Woodside Energy CEO Downplays LNG Risk From Russia-China Pipeline Deal

(Bloomberg) -- Woodside Energy shrugged off concerns that liquefied natural gas demand in Asia would ebb following the announcement that Russia’s Gazprom PJSC is building the Power of Siberia 2 gas pipeline to China.

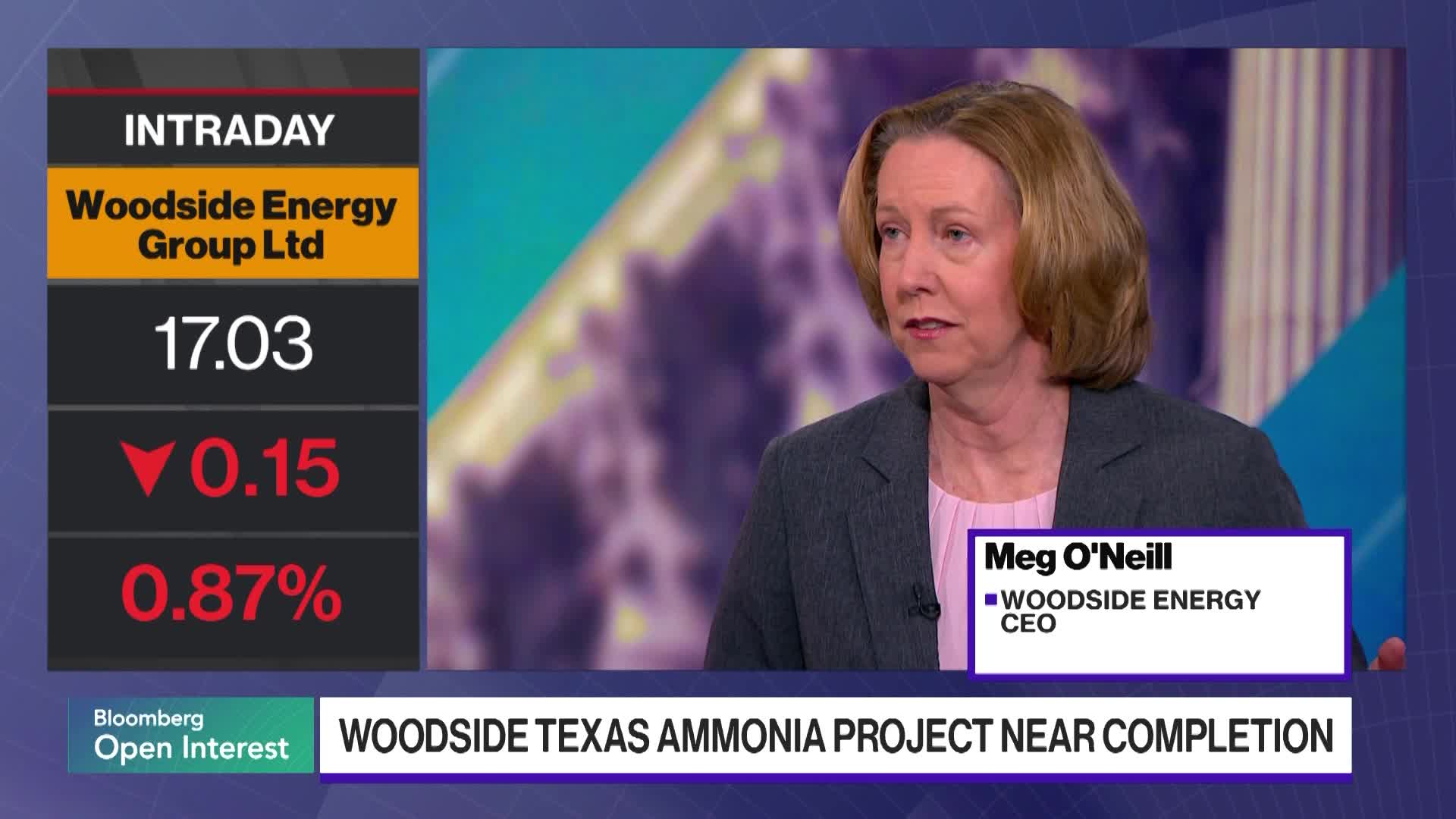

Chief Executive Officer Meg O’Neill said Tuesday that while China is part of the northeast demand region, other markets such as South Korea and Japan remain key. Demand in price-sensitive countries such as India, Pakistan and Bangladesh would also become increasingly more important, she added.

“If you looked over the last few years, China has signed up to a number of long-term LNG offtake agreements. With the tariff disputes, there has been less LNG going to China, but China has always had a strategy when it comes to energy that is diversification,” O’Neill said during an interview on Bloomberg TV.

O’Neill’s remarks come after the Power of Siberia 2 project was announced Tuesday. The pipeline would significantly expand Russian gas supply to China. BloombergNEF estimates supply to China could be displaced by as much as 40 million metric tons of LNG a year around 2031, which is when the pipeline expansion is slated to come online. The new deliveries to China could mean fewer LNG deals from the country in the next decade, raising potential challenges to global LNG suppliers such as Woodside.

In the company’s own expansion, Woodside is also moving forward with its Louisiana LNG project in Cameron Parish, O’Neill said. The company is in talks with the US government to get clarification on bringing materials into the foreign-trade zone, which could reduce tariff risk.

Out of the $17.5 billion estimated project cost, 75% of that could come from labor, while another 25% to 30% would cover materials, O’Neill said. Out of the material costs, half of which would be US-sourced, she added.

(Updates with additional details starting in fourth paragraph.)

©2025 Bloomberg L.P.