US Stocks Slide on Fed Worries as Yields Climb: Markets Wrap

(Bloomberg) -- US stocks fell as concerns over the Federal Reserve’s aggressive rate-hike path weighed on risk sentiment. Treasury yields jumped and the dollar rose.

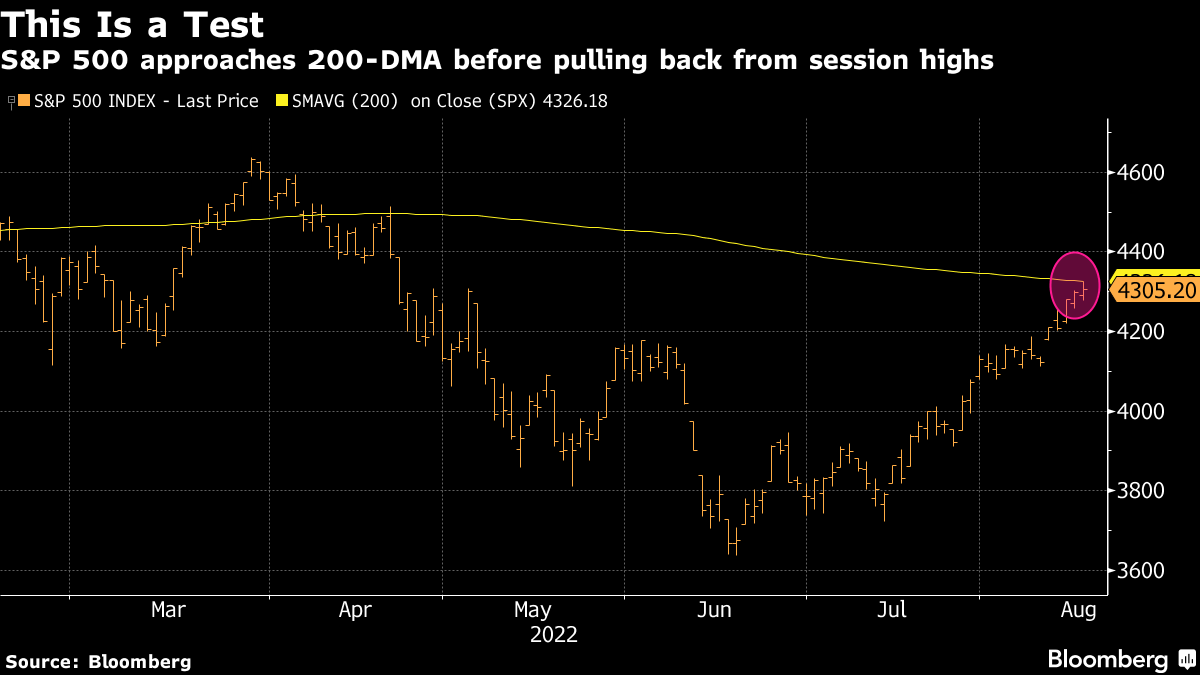

The S&P 500 Index declined, with all but two of the 11 industry groups trading in the red. The tech-heavy Nasdaq 100 underperformed, retreating more than 1%, as growth-related stocks bore the brunt of the selling.

Treasuries fell across the board, sending yields higher as investors awaited the minutes of the Fed’s last meeting for clues on policy makers’ sensitivity to weaker economic data.

While data Wednesday showed retail sales stagnated last month on declines in auto purchases and gasoline prices, other categories indicated resilient consumer spending. Excluding gasoline and autos, sales rose a better-than-expected 0.7%.

US stocks have rallied on signs of peaking inflation and an earnings-reporting season that saw four out of five companies meeting or beating estimates. Yet, prospects of the Fed continuing to raise rates to cool stubbornly high inflation has weighed on sentiment. Yields stayed higher after the latest retail sales figures, indicating concerns that the data may be firm enough to keep the Fed on a path of aggressive hikes.

In corporate news, Target Corp. fell as profit lagged behind Wall Street’s estimates, while Lowe’s Cos. gained after the home-improvement retailer reported earnings that beat estimates even as renovators wrestle with a slumping US housing market.

It’s been a choppy day for risk sentiment. Earlier on Wednesday, stocks rose in Asia amid speculation that China may deploy more stimulus to shore up its ailing economy. Some of those equity gains were surrendered when European trading opened and the focus turned to the Fed as well as UK inflation that soared to double digits for the first time in four decades.

The dollar rose 0.3% on Wednesday. Treasuries fell, with the 10-year yield adding seven basis points and the two-year rate climbing eight basis points. The spread between these two yields remained deeply inverted at about 47 basis points.

Oil fluctuated between gains and losses, and was in sight of a more than six-month low -- reflecting lingering worries about a tough economic outlook amid high inflation and tightening monetary policy.

Inflation remains the most closely-watched indicator in the second half. Will it come down gradually, or will it stay elevated, forcing the Fed to keep raising rates aggressively? Have your say in the anonymous MLIV Pulse survey.

Here are some key events to watch this week:

- Federal Reserve July minutes, Wednesday

- UK CPI, US retail sales, Wednesday

- Australia unemployment, Thursday

- U.S. existing home sales, initial jobless claims, Conference Board leading index, Thursday

- Fed’s Esther George, Neel Kashkari speak at separate events, Thursday

Some of the main moves in markets:

Stocks

- The S&P 500 fell 0.8% as of 10:17 a.m. New York time

- The Nasdaq 100 fell 1.3%

- The Dow Jones Industrial Average fell 0.5%

- The Stoxx Europe 600 fell 0.9%

- The MSCI World index fell 0.7%

Currencies

- The Bloomberg Dollar Spot Index rose 0.3%

- The euro rose 0.1% to $1.0186

- The British pound fell 0.2% to $1.2072

- The Japanese yen fell 0.8% to 135.27 per dollar

Bonds

- The yield on 10-year Treasuries advanced seven basis points to 2.87%

- Germany’s 10-year yield advanced 10 basis points to 1.07%

- Britain’s 10-year yield advanced 14 basis points to 2.26%

Commodities

- West Texas Intermediate crude rose 1.1% to $87.51 a barrel

- Gold futures fell 0.3% to $1,783.60 an ounce

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.