US Stock Futures Rise as Traders Assess Fed Hikes: Markets Wrap

(Bloomberg) -- US equity futures and European stocks climbed as bond yields pared their recent surge and investors weighed prospects of aggressive Federal Reserve rate hikes against reassuring earnings.

S&P 500 and Nasdaq 100 contracts both rose by at least 0.5% as the 10-year Treasury yield slipped to 2.8%. Technology led the advance in Europe’s Stoxx 600 benchmark as rates on benchmark German and UK government debt fell.

Friday’s stronger-than-expected US non-farm payrolls data added to the case for more Fed monetary tightening, and traders are looking to inflation numbers due this week for clues on the policy path. Rate-hike expectations have pushed up Treasury yields and the dollar, while a key part of the US bond curve is close to the most inverted level since 2000, suggesting investors foresee a recession as the Fed applies the brakes on the economy.

“The NFP miss was large enough to re-ignite the inflation debate and renew focus on US CPI prints,” said Peter McCallum, a strategist at Mizuho International Plc in London. “Indeed, a very unexpected move lower in US CPI is needed for the market to stop thinking about the Fed having to do more. And with more tightening, the probability of a hard landing rises.”

Crude oil slipped, while gold edged higher. Bitcoin pushed above $24,000.

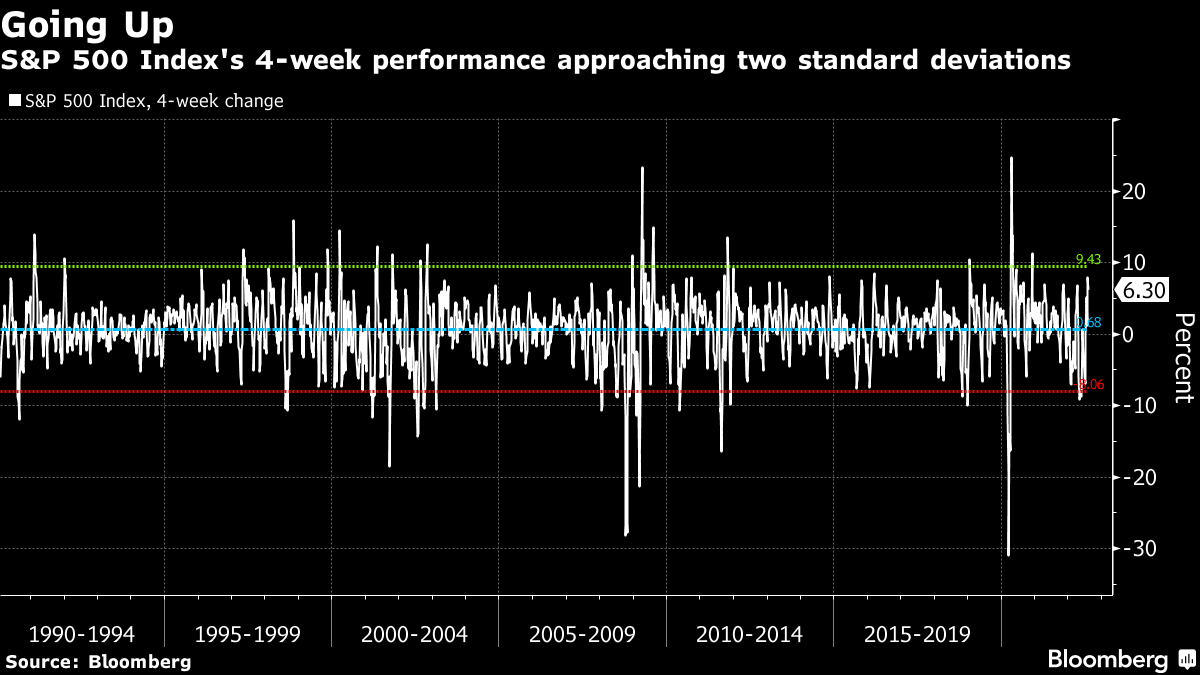

A better-than-feared second-quarter earnings season sparked a rally in stocks last month as investors bet that margins could withstand inflationary pressure. Optimism around a dovish tilt in Fed policy amid weaker economic data has also lifted sentiment.

But strategists at Morgan Stanley and Goldman Sachs Group Inc. expect corporate profit margins to contract next year given unrelenting cost pressures, an outlook that is at odds with the mood in equity markets. According to Morgan Stanley’s Michael J. Wilson, among the most vocal bears on US stocks, “the best part of the rally is over.”

Morgan Stanley, Goldman Strategists See a Dimming Profit Outlook

US inflation data this week could shape views on the outlook for Fed policy and inject more market swings. While price pressures may be topping out, it’s unclear if they will persist at stubbornly high levels. Traders now see greater odds of another 75 basis-point Fed hike in September, part of a global wave of rate increases.

The latest comments from Fed officials left a question mark over wagers on a policy pivot toward reducing borrowing costs next year.

‘Far From Done’

San Francisco Fed President Mary Daly said the US central bank is “far from done yet” in bringing down price pressures. Governor Michelle Bowman said the Fed should keep considering large hikes similar to the 75 basis-point increase approved last month until inflation meaningfully declines.

The July US payrolls report is “likely to enhance the Fed’s inclination to front-load interest rate hikes until the policy rate overshoots neutral by a good margin over the next few months,” TD Securities strategists including Priya Misra wrote in a note.

Elsewhere, the US Senate passed a landmark tax, climate and health-care bill, speeding a slimmed-down version of President Joe Biden’s domestic agenda on a path to becoming law.

Stocks tied to renewable energy rallied in New York premarket trading, with First Solar Inc. and SunRun Inc. among those advancing. Electric vehicle manufacturers also got a boost, with Tesla Inc., Rivian Automotive Inc. and Lucid Group Inc. gaining.

US-China tension over Taiwan remains elevated. China’s military announced a new exercise near the self-ruled island in the fallout from US House Speaker Nancy Pelosi’s visit.

The Worst Is Yet to Come for US Credit Markets: MLIV Pulse

What to watch this week:

- Iran nuclear deal talks, Monday

- US CPI data, Wednesday

- China CPI, PPI Wednesday

- Chicago Fed President Charles Evans, Minneapolis Fed President Neel Kashkari due to speak, Wednesday

- US PPI, initial jobless claims, Thursday

- San Francisco Fed President Mary Daly is interviewed on Bloomberg Television, Thursday

- Euro-area industrial production, Friday

- US University of Michigan consumer sentiment, Friday

Some of the main moves in markets:

Stocks

- Futures on the S&P 500 rose 0.5% as of 6:46 a.m. New York time

- Futures on the Nasdaq 100 rose 0.6%

- Futures on the Dow Jones Industrial Average rose 0.4%

- The Stoxx Europe 600 rose 0.7%

- The MSCI World index rose 0.2%

Currencies

- The Bloomberg Dollar Spot Index fell 0.2%

- The euro was little changed at $1.0192

- The British pound rose 0.2% to $1.2097

- The Japanese yen was little changed at 134.88 per dollar

Bonds

- The yield on 10-year Treasuries declined three basis points to 2.80%

- Germany’s 10-year yield declined five basis points to 0.91%

- Britain’s 10-year yield declined six basis points to 1.99%

Commodities

- West Texas Intermediate crude fell 1.1% to $88.06 a barrel

- Gold futures rose 0.2% to $1,794.50 an ounce

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.