China’s Sudden Pledge to Cut Steel Output Upends Carbon Policy

(Bloomberg) -- China’s promise to cut steel output for a second year looks like a bit of improvisation by the government, as a resurgent virus sweeps through the economy and chokes production in any case.

Beijing’s sudden pledge on Tuesday comes barely two months after it extended the steel industry’s deadline to peak its emissions by five years to 2030. The laxer stance was adopted after production crashed in the second half of 2021 because of the government’s insistence on reducing output from the prior year’s record in service of its climate goals.

The steel industry accounts for about 15% of China’s emissions, and the new policy seemed to indicate that the government was preparing the ground for carbon-intensive spending to support growth. It also suggested a broader reassessment of plans to decarbonize the economy, with more priority being placed on reining-in inflation and preventing damaging shortages of key materials in the wake of last year’s power crisis.

But the slowdown in the economy, driven in large part by the spread of the virus and the government’s crackdown on the metals-intensive property sector, has left steel output in the first quarter languishing more than 10% below last year’s levels. Further weakness is likely in April after a new round of lockdowns in the production hub of Tangshan.

The China Iron & Steel Association said mills have been asked to cut production amid limited demand. That may hold true now, but it won’t be the case once stimulus is unleashed to counter the worst effects of omicron on growth.

The bet seems to be that there’s enough headroom to raise steel output in the second half without busting the cap on production. As Kallanish Commodities Ltd. notes: “Crude steel production, and demand, have started 2022 weakly but could recover. This is the opposite to the trend in 2021.”

That calculation is helping to buoy iron ore prices, which are also drawing support from supply constraints after the world’s top two miners both reported lower production in their quarterly updates.

It also raises the intriguing possibility that China’s emissions from steel actually peaked during record production of 2020 -- a whole decade before the new deadline set for the industry, and the deadline for the economy as a whole.

Today’s Events

(All times Beijing unless shown otherwise.)

- China gas and hydrogen supply chain seminar, online, 15:00

- China March output data for base metals

- China’s 3rd batch of March trade data, including country breakdowns for energy and commodities

- China Agricultural Outlook Conference in Beijing

- China Photovoltaic Academic Conference, online, day 1

- Boao Forum in Hainan, day 1

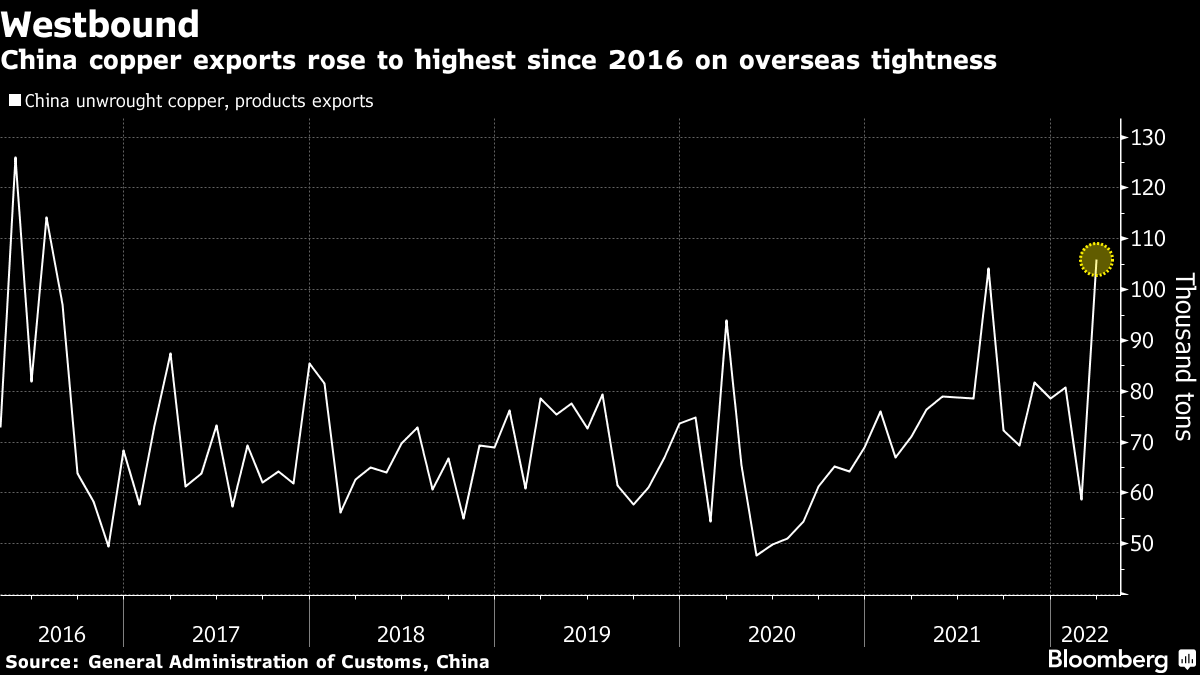

Today’s Chart

A global supply squeeze following Russia’s invasion of Ukraine has lifted China’s copper exports to the highest since 2016. Usually known as a massive importer of metals, the country sent over 100,000 tons of copper abroad last month, nearly double February’s amount. China’s aluminum exports also surged to a record last quarter as overseas markets tightened due to the war.

On The Wire

- China Trying to Ensure Food Supplies Amid Challenges: Officials

- Solar May Generate Half of World’s Power by 2050, Trina CEO Says

- China to Sign Forced Labor Treaties as Xinjiang Scrutiny Grows

- CHINA REACT: Loan Rates Steady But PBOC Still in Easing Cycle

- Sungrow Outlook, Target Cut After Earnings Miss: Street Wrap

- China March Gasoline Output Rose 10.8% Y/y to 13.7m Tons

- Several Chinese Cities Ease Housing Loans, Down Payment: Daily

- SAIC Motor Resumes Production at Shanghai Plant: Securities News

- Cnooc Expects 1Q Net Income to Rise 62%-89% Y/y

- Cnooc Says A-Shares to Start Trading in Shanghai April 21

- China’s Refined-Copper Output Growth May Slow to 4% This Year

The Week Ahead

Thursday, April 21

- BHP quarterly production report, 08:30 Sydney

- China Photovoltaic Academic Conference, online, day 2

- Boao Forum in Hainan, day 2

- EARNINGS: CATL

- USDA weekly crop export sales, 08:30 EST

Friday, April 22

- Bloomberg China April economic survey, 10:00

- China weekly iron ore port stockpiles

- Shanghai exchange weekly commodities inventory, ~15:30

- China Photovoltaic Academic Conference, online, day 3

- Boao Forum in Hainan, day 3

- EARNINGS: Huayou Cobalt, Sany Heavy

Saturday, April 23

- China Steel Development Forum in Bejing

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.