Most Mideast Stock Markets Set for Gains in May: Inside EM

(Bloomberg) --

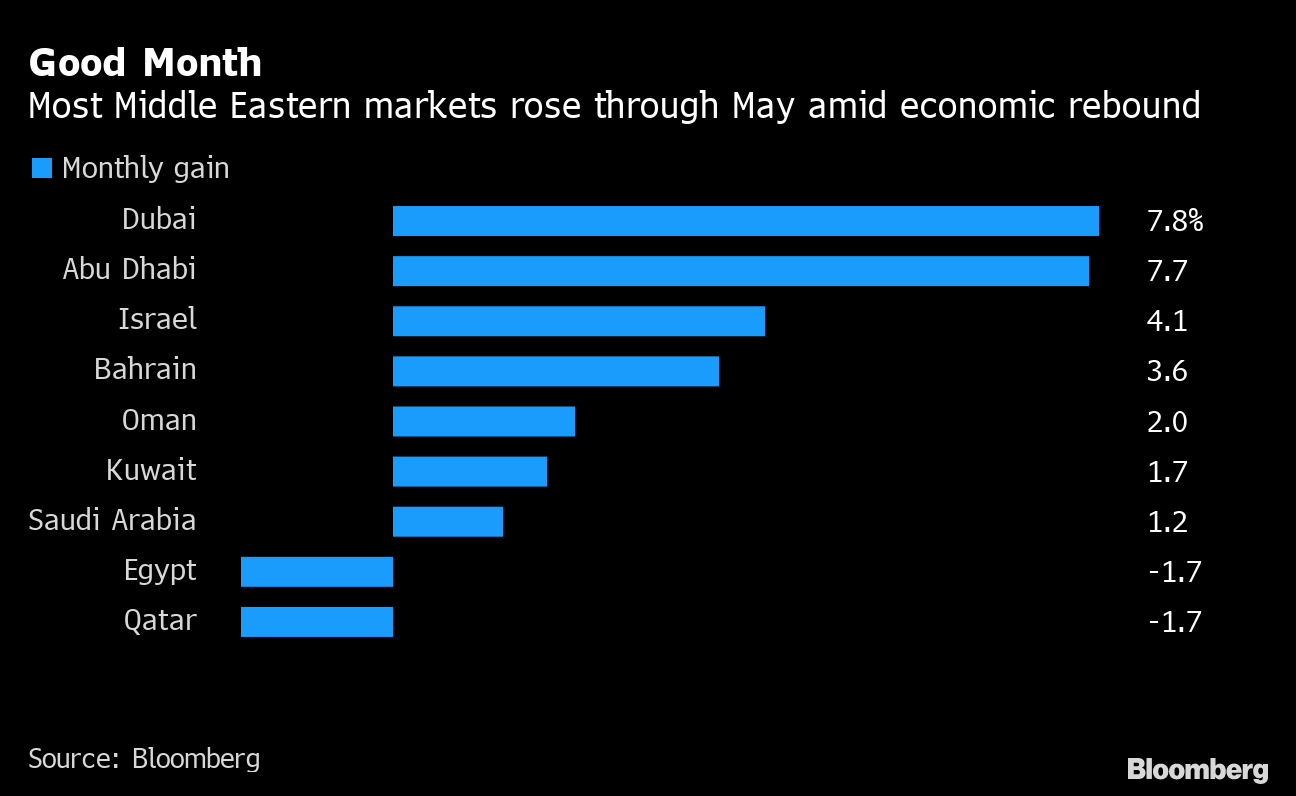

Stocks in the Middle East are poised to end the month higher on prospects of an economic rebound.

Benchmark indexes in the United Arab Emirates led gains through May. The UAE, a federation of seven sheikhdoms including Dubai and Abu Dhabi, has one of the highest coronavirus vaccine inoculation rates globally.

“There are multiple factors” for the gains across the region, including “vaccinations and ease in restrictions, recovery in oil price as well as growth in the private sector,” said Harshjit Oza, head of research at Abu Dhabi-based International Securities. However, geopolitics continue to weigh on Egyptian shares, he said.

Brent crude, a key source of revenue for economies in the Gulf, climbed about 3.5% this month. The S&P 500 ended last week near a record, while the MSCI Inc.’s emerging markets index closed at the highest level in a month.

Stocks in Saudi Arabia, Kuwait, Bahrain, Oman and Egypt rose on Sunday. Shares in Dubai, Abu Dhabi and Qatar fell, while those in Israel were little changed.

MIDDLE EAST MARKETS:

- Kuwait’s Premier Market index rises as much as 0.6%

- National Bank of Kuwait +1.2%; Boubyan Bank +0.8%; Burgan Bank +2.2%

- In Saudi Arabia, the Tadawul All Share Index climbs for a fourth day, the longest winning streak in a month

- The Tadawul Media sub-index leads gains

- RELATED: Saudi Unemployment Rate Fell from Pandemic Highs

- Saudi Central Bank Gets a New Name and Governor

- Abu Dhabi’s ADX General Index falls for a third day, the longest losing streak in a month

Adnoc Distribution falls 8.1%, down for a second day after parent company Adnoc sold a stake in the company at a discount

- NOTE: Adnoc’s $1.6 Billion Stock, Bond Sale Triggers Drop in Fuel Unit

- The Dubai Financial Market General Index falls for a second day

- Dubai Investments -2.3%; Dubai Islamic Bank -0.4%; Aramex -1.4%

- Egypt’s EGX 30 index climbs most in the region after falling for four days, led by gains in Commercial International Bank

- The lender rises as much as 2.3% after dropping about 10% the past two weeks

More stories like this are available on bloomberg.com

©2021 Bloomberg L.P.