U.K.’S Post-Brexit Economy Collides With Key Climate Tool

(Bloomberg) --

The U.K.’s industry is facing even higher carbon costs after the nation debuted its post-Brexit emissions trading system on Wednesday.

Putting a price on pollution raises the challenge for the British government of how to be a world leader on climate issues while at the same time making sure its businesses can compete globally. The market’s first day of trading showed that British emissions will be at least as expensive as those in Europe, ratcheting up tension between the climate ambitions of politicians and the need to increase industrial output to boost the economy.

”Today’s first U.K. emissions trading system auction is a major milestone in delivering our goal to clean up our energy system, support businesses to decarbonize at the least cost and drive forward the green industrial revolution,” said U.K. Energy Minister Anne-Marie Trevelyan. “At every step of the way, we will protect the competitiveness of British industry and minimize risk of carbon leakage as we transition to a green economy.”

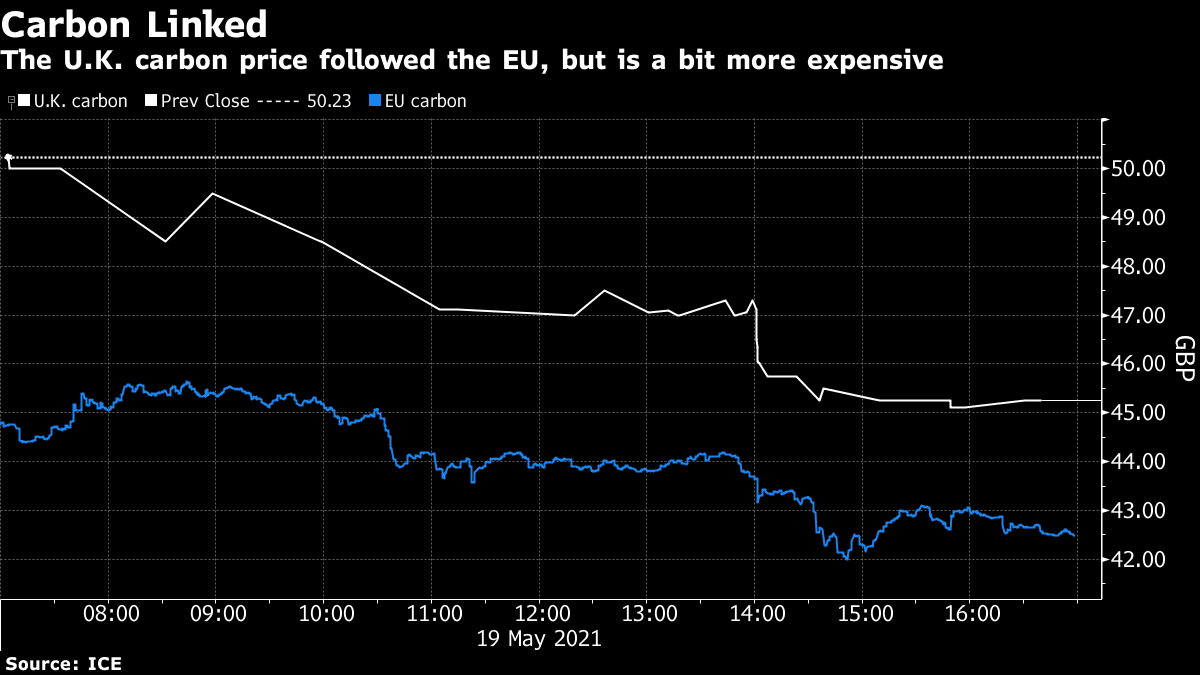

The U.K. sold permits for about 6 million metric tons of carbon emissions for just under 44 pounds ($62.30), about the same price as European permits. Still, on the first day of trading benchmark futures contracts for U.K. emissions closed at a 6.5% premium to the EU equivalent. If the price maintains around the current level, it could trigger government intervention as soon as this summer.

That differential could be part of the growing pains of a new market, but it’s also be a sign that at least some market participants expect the contracts to be more expensive than those in the EU.

The U.K. system is also much smaller than the one in Europe and set to shrink even more. Prime Minister Boris Johnson has vowed to cut emissions by 78% by 2035 on the way to zeroing out emissions by the middle of the century.

While the EU has a similar goal for 2050, its path to get there is much different. Coal plants are already nearly extinct in the U.K. and will be completely shutdown by 2024. Germany may take until 2038 to hit that milestone and EU countries like Poland beyond that.

That means the U.K. will need to cut emissions from more difficult sectors like industry and use more expensive technologies to meet its goals. Incentivizing that shift will require a consistently higher carbon price.

“The U.K. has a more ambitious climate target than the European Union, and that’s ultimately going be reflected in the price,” said Ariel Perez, partner and head of environmental products at Hartree Partners LP. “The U.K. has already achieved more emission reductions than Europe. So the remaining abatement options in the U.K. are fewer and more expensive than those in Europe.”

This is just the beginning and prices in the two systems may align in future. If they don’t, that could shift the balance against U.K. business.

“If U.K. allowances would actually trade significantly higher than EU allowances, then this would be a competitive disadvantage for U.K. participants,” said Sebastian Rilling, EU power and carbon market analyst at ICIS.

While the U.K. modeled its market on the EU one, which it participated in for over 15 years, there are some crucial differences. One obvious difference is that it’s new. That means companies like power generators haven’t built up a surplus of permits like they have over the years in Europe.

That led to a surge in demand for the first auction on Wednesday afternoon. Bidders offered to buy permits to cover more than 29 million tons of emissions, though only 6 million were for sale.

“There’s pent up demand,” said Louis Redshaw, chief executive officer of Redshaw Ltd. and a former Barclays Plc trader. “Electric utilities will buy everything they possibly can.”

Under the EU system, carbon auctions usually begin in January, so that businesses can buy up permits gradually through the year. But British installations have been polluting for nearly five months without being able to buy any permits.

The EU carbon price has surged dramatically in recent months as the market expects a tougher climate agenda to drive up the cost of emissions. Prices have surged more than 50% this year, beating most analyst estimates. Many traders are using the options market to bet that carbon will sail through 100 euros by the end of the year.

In the rules set out for the U.K. system, the government has signaled it will be on the look out for any sign that rising costs could lead to a competitive disadvantage for businesses.

The government has given itself greater ability than the EU to meddle in the market during its first years. Three months of elevated prices would trigger intervention, compared to 6 months for Brussels. The U.K. could also take action to alter the supply of permits. The current threshold for government intervention is 44.74 pounds in the futures market, 51 pence below Wednesday’s closing price.

While a high carbon price is needed to ensure decarbonization, “further work is needed to ensure a level playing field that supports companies in hard to decarbonize sectors and protects competitiveness,” said Tom Thackray, director of infrastructure and energy at the Confederation of British Industry.

(Updates with analyst comment from fourth paragraph)

More stories like this are available on bloomberg.com

©2021 Bloomberg L.P.