prone to large swings this year. The Federal Reserve is embarking on aggressive interest-rate hikes, while a top European Central Bank official said it would take time for inflation to be brought down.

Russian production has so far proved resilient in the face of European Union sanctions on its seaborne crude flows and a Group of Seven price cap, with the OPEC+ producer mulling additional measures in response to the ceiling.

Meanwhile, TC Energy Corp.’s restart plan for the Keystone pipeline is under review, the Pipeline and Hazardous Materials Safety Administration said on Monday. The conduit was shut earlier this month after an oil leak.

Elements, Bloomberg’s daily energy and commodities newsletter, is now available. Sign up here.

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.