Oil Little Changed Amid Stronger Dollar With Supply Deficit Seen

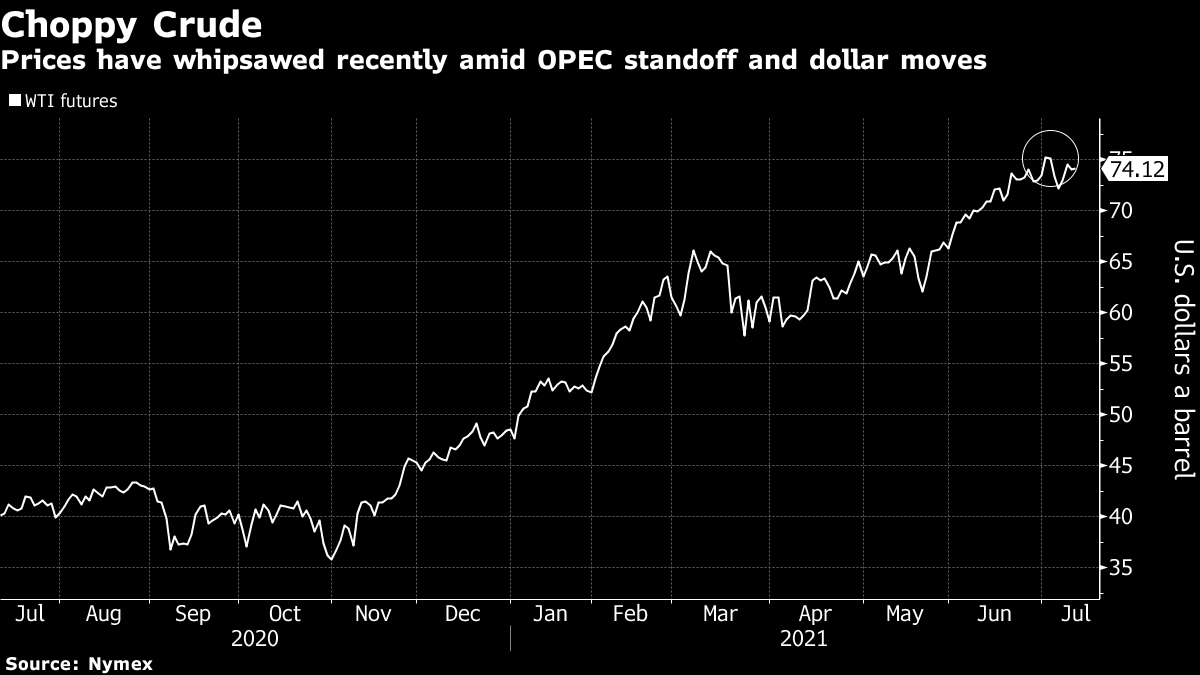

(Bloomberg) -- Oil pivoted between small gains and losses, pressured by a stronger dollar, after the International Energy Agency said that crude traders are bracing for a deepening supply deficit.

Futures in New York traded in a tight $1.06-range on Tuesday. The U.S. dollar rose for a second session, reducing the appeal of commodities priced in the currency. Meanwhile, the IEA warned in a report that deadlock in the OPEC+ alliance may cause global markets to “tighten significantly.”

While the IEA report is bullish, the stronger dollar has limited price gains, said Bob Yawger, head of the futures division at Mizuho Securities. “We’re just chopping around looking for direction.”

Oil prices have gained more than 50% this year with vaccination progress and the reopening of economies boosting fuel consumption. OPEC and its allies have supported prices by taking a gradual approach this year to returning shuttered supplies.

Yet, the oil cartel has been deadlocked on increasing production as the dispute between the United Arab Emirates and Saudi Arabia carries on. Both countries have locked in stable crude output for next month.

“It’s a market that, unless they put more oil in, is very, very tight,” said Ed Morse, head of commodities research at Citigroup Inc.

WTI’s prompt spread weakened Tuesday to 58 cents in backwardation, compared to 79 cents in backwardation a week ago.

Nonetheless, the demand rebound is imperiled by the swift spread of the virus’ delta variant, which is forcing restrictions on work and mobility as it spreads through a largely unvaccinated Southeast Asia.

Indonesia, Southeast Asia’s biggest economy, is being wracked by a particularly brutal wave of Covid-19, with movement curbed in the industrial heartland of Java and the tourist enclave of Bali. Malaysia is still in the midst of a nationwide lockdown, while Thailand has just stepped up restrictions.

In the U.S., crude stockpiles dropped 4 million barrels last week, according to a Bloomberg survey. The industry-funded American Petroleum Institute will report its supply tally later Tuesday, while government data will be released on Wednesday.

More stories like this are available on bloomberg.com

©2021 Bloomberg L.P.