North Asia Moves to Curb Russian Coal Imports After EU Ban

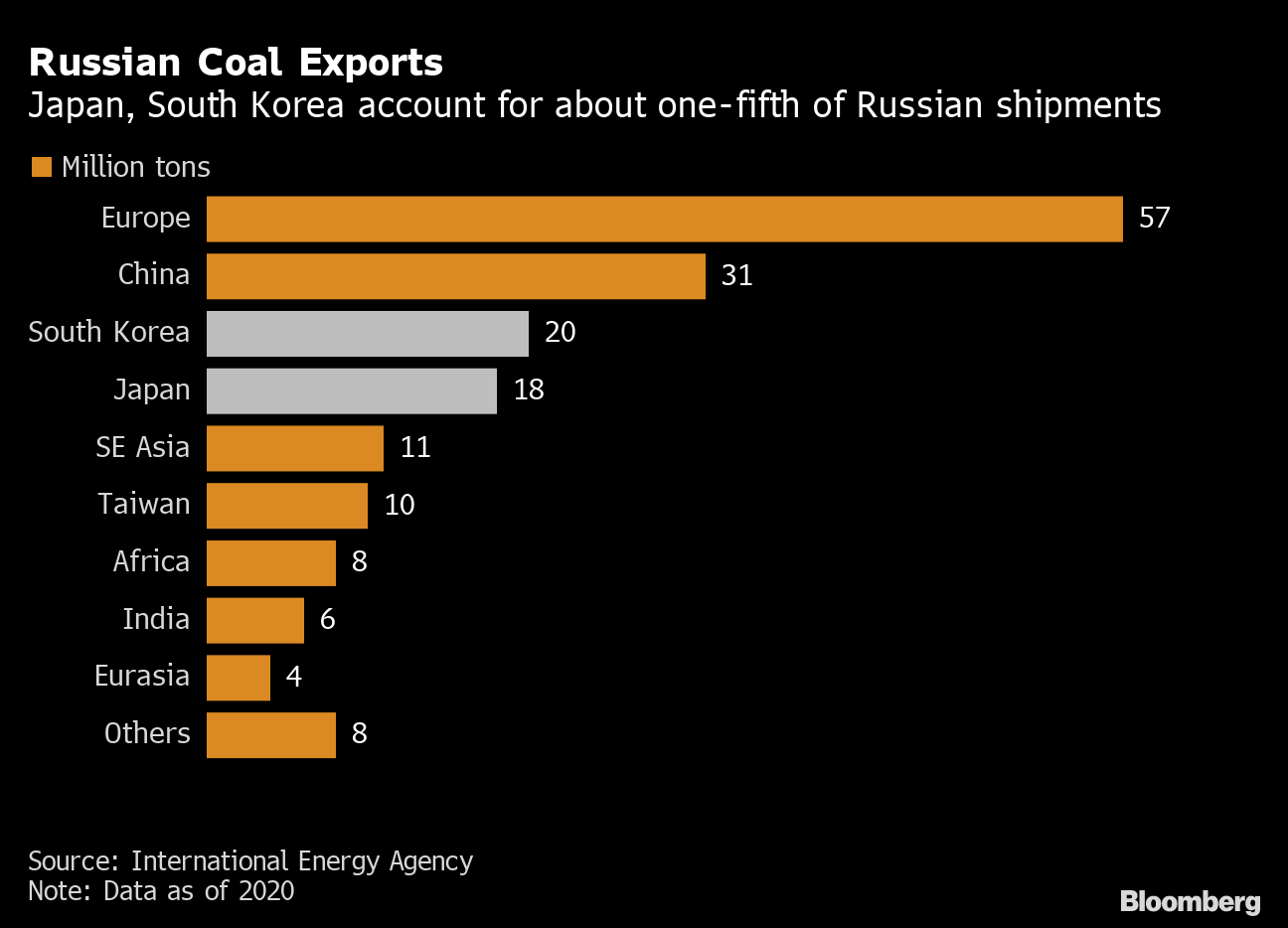

(Bloomberg) -- Policymakers and companies in Japan and South Korea are making moves to curb Russian coal imports, adding to pressure on Moscow after the European Union imposed a ban on its fuel.

Japan “will aim to stop importing coal from Russia” as a longer-term goal and will over time use energy conservation, other power generation and alternative country supply to reduce its dependency on Russia, Trade Minister Koichi Hagiuda said on Friday.

While Hagiuda didn’t give a time frame for the pullback, the plan signals a policy reversal for Japan, which had previously drawn a line at cutting energy ties to Russia because of its heavy dependence on fuel imports. Japan plans to gradually wind down imports and is also considering additional financial sanctions, local media Nikkei earlier reported.

Separately, several power generators in South Korea and Japan said they won’t make additional spot or term purchases of Russian coal.

The decisions in Asia come as pressure builds against Russia in response to reports that the country’s forces committed apparent war crimes in Ukraine. The EU agreed on Thursday to ban Russian coal imports, while the Group of Seven leaders issued a statement saying that the countries will ban new investment into Russia’s energy sector and expand trade restrictions, including phasing out and banning coal imports.

Japan is the third-biggest coal importer, and gets about 13% of its power-generating supply from Russia. About 17% of South Korea’s coal imports came from Russia last year.

Jera Co., Japan’s top power producer, has Russian coal as part of its portfolio but aims to secure supply from other countries going forward, according to a company spokesman. Shikoku Electric Power Co., a smaller Japanese utility, said earlier this week that it won’t import from Russia for the time being, after buying 10% in the previous fiscal year.

In South Korea, at least three coal-fired power plant operators, units of state-owned utility Korea Electric Power Corp., said they won’t commit to future purchases after their existing contracts come to an end. Two of the units added that they are not anticipating a supply disruption given that their portion of Russian supply is less than 10%.

Related story: Europe’s Russia Coal Ban to Fuel Global Fight for Dirty Fuel

Japan, which imports almost all of its energy needs, has been forced to reckon with its dependence on Russian resources since the conflict in Ukraine started. The country’s trade ministry convened a panel meeting at the end of March in order to strengthen energy security and target curbing dependence on Russian fuel, discussing measures such as installing energy-conserving infrastructure at steel mills to use less coal.

But the country has been reluctant to make a complete break with Russia. Prime Minister Fumio Kishida said last week that the country wouldn’t withdraw from the Sakhalin-1 offshore oil joint venture with Russia, or the Sakhalin-2 liquefied natural gas export project, citing Japan’s energy security needs. Kishida is scheduled to hold a news conference at 6 p.m. Tokyo time on Friday.

Kishida is also set to announce the expulsion of some Russian diplomats, FNN reported on its website, bringing it in line with European nations including Germany and France. Tokyo officials had initially been unwilling to take such a step, but decided that the killing of civilians took the situation to a new level, FNN said, without specifying where it got the information.

Other new sanctions are likely to include freezing the assets of Sberbank of Russia PJSC, and a ban on Russian timber imports, the Yomiuri reported earlier.

(Updates with details throughout.)

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.