Oil sinks below $100 as China’s lockdowns imperil demand outlook

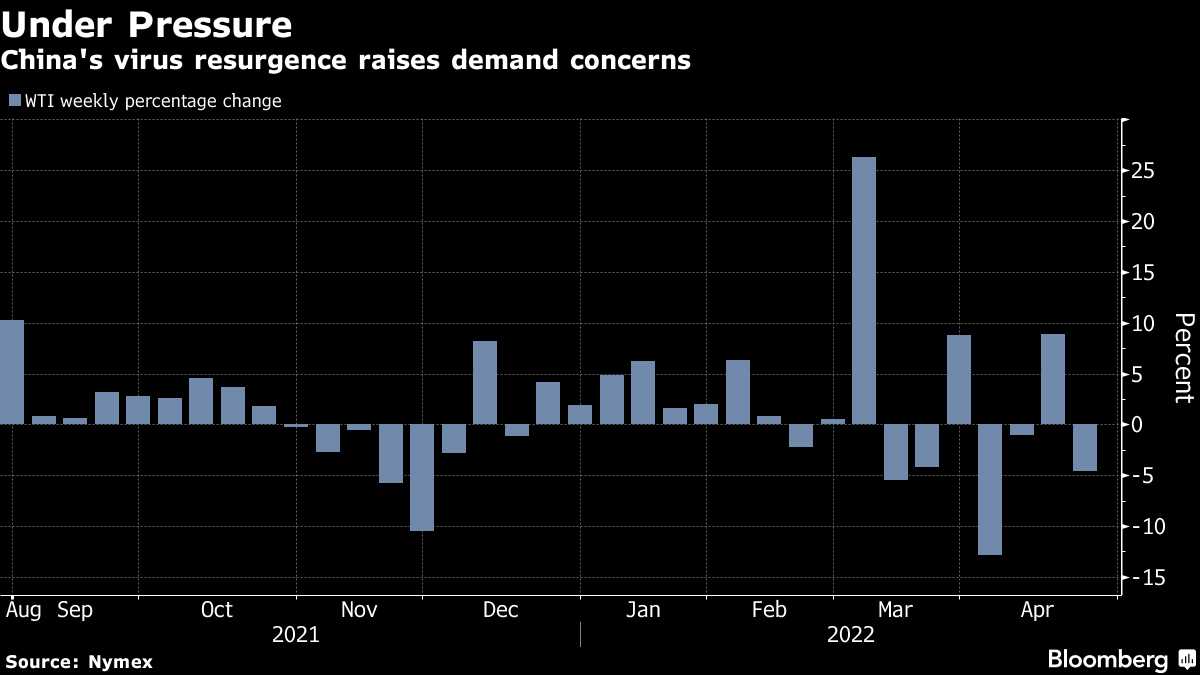

(Bloomberg) -- Oil pushed lower at the start of the week on concerns that a spreading Covid-19 outbreak in China will weigh on global demand.

West Texas Intermediate futures slid almost 3% to trade below $100 a barrel amid a rout in stocks and other raw materials. Shanghai reported record daily deaths over the weekend, while authorities in Beijing warned the virus was silently spreading. The world’s biggest crude importer is heading for the worst oil demand shock this month since the early days of the coronavirus.

China’s travails with Covid-19 add another source of volatility to an oil market that’s been whipsawed by the Russian invasion of Ukraine. The war has fanned inflation, and the European Union is discussing measures to restrict oil imports from Russia. That could tighten the market and drive prices higher.

China has implemented lockdowns in a number of cities as it pursues a Covid Zero strategy. Residents in a Beijing district were told to submit to three days of virus testing starting Monday in a bid to snuff out a rash of cases in the area. Shanghai is entering its fourth week of strict lockdown.

The nation’s demand for gasoline, diesel and aviation fuel in April is expected to slide 20% from a year earlier, according to people with inside knowledge of China’s energy industry. That’s equivalent to a drop in crude oil consumption of 1.2 million barrels a day, they said.

“Demand worries are back in focus,” said Vandana Hari, founder of Vanda Insights in Singapore, citing China’s virus lockdowns and easing global economic growth. “Risk is skewed to the downside.”

The market is poised for additional supply, adding to bearish signs. Libya is expected to resume output from shuttered fields in the coming days, while the CPC oil terminal on Russia’s Black Sea coast has resumed regular operations after one of two moorings damaged in a storm was repaired.

Brent remains in backwardation -- a bullish structure where near-dated contracts are more expensive than later-dated ones -- but it’s narrowed considerably since early March. The prompt timespread for the benchmark was 56 cents a barrel in backwardation, compared with a high of $4.64 on March 2.

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.