Oil Declines As Omicron and Monetary Tightening Darken Outlook

(Bloomberg) -- Oil fell for the first time in three days as traders grew more concerned about the demand impact from the omicron variant and tighter monetary policy.

Futures in New York dropped toward $71 a barrel after rising 2.3% over the past two sessions. Daily Covid-19 cases in the U.K. have jumped to a record, while hospitalizations have surged across the U.S. The Bank of England unexpectedly raised interest rates for the first time since the pandemic struck in a sign that inflation is now of bigger concern to leading central banks than the virus.

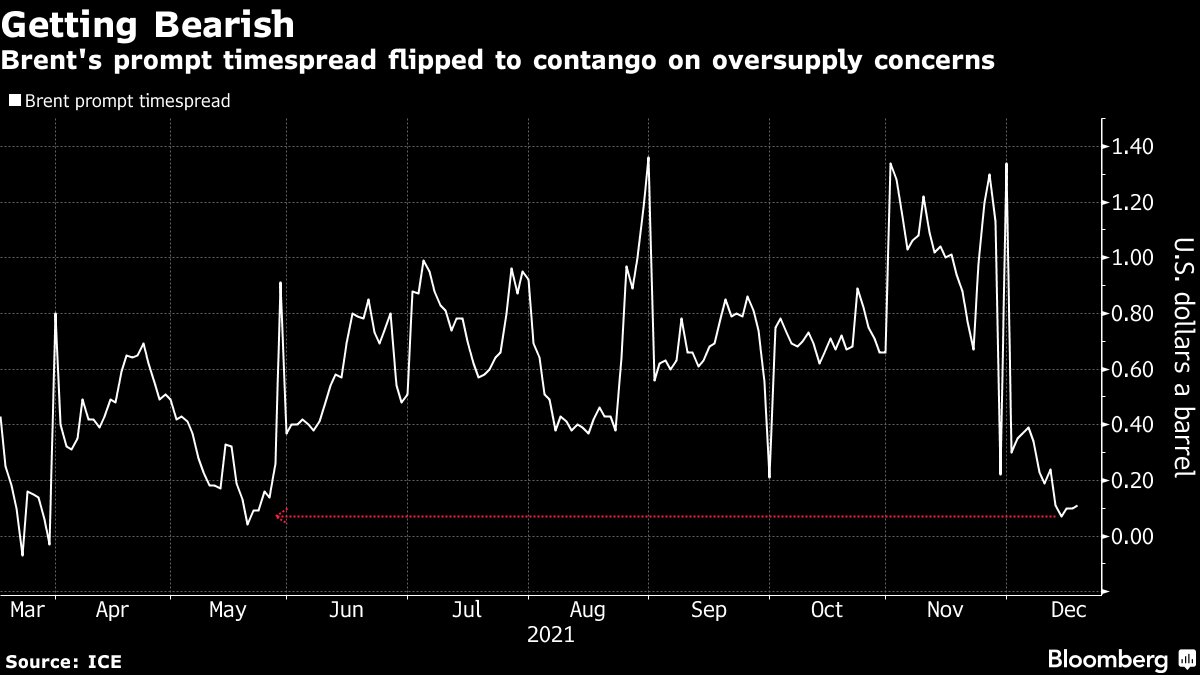

Signs are also emerging of softening oil demand in Asia, while the International Energy Agency said this week that the global market had returned to surplus as omicron impedes travel. The weakness is showing up in the market’s structure, with Brent on the cusp of a bearish contango structure after dipping into this on Tuesday.

“Crude oil has dipped again to trade slightly down on the week as omicron developments continue to impact the short-term demand outlook,” said Ole Sloth Hansen, head of commodities research at Saxo Bank A/S in Copenhagen.

This week has seen traders hit with conflicting signals on demand and supply. Those range from the central banks’ moves, to new restrictions to limit the spread of omicron, and declining inventories in the U.S. That has caused a generally risk-off attitude in oil markets, leading the aggregate volume of futures contracts to drop over the past two sessions.

Omicron is starting to limit the movement of people. The City of London has transformed from a raucous district with thousands of workers celebrating Christmas into a no-party zone in the space of a week. Almost half of staff didn’t go to the office on Monday, the lowest since September, according to data compiled by Google, which tracks the location of its users.

More stories like this are available on bloomberg.com

©2021 Bloomberg L.P.