China Will Need World’s Grains to Feed Home-Grown Meat Ambitions

(Bloomberg) -- China’s reaffirmation of a long-term goal to be almost entirely self-sufficient in pork production means it will keep scooping up global grain supplies to feed the world’s largest pig herd.

The country, which consumes half of the world’s pork, will maintain a target to produce 95% of the protein at home through 2025. It wants to be self sufficient in poultry and egg, 85% for beef and mutton, and 70% for dairy, the agriculture ministry said, adding that they form part of China’s food security goals.

The targets will likely bolster overseas purchases of soybeans and feed grains needed to fatten hogs, cattle and poultry. China is already the top importer of soybeans and corn, and has purchased unprecedented amounts in the past two years to feed a hog herd recovering from African swine fever. The buying binge sparked a global price rally as investors were also worried about supply.

“Imports of feed grain are likely to remain high for the foreseeable future as China begins to prioritize domestic production of meat and dairy,” said Darin Friedrichs, co-founder and market research director of Sitonia Consulting, a China-based agriculture information service provider.

The self-sufficiency goals, which were flagged since 2020 at least, come as the deadly African swine fever outbreak about three years ago destroyed roughly half of China’s hog population and spurred a surge in meat imports and record pork prices. It accelerated a push to modernize hog production and cut costs.

Today the national herd has recovered to a six-year high and is 17% bigger than before the disease struck. Futures in Dalian are down about 50% this year, underscoring the boom-bust cycle China’s pig farming industry is notorious for.

The self-sufficiency targets are part of a series of measures to ensure stable meat supplies and prices. The ministry said China’s consumption of livestock products will continue to grow but there will be gaps in feed grain supply and demand. It also noted that China is “heavily reliant” on imports for soybeans.

Today’s Events

- USDA weekly crop export sales, 08:30 EST

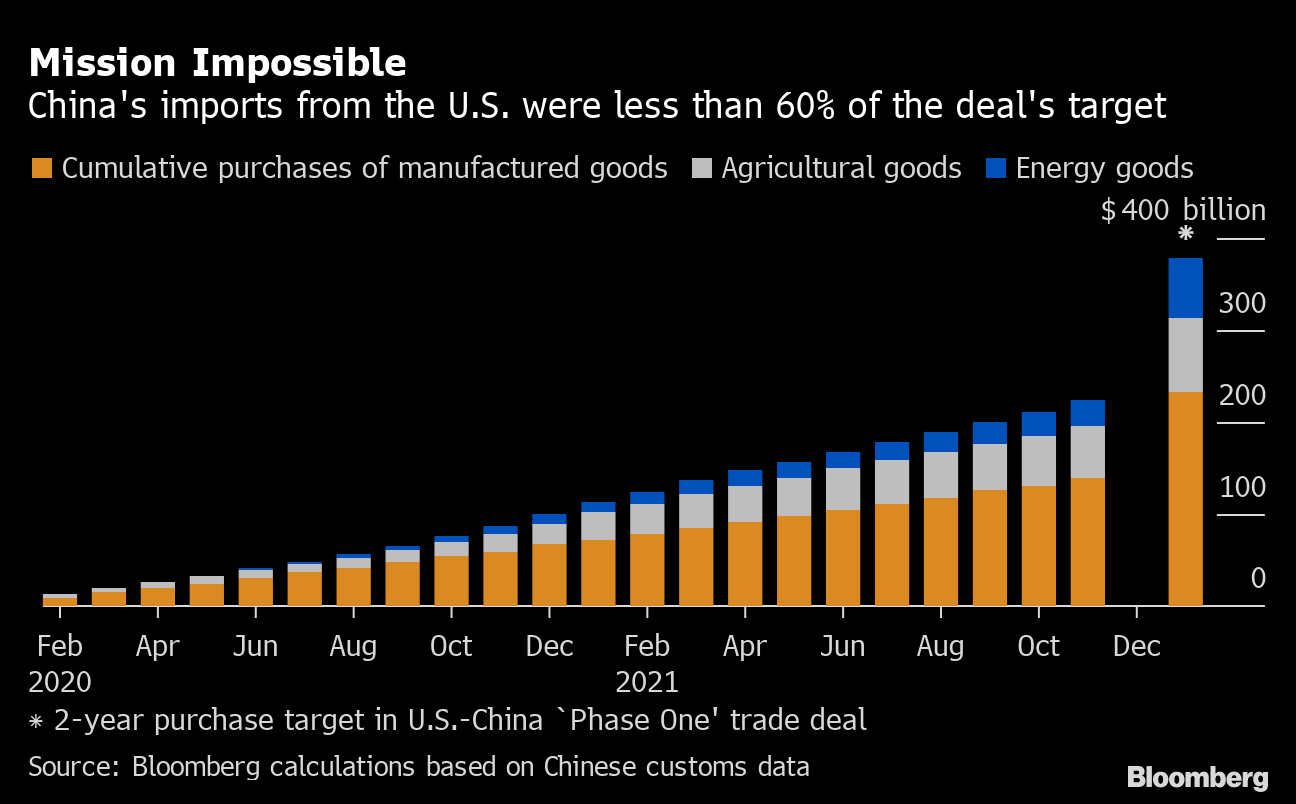

Today’s Chart

When the trade deal between China and the U.S. was signed in January 2020, there were hopes it would lead to a reduction in bilateral tensions and restore some balance to trade, but those goals are proving elusive. Since the signing of the phase-one agreement, Chinese imports from the U.S. have hit a record. However, as of the end of last month Beijing was well behind on promises made -- buying little more than 59% of the extra $200 billion in manufactured, agricultural and energy goods it said it would by the end of 2021.

On The Wire

China approved a merger of key rare-earths companies, creating a behemoth that will strengthen its control over the global sector it has dominated for decades.

The entity will be formed through merging rare-earth units of government-owned companies including China Minmetals Corp., Aluminum Corp. of China and Ganzhou Rare Earth Group Co., according to a stock exchange filing from China Minmetals Rare Earth Co. The new group will accelerate the development of mines in the south, CCTV reported.

- Iron Ore Rebound Stalls as Inventories Pile Up at China’s Ports

- Chinese Miner Jinchuan International Said to Mull Going Private

- Citi Lifts Ming Yang TP 33%, Upbeat on China’s Wind Power Push

The Week Ahead

Friday, Dec. 24

- China weekly iron ore port stockpiles

- Shanghai exchange weekly commodities inventory, ~15:30

- Mysteel annual conference in Shanghai

More stories like this are available on bloomberg.com

©2021 Bloomberg L.P.