US Futures, Stocks Fall as Fed Outlook Takes Toll: Markets Wrap

(Bloomberg) -- US equity futures retreated on Monday along with stocks in Europe as a risk-off mood took hold at the start of a key week for financial markets when central bankers gather at their annual Jackson Hole retreat.

Futures on the S&P 500 and Nasdaq 100 fell more than 1% each. The 10-year Treasury yield was little changed while two-year yields rose about six basis points, deepening the yield-curve inversion that’s seen as a harbinger of a recession. The dollar spot index climbed to a five-week high.

A jump in global shares from June’s bear-market lows, stoked by the market’s expectations for a pivot to slower rate hikes, is fizzling after repeated Federal Reserve policy makers warned that interest rates are going higher. The Jackson Hole symposium gives Fed Chair Jerome Powell a platform to reset those bets, which are vulnerable to the possibility of persistently elevated price pressures even as economic growth stumbles.

“The expectation is still that Powell will reaffirm what he and his colleagues have been saying in public recently,” said Craig Erlam, a senior market analyst at Oanda. “The risk is that he says something dovish -- intentionally or otherwise -- after investors position for the opposite and triggers another risk-on rally in the markets.”

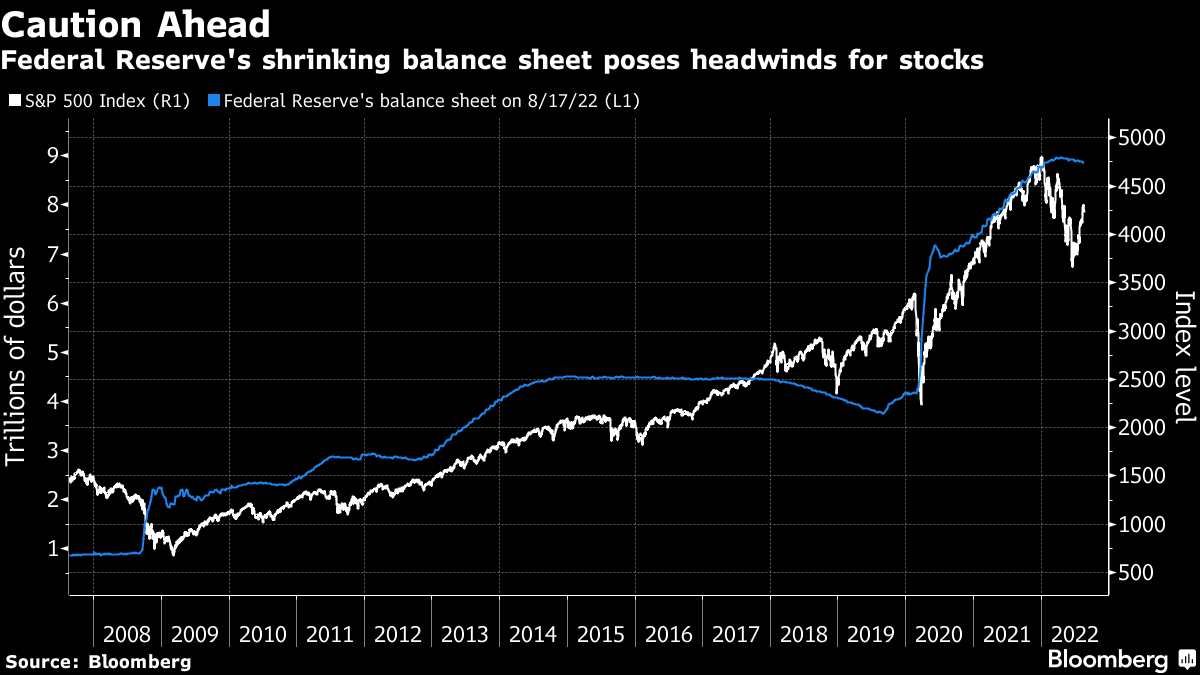

Investors are also waking up to the looming acceleration of the Fed’s balance-sheet reduction. So-called quantitative tightening kicks into top gear next month, and will add to pressure on riskier assets which have benefited from ample liquidity.

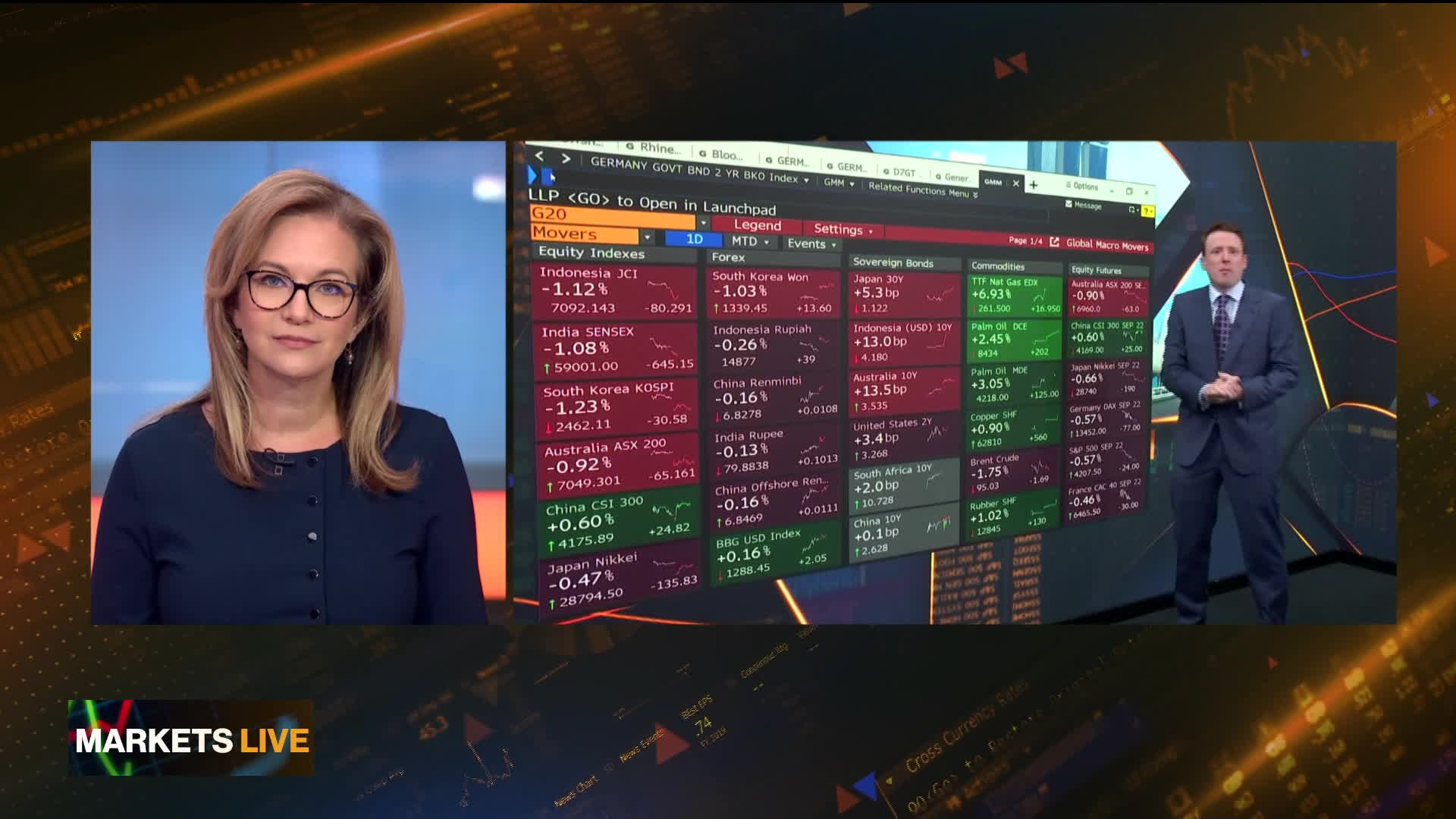

The Stoxx Europe 600 index dropped to its lowest level in more than three weeks, with carmakers and the tech sector among the leading decliners. MSCI Inc.’s Asia-Pacific share index fell for a third day with losses evident in most major markets except for some gains in China, where a move by banks to trim lending rates aided property developers.

The latest MLIV Pulse survey suggests stocks and bonds are set to tumble once more even though inflation has likely peaked: some 68% of respondents see the most destabilizing era of price pressures in decades eroding corporate margins and sending equities lower.

“It is likely central bankers, including Fed Chair Powell, will remain hawkish in dealing with inflation albeit with a bit of caution creeping in given the emerging economic downturn,” Shane Oliver, head of investment strategy at AMP Services Ltd., wrote in a note.

Gas Supply Crunch

Meanwhile, natural-gas prices in Europe jumped as fears returned about a prolonged halt in supplies through a major pipeline, jeopardizing an already struggling economy.

In China, banks lowered the one-year and five-year loan prime rates on Monday in the slipstream of a decision by the nation’s central bank last week to cut a key policy rate.

The Chinese demand outlook is weighing on oil, which sank below $90 a barrel in New York before paring the decline. Traders are monitoring Iran nuclear talks that could lead to more supplies.

What to watch this week:

- US new home sales, S&P Global PMIs, Tuesday

- Fed’s Neel Kashkari speaks at Q&A session, Tuesday

- US durable goods, MBA mortgage applications, pending home sales, Wednesday

- US GDP, initial jobless claims. Thursday

- Fed annual policy symposium in Jackson Hole, Wyoming, Thursday

- ECB’s July minutes, Thursday

- Fed Chair Powell speaks at Jackson Hole, Friday

- US consumer income, PCE deflator, Friday

Some of the main moves in markets:

Stocks

- Futures on the S&P 500 fell 1.1% as of 6:37 a.m. New York time

- Futures on the Nasdaq 100 fell 1.4%

- Futures on the Dow Jones Industrial Average fell 0.9%

- The Stoxx Europe 600 fell 0.8%

- The MSCI World index fell 0.3%

Currencies

- The Bloomberg Dollar Spot Index rose 0.2%

- The euro fell 0.3% to $1.0008

- The British pound fell 0.2% to $1.1807

- The Japanese yen was little changed at 136.91 per dollar

Bonds

- The yield on 10-year Treasuries was little changed at 2.98%

- Germany’s 10-year yield advanced two basis points to 1.25%

- Britain’s 10-year yield advanced four basis points to 2.45%

Commodities

- West Texas Intermediate crude fell 0.1% to $90.65 a barrel

- Gold futures fell 0.8% to $1,748.10 an ounce

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.