China’s Import Scrutiny Spurs U.S. Corn Cancellations

(Bloomberg) -- China is clamping down on some corn imports amid concern that overseas purchases have spiraled out of control, prompting several feed mills to cancel their U.S. cargoes.

Chinese customs authorities are restricting imports into free trade zones, which aren’t counted toward an official annual purchase quota, according to people with knowledge of the matter. Total U.S. corn cancellations are estimated to be less than 1 million tons, said two of the people, who asked not to be identified as the matter is private.

The increased scrutiny by Beijing over its corn imports comes as the broader market focuses on whether the country will continue its heightened purchases of raw materials from grains to metals to fossil fuels. Prices across a variety of products have soared this year partly because of Chinese demand, raising import costs and sparking fears over inflation in the Asian nation.

Corn futures in Chicago fell as much as 2% before erasing losses as traders determined the scrapped purchases aren’t big enough to alter an already tight supply situation. Some market watchers claim China, which is forecast to import a record amount of corn this year, is trying to get a better deal after prices recently surged above $7 a bushel for the first time since 2013.

“China is playing a negotiating game,” said David Martin, founder of Martin Fund Management in New York.

China’s crackdown on corn purchases is targeted at businesses that have set up blending facilities in the free trade zones, according to the people familiar with the matter. These facilities allow firms to mix the imported corn with other raw materials to produce livestock feed that enable them to profit from zero-tariff imports, the people said.

Calls to Chinese customs outside business hours went unanswered.

Illinois corn farmer Matt Bennett, a co-founder of commodities brokerage and consulting firm AgMarket.net, that China has a pattern of crop-import cancellations only to start “buying the daylights out of stuff.”

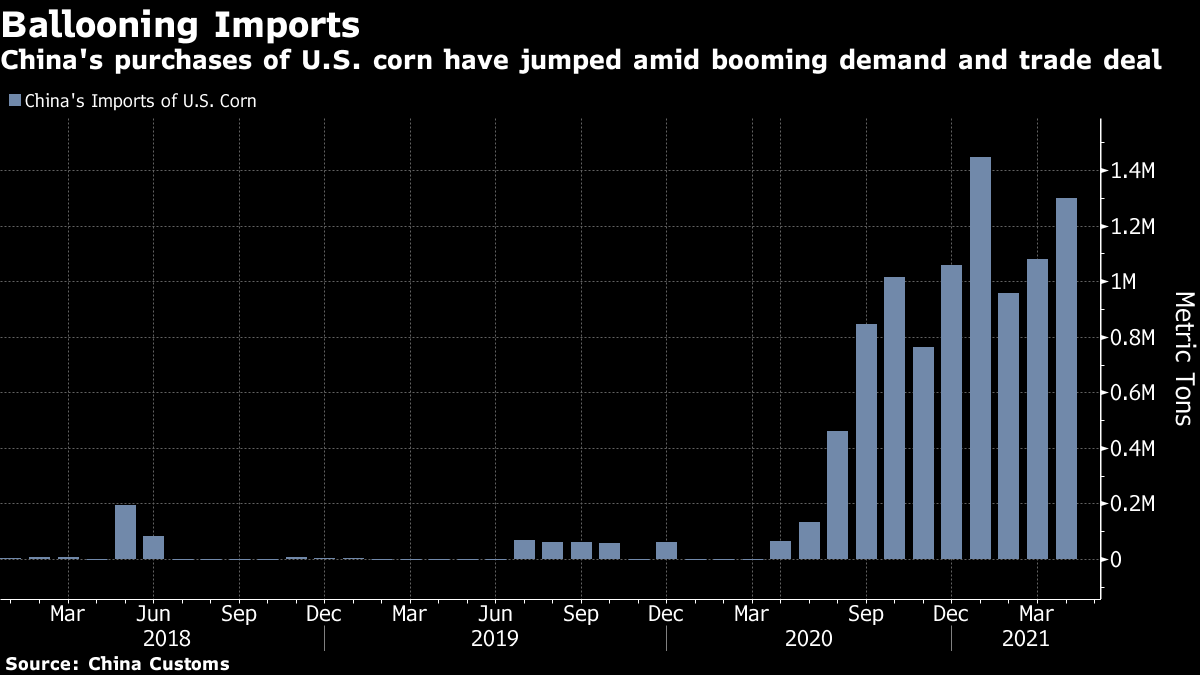

The canceled shipments are a small amount compared to more than 20 million tons of American corn that China has purchased this season. The Asian nation has been a key source of demand for the grain to feed its recovering hog herd, helping to push prices to multiyear highs. Imports from the U.S. have soared as Beijing also seeks to fulfill its commitments for the “phase one” trade deal signed with the U.S. in January 2020.

The latest move by China “is likely to have only a very small impact on China’s compliance with the overall purchase commitments on the phase one agreement,” said Chad Bown, an expert at the pro-trade Peterson Institute for International Economics in Washington. “Corn is just too small a portion of the overall deal.”

Corn Quotas

China allocates annual corn import quotas to state and private firms. State-owned Cofco Corp. may at times receive an allowance to buy an additional amount that it resells domestically to private mills or to replenish state reserves.

The quotas for 2021 are set at 7.2 million tons. Imports outside the quota are possible, but may incur tariffs of 65% of the purchase price. Shipments into bonded zones are exempt from duties.

The proliferation of businesses that are shipping corn into bonded zones and blending them for animal feed has alarmed authorities, who are seeking to control imports and maintain the quality of feed products.

Last month, Shandong province shut down a feed producer located at a local bonded zone after its product was found to have fallen short of protein requirements. The plant mainly blended corn with a low amount of distillers dried grains, or DDGS, said one of the people.

All the cancellations will be of old U.S. corn crop from the 2020-21 marketing year, the people said. More than 15 million tons of American corn have been purchased for state stockpiles from old and new crops, two of the people said.

(Corrects spelling of Bown’s name in 10th paragraph in story published May 26.)

More stories like this are available on bloomberg.com

©2021 Bloomberg L.P.