BP Halts Share Buybacks as Pressure on Energy Major Mounts

(Bloomberg) -- BP Plc is halting share buybacks to shore up its balance sheet as pressure mounts on the UK energy giant to deliver on its turnaround.

The company slashed a $750 million quarterly stock repurchases program that had already been reduced last year, according to an earnings report on Tuesday. BP also withdrew its guidance of returning 30% to 40% of operating cash flow to shareholders, while aiming for 2026 spending at the low end of its previous forecast.

The fourth quarter capped a tumultuous year for BP that started with activist investor Elliott Investment Management pushing for drastic change and ended with Chairman Albert Manifold ousting Murray Auchincloss from the helm. The moves to prioritize balance-sheet repair over investor payouts are an effort to make difficult, prudent decisions and clear the decks for Meg O’Neill, the incoming chief executive officer who will take over in April, analysts said.

Still, the company’s indebtedness barely fell last year and BP kept the same target range of $14 billion to $18 billion of net debt for the end of 2027, despite savings from the buyback halt and its push to sell low-returning assets.

“We are a little surprised to see the net debt target unchanged given the implied savings from the buyback over 2026-27,” RBC analyst Biraj Borkhataria said in a note.

Net debt ended last year at about $22.2 billion, excluding hybrid bonds and lease obligations.

BP shares fell as much as 5.7% in early London trading on Tuesday.

BP is now the only one of the top five oil majors without a share repurchase program, and any future decision on buybacks will only be made once O’Neill arrives, Chief Financial Officer Kate Thomson said in an interview.

Big Oil funneled heaps of cash to investors in recent years when crude prices were elevated. While prices have retreated, US rivals Chevron Corp. and Exxon Mobil Corp. have signaled they’ll keep returning money to shareholders at current levels. Shell Plc has so far maintained its quarterly buyback of $3.5 billion, while TotalEnergies SE is expected to reduce its investor payout when the company reports results on Wednesday.

The strategic shakeup Auchincloss announced last February pulled back from failed low-carbon ventures and refocused BP on its core oil and gas business. The shift was correct but “increased rigor and diligence are required to make the necessary transformative changes to maximize value for our shareholders,” Chairman Manifold said in December’s CEO-swap announcement.

O’Neill, the Woodside Energy Group Ltd. CEO that Manifold picked to replace Auchincloss, has a track record as a champion of fossil fuels. Some groundwork has now been laid for her and she’ll be handed an upstream portfolio featuring key assets in Brazil, the Middle East and US.

BP said on Tuesday that its big Bumerangue discovery in Brazil announced last year has 8 billion barrels of liquids in place, split 50%-50% between crude and condensate. An appraisal program to determine the commercial viability of the project is expected to start around the end of this year.

“The story for BP from here is about the focus on rebuilding trust in capital allocation,” Barclays Plc analyst Lydia Rainforth said in a note on Tuesday.

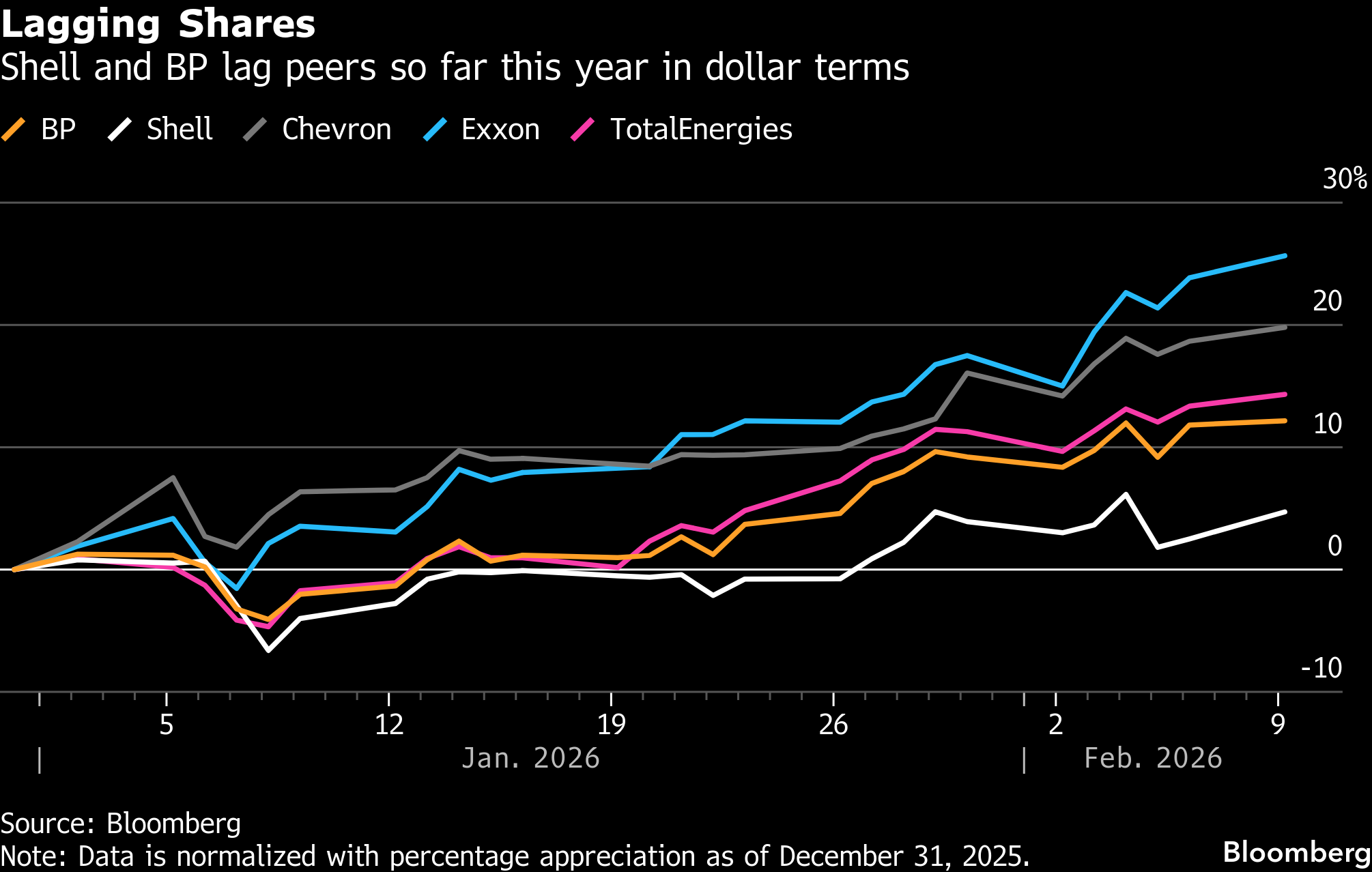

Like Shell, BP has been slower to increase production than US peers, and the shares of the two London-based companies have lagged behind in dollar terms so far this year. BP expects its reported production in 2026 to be slightly lower compared to last year.

Including the divestment of its lubricant business Castrol, BP’s cost cuts target will deepen by as much as $1.5 billion through the end of 2027. As part of its turnaround plan last year, the company had announced $4 billion to $5 billion of cost cuts by the end of 2027.

“Headcount is just one number that we have with regards to the structural cost reductions that we’re looking at across the business,” Interim CEO Carol Howle said in an interview. “And our focus is really delivering across all dimensions.”

BP’s net income of $1.54 billion in the fourth quarter was in line with the average analyst estimate of $1.53 billion.

In a presentation to investors on Tuesday, BP maintained its assumption for benchmark Brent prices at $72.9 a barrel this year, the same as in its strategic review. Futures have fallen from last year’s peaks above $80 to trade below $70.

Energy Transition

BP detailed a previously-flagged $4 billion of writedowns from its energy transition business in the fourth quarter, which included Archaea Energy, the biogas business BP agreed to buy for $4.1 billion in 2022, as well as its solar and battery unit Lightsource and offshore wind assets.

Those assets had been core to BP’s green goals when former CEO Bernard Looney in 2020 announced a move into low-carbon ventures and away from oil and gas.

(Updates context starting in the eighth paragraph.)

©2026 Bloomberg L.P.