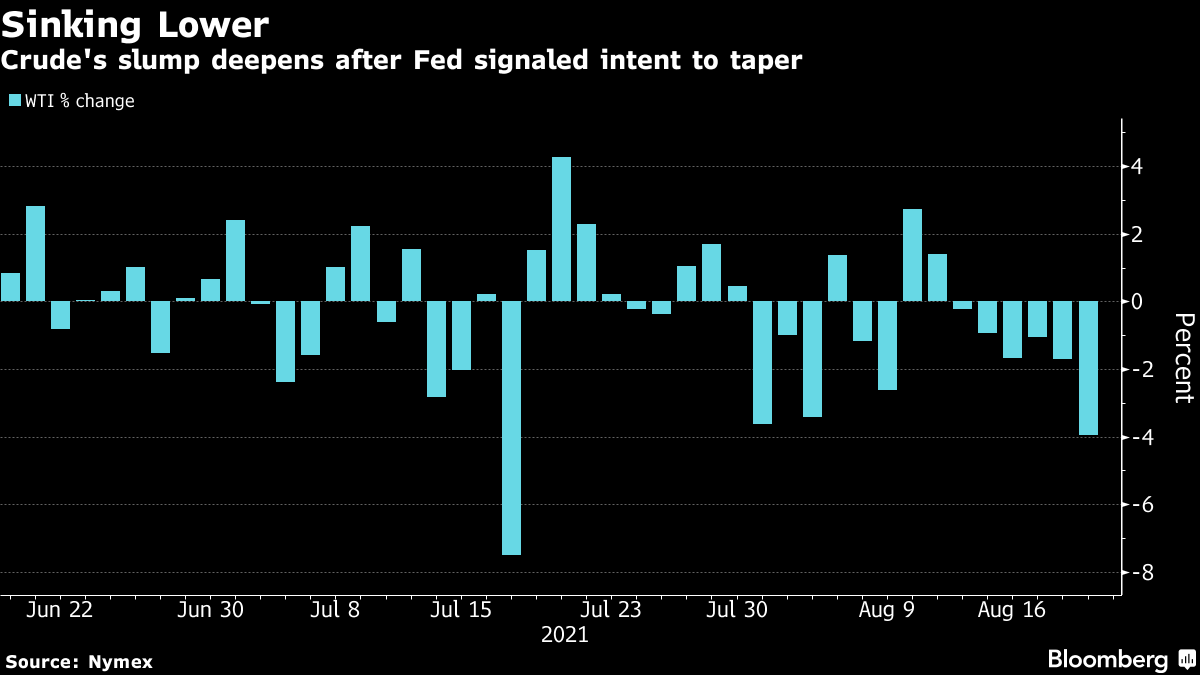

Oil Slides to Lowest Since May After Fed Signals Intent to Taper

(Bloomberg) -- Oil extended its drop to the lowest level since May after the U.S. Federal Reserve on Wednesday signaled it was set to start tapering asset purchases within months, hurting commodities and lifting the dollar.

West Texas Intermediate futures fell as much as 4.3%, declining for a sixth straight day and sinking in tandem with equities and other raw materials like copper and iron ore. The Fed delivered a fresh blow to crude, which had already been struggling as the delta coronavirus variant menaces Asia, leading to worsened demand indicators including a slip in China refinery output.

“The dollar is seeing considerable strength as the Fed moves to cool the economy,” said John Kilduff, a partner at Again Capital LLC. “Oil was already seeing downward pressure as the market reeled from softened demand coming out of China, and waning commodities appeal is encouraging the slump further.”

To cushion the U.S. economy from the blow inflicted by the pandemic, the Fed has been buying $120 billion of assets every month, buoying commodities. The minutes of the bank’s July meeting showed a potential pullback in its monthly bond purchases, as most participants now judged it could be appropriate to start reducing the pace of stimulus.

Oil’s rally in the first half of the year has lost momentum since July amid the threat to demand posed by the spread of the delta variant. Gains in the dollar in recent weeks have also weighed on crude, making commodities priced in the U.S. currency more expensive. At the same time, OPEC+ has pushed ahead with gradually restoring supplies.

“Economic growth concerns, stronger dollar and a risk-off environment are not helping oil,” said Giovanni Staunovo, an analyst at UBS Group AG. “Demand will continue to recover in an uneven way over the coming weeks and the oil market remains under-supplied. So that should still support prices down the road.”

More stories like this are available on bloomberg.com

©2021 Bloomberg L.P.