Oil Drops Back Near $70 Despite Signs of Strengthening Demand

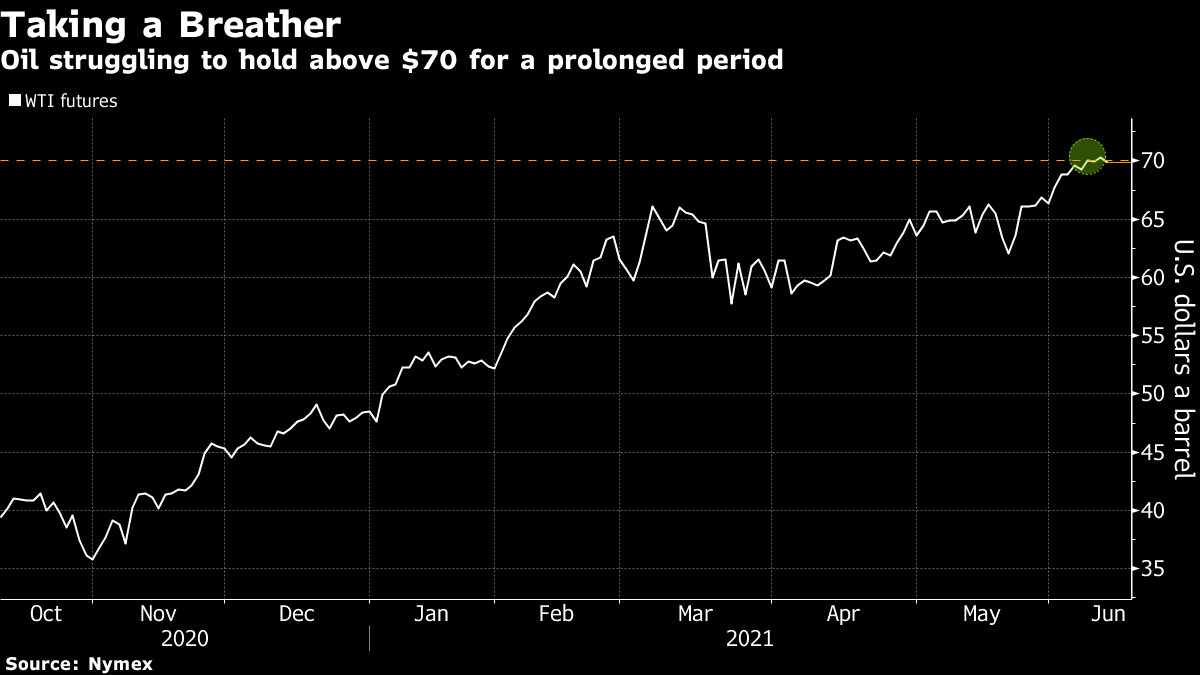

(Bloomberg) -- Oil dipped despite bullish signs on the demand outlook, with prices struggling to maintain upward momentum above $70 a barrel.

Futures in New York have bounced around that mark since topping the level for the first time since October 2018 earlier this week. While prices fell 0.4% on Friday, the demand picture remains positive. Road traffic in the U.S. and most of Europe is pretty much back to pre-virus levels, and OPEC is predicting that the global recovery will gather strength in the second half of the year.

The market is also firming in a bullish structure and Goldman Sachs Group Inc. sees jet fuel demand accelerating as vaccination rates climb. The International Energy Agency will give an updated snapshot on the market later Friday.

Oil is still set for a third straight weekly gain as a strong recovery in Europe, the U.S. and China underpins a rebound in prices. The market continues to watch for progress on Iranian nuclear talks, with a top American envoy appealing to Tehran to accept a “mutual return” to the 2015 accord.

“Expectations of a Western hemisphere demand rebound have been fully priced in, so the next leg up may not be around the corner,” said Vandana Hari, the founder of energy consultant Vanda Insights in Singapore. “The bulls have decided to not worry about Iran return until it actually happens.”

The prompt timespread for Brent was 53 cents in backwardation -- a bullish structure where near-dated prices are more expensive than later-dated ones. That compares with 38 cents on Monday.

Oil demand will jump by about 5 million barrels a day in the second half of 2021 compared with the first half, according to a report from OPEC on Thursday. The estimates were little changed from a month ago. Separately, spare capacity held by OPEC+ -- estimated at 5.8 million barrels a day on paper -- could be smaller than expected due to questionable accounting.

More stories like this are available on bloomberg.com

©2021 Bloomberg L.P.