Global Stocks Near Two-Month High; Oil Snaps Drop: Markets Wrap

(Bloomberg) -- Stocks in Asia climbed along with US equity futures on Friday, helped by gains in technology shares, and oil snapped a slide as investor sentiment steadied after another turbulent week.

An Asian equity index rose 0.8%, while S&P 500, Nasdaq 100 and European contracts posted modest gains. Taiwan recouped losses fueled by US House Speaker Nancy Pelosi’s visit, a jump that may have helped the wider mood.

The 10-year Treasury yield was steady at about 2.68% and the dollar edged up. The inversion between two-year and 10-year yields remained near the deepest since 2000, indicating worries about a recession as monetary policy tightens.

Cleveland Federal Reserve Bank President Loretta Mester reiterated Thursday the US central bank’s determination to quell inflation. Interest-rate hikes are fanning economic angst and sapping assets like oil, which snapped a slide but remained below $90 a barrel at levels last seen before Russia invaded Ukraine.

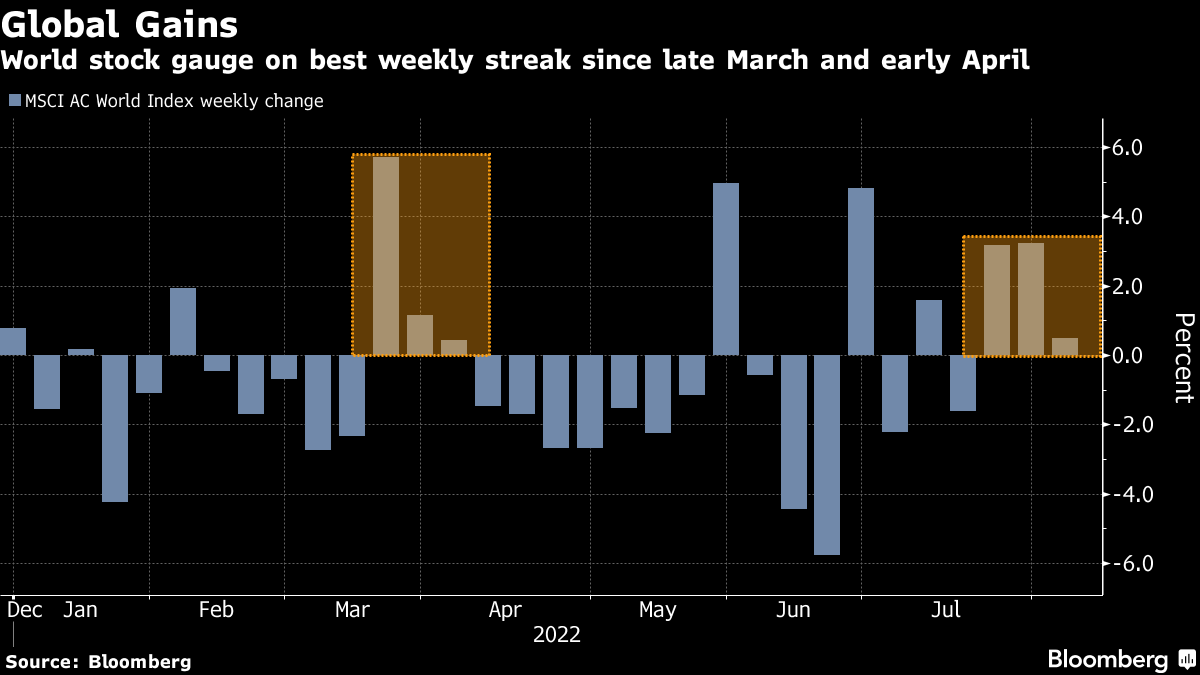

A global equity index is set for a third weekly advance and near a two-month peak in a recovery from bear-market lows, helped by resilient US company profits. The durability of the bounce remains in doubt as borrowing costs go up.

“It’s a little too early to say the risk is off the table,” Carol Schleif, deputy chief investment officer at BMO Family Office, said on Bloomberg Television. “Significant slowing” is starting to come in parts of the US economy, she said.

US payrolls Friday are the next key data point for markets. Hiring likely softened in July but the labor market remains consistent with an expanding rather than recessionary economy and the Fed will press on with rate hikes, according to Anna Wong, chief U.S. economist for Bloomberg Economics.

Separately, Democrats agreed on a revised version of their tax and climate bill, adding a new 1% excise tax on stock buybacks.

Investors are also monitoring the aftermath of Pelosi’s visit to Taiwan. China, which regards the self-ruled island as part of its territory, reportedly fired missiles over Taiwan during military drills -- a major escalation if confirmed.

This week’s MLIV Pulse survey is asking about your outlook for corporate bonds, mergers and acquisitions and health of US corporate balance sheets through the end of the year. It takes one minute to participate in the MLIV Pulse survey, so please click here to get involved anonymously.

What to watch this week:

- US employment report for July, Friday

Some of the main moves in markets:

Stocks

- S&P 500 futures rose 0.3% as of 1:15 p.m. in Tokyo. The S&P 500 fell 0.1%

- Nasdaq 100 futures added 0.3%. The Nasdaq 100 rose 0.4%

- Japan’s Topix index increased 0.8%

- South Korea’s Kospi added 0.9%

- Hong Kong’s Hang Seng index was up 0.1%

- China’s Shanghai Composite index climbed 0.3%

- Australia’s S&P/ASX 200 index rose 0.4%

- Euro Stoxx 50 futures climbed 0.2%

Currencies

- The Bloomberg Dollar Spot Index increased 0.1%

- The euro was at $1.0239, down 0.1%

- The Japanese yen was at 133.20 per dollar, down 0.2%

- The offshore yuan was at 6.7520 per dollar

Bonds

- The yield on 10-year Treasuries was steady at 2.68%

- Australia’s 10-year bond yield dropped five basis points to 3.09%

Commodities

- West Texas Intermediate crude was at $88.91 a barrel, up 0.4%

- Gold was at $1,792.22 an ounce, up 0.1%

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.